By Nathan Stovall and Ranvir Vala

SNL Financial Execlusive

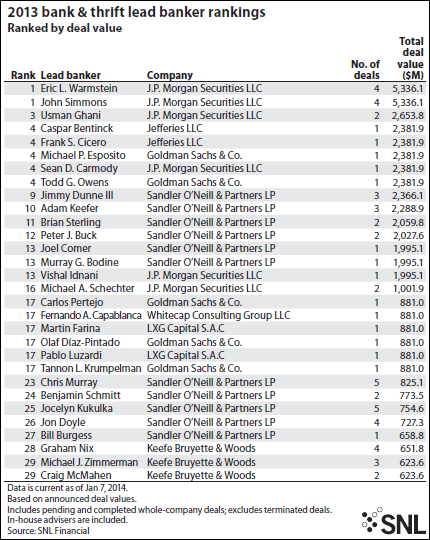

A handful of big-ticket transactions in the bank space propelled investment bankers from J.P. Morgan Securities LLC to the top of SNL's lead banker rankings in 2013.

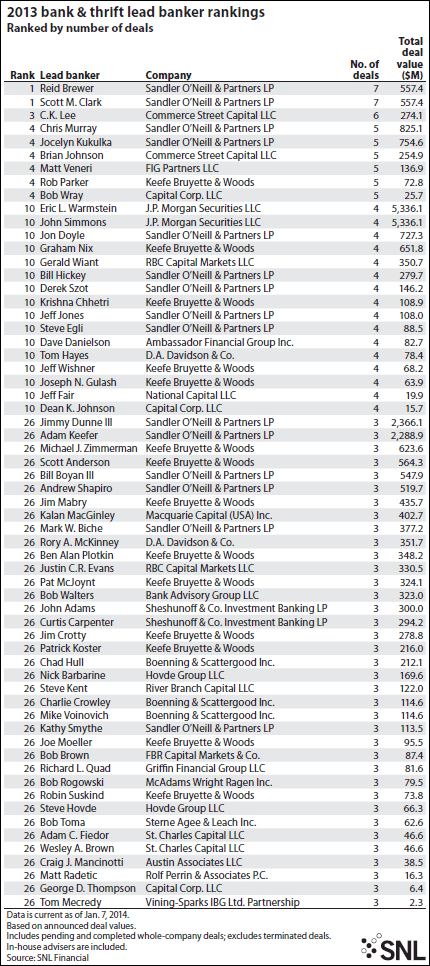

While the most active investment banks working in the bank M&A arena dominated the rankings in the first half of the year, with most deals being smaller in size, a few large bank deals surfaced in the second half of 2013 that shook up the rankings of lead bankers advising the sector. Bankers from the likes of Sandler O'Neill & Partners LP and Stifel Financial Corp. unit Keefe Bruyette & Woods Inc. continued to prominently feature in SNL's rankings of lead bankers, with both firms easily topping the league tables in terms of number of engagements - working on 47 and 44 transactions, respectively, in 2013. However, larger bank deals firmly pushed a few investment bankers from J.P. Morgan Securities to the top of the rankings.

Indeed, two J.P. Morgan i-bankers - Eric Warmstein and John Simmons - stood out among investment bankers advising in the bank and thrift space in 2013. The two i-bankers each advised on four deals totaling $5.34 billion, with all of the engagements coming in the second half of the year. Fee information was available for three of the deals, with the transactions set to bring their firm close to $40 million in fees, assuming the deals close, according to SNL's analysis.

Although the deals were almost certainly weeks, if not months, in the making, two of J.P. Morgan's engagements came in quick succession in July 2013, when it advised MB Financial Inc. on the $668.7 million purchase of Taylor Capital Group Inc. and then a week later landed the sell-side advisory role on CapitalSource Inc.'s $2.3 billion sale to PacWest Bancorp.

J.P. Morgan i-bankers Warmstein, Michael Schechter, Simmons and Usman Ghani worked on the MB Financial/Taylor deal, while Sandler O'Neill Principal William Burgess and Sandler's Benjamin Schmitt advised the seller in the transaction. MB Financial told SNL earlier in 2013 that it selected J.P. Morgan for the Taylor Capital deal because the company was pleased with the work the investment bank did when it served as the lone book manager on its $201.3 million common stock offering in the fall of 2009.

