By Aarti Kanjani, SNL Financial

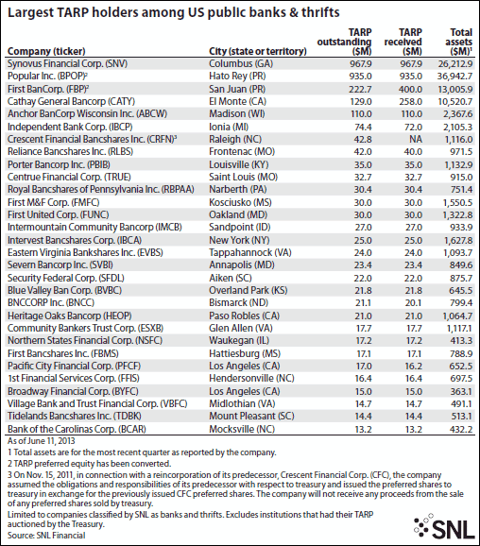

Columbus, Ga.-based Synovus Financial Corp. and Hato Rey, Puerto Rico-based Popular Inc. - two of the 50 largest publicly traded banks and thrifts in the U.S. - continue to have TARP outstanding, with Synovus still owing the largest outstanding TARP investment of $967.9 million.

Looking at the exit plans of the major TARP holders, Synovus expects TARP repayment will likely occur during the third quarter of 2013. Its unit, Synovus Bank, on April 26 entered into a $30 million senior unsecured term loan agreement with BNC Bancorp, which helped BNC redeem $31.3 million in TARP funds.

"Actions drive us closer to TARP exit in the most shareholder-friendly fashion," Popular Inc. said in a Form 8-K filed April 30.

No. 4 on the list of the largest TARP holders as of June 3, Cathay General Bancorp, said March 20 that it has paid the U.S. Treasury $129 million, plus accrued and unpaid dividends, to redeem 50% of its outstanding series B preferred stock issued under the TARP Capital Purchase Program.

Of the five largest TARP holders among U.S. public banks and thrifts as of Feb. 10, 2013 - SNL's previous examination of the matter - Flagstar Bancorp Inc. and Citizens Republic Bancorp Inc. have since exited the plan. Citizens was the third-largest TARP holder in SNL's previous analysis, with an investment of $300 million. It sold to FirstMerit Corp. on April 12, and FirstMerit purchased from the Treasury all of the outstanding shares preferred stock originally issued by Citizens, including all accrued but unpaid dividends, for a purchase price of approximately $355 million.

Flagstar was the fourth-largest holder of TARP funds in SNL's prior analysis. In an auction that commenced June 3, the Treasury auctioned its warrant positions in the company. It held $266.7 million in TARP. It was previously dropped from a Treasury auction, after the thrift announced an unfavorable court ruling.

Other notable exits since Feb. 10 include United Community Banks Inc. and Old Second Bancorp Inc., the TARP for which was auctioned June 3.

NewBridge Bancorp on May 2 issued notices to redeem 37,372 shares of the company's 52,372 outstanding shares of series A preferred stock issued under TARP. The Treasury on April 18 held an auction to sell all of its TARP investment in the company's series A preferred stock. The sale was settled April 29. As a result, the company is no longer subject to the rules and regulations of TARP. As of Feb. 10, 2013, the company was the 11th-largest TARP holder.

To date, Treasury has recovered $271 billion through repayments, dividends, interest and other income, compared to the $245 billion initially invested through TARP, according to the department's June 6 report.

The Treasury has held 16 rounds of auctions. Its losses spiked in auction 14; the aggregate discount fell to 8.95% in auction 15. Pricing continued to improve in the latest auction, resulting in an 8.26% aggregate discount.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.