Despite the hyperbole, several states are still having real estate problems from overbuilding, such as Georgia and Florida.

The seven branches of First Community Bank of Southwest Florida, Fort Myers, Florida, also operating as Community Bank of Cape Coral, were closed with C1 Bank, Saint Petersburg, Florida, to assume all of the deposits. Established Marcy 1, 1999 there were 62 full time employees as of March 31, 2013 at their four offices in Fort Myers, three in Cape Coral, and one in Bonita Springs. Year-end 2006 they had 74 full-time employees before they acquired the three offices in Cape Cora April 25, 2009.

First Community took its first year-end lost with this merger (-$182 ,000 ) and recorded it highest non-current loans at $11.4 million. It moved completely in the wrong direction at the worst economic time of all.

Records show Community Bank of Cape Coral had equity capital of $6.6 million end of 2008 and a minus $2 million loss before extraordinary items prior to the merger with First Community Bank of Southwest Florida.

http://www.bankencyclopedia.com/Community-Bank-of-Cape-Coral-57796-Cape-Coral-Florida.html

The next year it had its largest loss, 2009 , -$11.5 million with $7.9 million charge off.

The end of June, 2013, First Community Bank of Southwest Florida had the lowest capital ratios on banks seen to date:

Tier 1 risk capital Ratio was -0.0031 Tier 1 leverage ratio was -0.0025

It lost money since 2007 with heavy non-current loans, with the highest March 31, 2013 (current numbers were not available) $19.9 million, with a major loss for the half-year of 2013: $9 million.

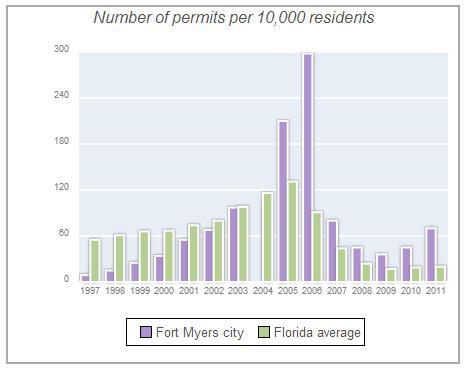

Construction/Land Development loan charge offs reflect in the single-family new house construction building permits:

1997: 45 buildings, average cost: $93,500

1998: 72 buildings, average cost: $78,500

1999: 120 buildings, average cost: $108,100

2000: 163 buildings, average cost: $138,900

2001: 267 buildings, average cost: $130,900

2002: 327 buildings, average cost: $137,500

2003: 466 buildings, average cost: $103,800

2004: 0 buildings

2005: 1012 buildings, average cost: $137,300

2006: 1435 buildings, average cost: $186,400

2007: 388 buildings, average cost: $167,600

2008: 219 buildings, average cost: $256,600

2009: 174 buildings, average cost: $230,500

2010: 215 buildings, average cost: $249,300

2011: 337 buildings, average cost: $228,500

http://www.city-data.com/city/Fort-Myers-Florida.html

(in millions, unless otherwise)

Net Equity

2006 $32.6

2007 $24.8

2008 $21.0

2009 $17.3

2010 $10.8

2011 $10.5

2012 $8.4

6/30 -$1.4

Profit

2006 $1.3

2007 -$5.1

2008 -$182,000

2009 -$11.5

2010 -$6.6

2011 -$5.3

2012 -$1.7

6/30 -$9.0

Non-Current Loans

2006 $5.0

2007 $4.0

2008 $11.4

2009 $4.8

2010 $9.0

2011 $5.8

2012 $10.6

3/31 $19.9

Charge Offs

2006 $2.5 ( $2.2 construction/land, $137,000 commercial/indust., $125,000 1-4 family)

2007 $5.1 ( $4.8 construction/land, $264,000 commercial/indust., $47,000 individuals)

2008 $2.6 ( $1.4 construction/land, $1.0 1-4 family, $228,000 commercial/ind.,$79,000 individual.)

2009 $7.9 ( $3.8 const./land, $1.1 nonfarm/nonres.,$442,000 comm./indus.,$197,000 multi-family, $79,000 individuals)

2010 $6.5 ($3.5 commercial/industrial, $868,000 1-4 family, $824,000 const./land, $707,000 multifamily, $541,00 nonfarm/nonres., $35,000 individuals)

2011 $3.0 ( $2.1 nonfarm/nonresidential., $592,000 constr./land, $213,000 1-4 family, $98,000 individual., -$21,000 commercial/industrial

2012 $2.3 ($1.2 1-4 family residential, $925,000 nonfarm/nonres.,$401, 000 commercial/industrial, $28,000 construct./land, $16,000 individuals)

6/30 $1.6 ($896,000 1-4 family, $396,000, nonfarm/nonresidential,$363,000 commercial/industrial.

Construction and Land, 1-4 family multiple residential, Multiple Family Residential, Non-Farm Non-Residential loans.

The bank tried to turn this around, adjusting its board of directors:

Board of Directors:

Gerard A. McHale, Jr.Certified Public Accountant

Gene R. SolomonCertified Public Accountant

Paul E. MalbonOperator of Best Western Beach Resort, a gulf front hotel

Randall P. Henderson, Jr.Real Estate Investment

Robert D. Knight, Jr.Custom Home Builder

Rudolf P. Guenzel,Chairman of the Board and Chief Executive Officer (named chairman October 13, 2012*)

Suzanne H. EdwardsWife; Mother; Community Volunteer

Wayne KirkwoodPresident and Chief Executive Officer of Kirkwood Electric, Inc.

*October 13, 2012 Rudolf "Rudy" Guenzel -has been named CEO and chairman of the board at First Community Bank of Southwest Florida (fcb-yourbank.com). With more than 45 years of banking experience, he was previously president and CEO of BancFlorida Financial Corp. in Naples and Peoples Bank of California in Los Angeles, among others. Guenzel will be responsible for First Community Bank's operations and oversee board of directors' meetings.

Involved in Imperial Credit and real estate

http://www.prnewswire.com/news-releases/imperial-credit-industries-announces-appointment-of-new-chief-executive-officer-77526017.html

NY Times states: European American Bank has named Rudolf P. Guenzel and Richard W. Dalrymple executive vice presidents.

http://www.nytimes.com/1981/01/12/business/executive-changes-219888.html

It was much too late in 2012.

As of March 31, 2013, First Community Bank of Southwest Florida had approximately $265.7 million in total assets and $254.2 million in total deposits. In addition to assuming all of the deposits of the failed bank, C1 Bank agreed to purchase essentially all of the failed bank's assets

The FDIC estimates that cost to the Deposit Insurance Fund will be $27.1 million.

Bank of Southwest Florida is the 17th FDIC-insured institution to fail in the nation this year, and the third in Florida.

List of Bank Failures:

www.fdic.gov/bank/individual/failed/banklist.html

Bank Beat:

http://www.leasingnews.org/Conscious-Top%20Stories/Bank_Beat.htm

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.