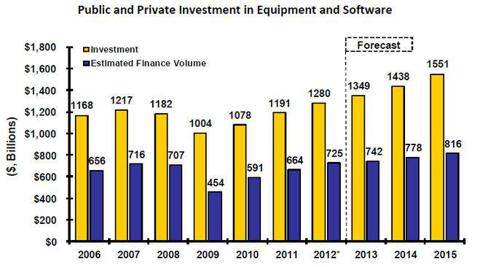

Despite the talk about the "fiscal cliff,{ the Equipment Leasing and Finance Foundation U.S. Equipment Finance Market Study 2012-2013 (available for $300) found "$1.3 trillion to be invested in plant, equipment, and software, 55% ($742 billion) of that investment is expected to be financed through loans, leases, and lines of credit.

" In 2014, the equipment finance market size is projected to grow by $36 billion to $778 billion.

" Research findings suggest the equipment finance market will expand over the next two years; however, the growth rate will slow.

" In 2011, 72% of firms used at least one form of financing (excluding credit card use)."

"Companies with less than $1 million in revenues used financing in only 49% of their equipment acquisitions, while companies with revenues of $25 million to $100 million used financing in 86% of their acquisitions, according to the 2012 Foundation survey.

" Companies with sales from $25 million to $100 million doubled their share of leasing volume from 2006 to 2011. Companies with less than 51 employees also doubled their share of equipment acquisition via leasing in this time period. "

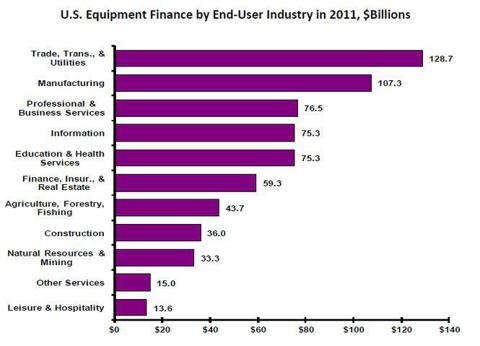

"The three biggest equipment categories that large companies finance are communication equipment, computer equipment, and software, which together accounted for nearly 65% of the large companies' total financing volume in 2011."

Complete Fact Sheet PDF

http://www.leasingnews.org/PDF/USMarketFactSheet.pdf

Purchase Full Report $300:

http://www.store.leasefoundation.org/cgi-bin/msascartdll.dll/ProductInfo?productcd=MktStudy12-13

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.