J.P. Morgan landed an even larger engagement shortly thereafter, working on the PacWest/CapitalSource deal. Jefferies LLC served as lead adviser to PacWest, with i-bankers Caspar Bentinck and Frank Cicero working on the deal. Castle Creek Financial LLC and Goldman Sachs & Co. also acted as financial advisers to PacWest, with Goldman's Todd Owens and Michael Esposito serving as leads on the transaction. The deal represented Goldman's second engagement over $500 million in 2013.

The other engagement was Goldman's work advising City National Bank of Florida on its $882.8 million sale to Banco de Credito e Inversiones SA. Goldman i-bankers Tannon Krumpelman, Carlos Pertejo and Olaf Díaz-Pintado advised on the transaction. LXG Capital S.A.C bankers Pablo Luzardi and Martin Farina and Whitecap Consulting Group LLC banker Fernando Capablanca advised the buyer on the transaction.

J.P. Morgan landed three deals over $500 million in 2013, with the third deal over that size coming in September, when it advised Umpqua Holdings Corp. on its roughly $2.0 billion planned purchase of Sterling Financial Corp. J.P. Morgan i-bankers Warmstein, Simmons, Ghani and Vishal Idnani were lead bankers on that transaction.

J.P. Morgan had advised Umpqua on its purchase of Financial Pacific Holding Corp. three months earlier and had served as the sole book manager on the company's common equity offering in 2009 and again on its common equity and convertible preferred equity offering in 2010.

Meanwhile, Sandler O'Neill served on the sell side of the Umpqua/Sterling transaction, with investment bankers Jimmy Dunne III, Brian Sterling, Murray Bodine, Joel Comer, Peter Buck and Adam Keefer as lead bankers on the deal. A handful of other Sandler i-bankers were even more active in 2013, including Principal Scott Clark and Vice President Reid Brewer, who each worked on seven deals, totaling $557.4 million. Clark and Brewer's largest deal engagement came when they, along with Sandler Senior Managing Principal Jon Doyle, advised Rockville Financial Inc. on its pending merger-of-equals with United Financial Bancorp Inc. Doyle worked on four transactions totaling $727.3 million in 2013, including work as adviser to First Financial Holdings on its nearly $300 million sale to SCBT Financial.

Sandler's Peter Finnerty Jr. also served as a lead banker on the SCBT/First Financial deal. Sandler O'Neill had a deep relationship with First Financial, having served as book manager on its common stock offering in the fall of 2009. Two years later, Sandler advised the company on the sale of its insurance agency and on the sale of performing loans and distressed assets. Sandler also advised First Financial on the purchase of a failed bank in the spring of 2012.

Keefe Bruyette & Woods landed the buy-side engagement on the SCBT/First Financial transaction. KBW i-banker Jim Mabry served as lead banker to SCBT on the deal and worked on three transactions totaling $435.7 million in 2013.

Keefe Bruyette & Woods bankers found their way onto some other large transactions in 2013. Keefe Bruyette & Woods earned the buy-side engagement on the nearly $500 million United Bankshares Inc./Virginia Commerce Bancorp Inc. deal, with Robert Stapleton and Graham Nix serving as lead bankers. Keefe Bruyette & Woods had advised United Bankshares on its sale of George Mason Mortgage LLC in the summer of 2004. Sandler O'Neill won the sell-side engagement on Virginia Commerce to United Bankshares, with Bill Boyan and Andrew Shapiro serving as lead bankers on the transaction. Sandler O'Neill had served as book manager on the company's common stock offerings in July 2010 and April 2004.

Keefe Bruyette & Woods also landed the buy-side engagement on another large deal in 2013: Union First Market Bankshares Corp.'s $444.5 million purchase of StellarOne Corp. Keefe Bruyette & Woods' Scott Anderson, a managing director and co-head of depositories investment banking, served as lead banker to Union First, while Raymond James & Associates Inc. bankers Christopher Choate and Brian Nestor landed the sell-side engagement on the deal.

Keefe Bruyette & Woods has a longstanding relationship with Union First Market Bankshares, having advised the bank on its last five acquisitions. Anderson served as lead banker on several of those transactions. Keefe Bruyette & Woods also served as book manager on the company's common stock offering in September 2009.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.