By Aarti Kanjani and Robert Clark, SNL Financial

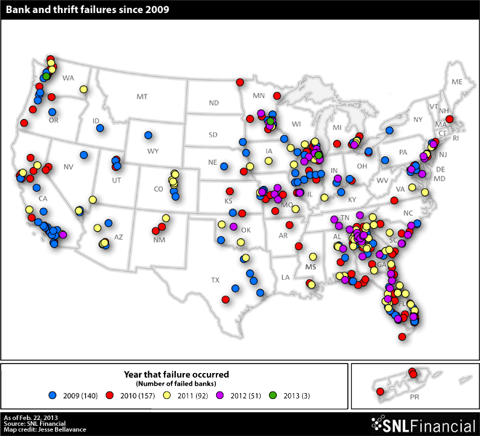

Regulators did not close any banks Friday, Feb. 22, keeping the year's total number of failures at three. In 2012, regulators had closed 11 banks through Feb. 24.

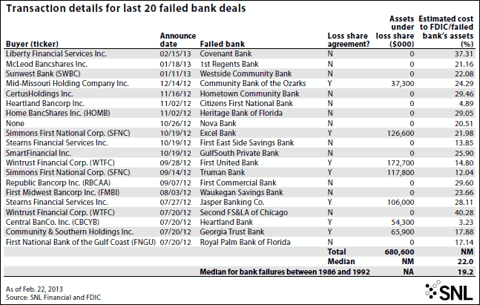

As of Feb. 22, the three bank failures thus far in 2013 did not involve a loss-share agreement. In 2012, the FDIC entered loss-share agreements with the buyers of 20 of the 51 closed banks. In 2011, the FDIC entered loss-share agreements with the buyers of 58 of the 92 closed banks.

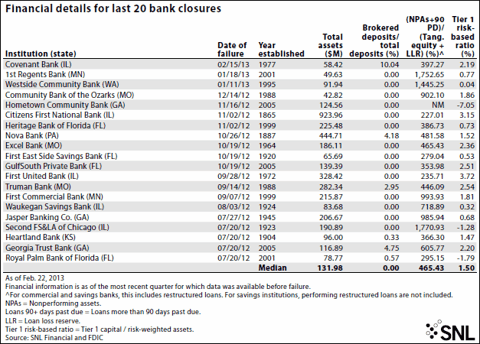

The median cost to the deposit insurance fund at the time of announcement as a percentage of the failed banks' assets was 22% in 2013, 21% in 2012 and 23% in 2011.

Chicago-based Covenant Bank ($58.4 million)

The bank was established in 1977 and had its sole branch in Chicago. In November 2012, Covenant Bank disclosed the need for an immediate capital infusion. Also that month, the bank was issued a prompt corrective action directive by the FDIC. It had been issued a consent order by the FDIC in June 2011. As of Dec. 31, 2012, the bank's Tier 1 ratio was 2.19%, and its Texas ratio was 397.27%.

(Full Story: http://leasingnews.org/archives/Feb2013/2_19.htm#bank_beat)

Andover, Minn.-based 1st Regents Bank ($49.6 million)

The bank was established in 2001 and had its sole branch in Minnesota. The FDIC issued the bank a consent order in March 2010. As of Sept. 30, 2012, its equity capital fell to $924,000 and its Texas ratio was 612.51%.

(Full Story: http://leasingnews.org/archives/Jan2013/1_22.htm#bank_beat )

University Place, Wash.-based Westside Community Bank ($91.9 million)

Westside Community operated two branches in the Tacoma, Wash., area. The bank had previously agreed to sell the company to a group of investors for $5.7 million in August 2012. The FDIC issued a prompt corrective action directive to Westside Community in June 2012. As of Sept. 30, 2012, 32.50% of the bank's assets were nonperforming.

(Full story: http://leasingnews.org/archives/Jan2013/1_15.htm#beat )

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.