By Maria Tor and Zuhaib Gull

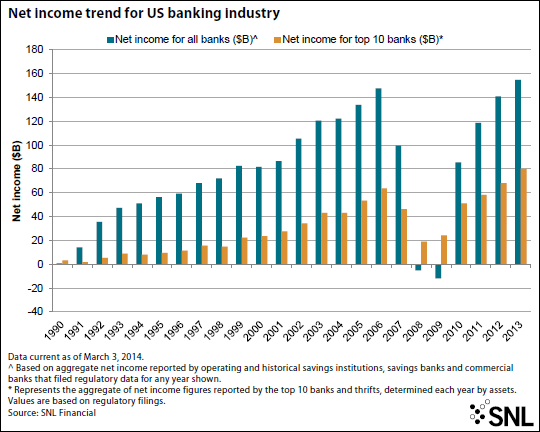

Commercial banks and savings banks earned $154.62 billion in 2013, a record high in the 23 years that SNL Financial has tracked bank regulatory data. More than half of the year's profits were earned by the largest 10 banks by assets.

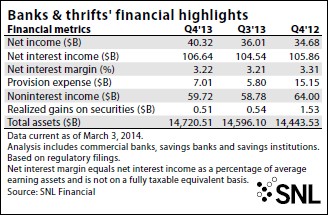

In the fourth quarter, banks earned net income of $40.32 billion in aggregate. Profits were up compared to both the prior quarter and year-ago quarter, when banks made $36.01 billion and $34.68 billion, respectively.

Net income earned by the industry in 2013 was the highest in a single year among all years since 1990. When adjusting for inflation using the core Personal Consumption Expenditures Index, 2006 was the only year more profitable than 2013 among the years SNL Financial analyzed.

Commercial banks and savings banks earned $154.62 billion in 2013, a record high in the 23 years that SNL Financial has tracked bank regulatory data. More than half of the year's profits were earned by the largest 10 banks by assets.

In the fourth quarter, banks earned net income of $40.32 billion in aggregate. Profits were up compared to both the prior quarter and year-ago quarter, when banks made $36.01 billion and $34.68 billion, respectively.

Net income earned by the industry in 2013 was the highest in a single year among all years since 1990. When adjusting for inflation using the core Personal Consumption Expenditures Index, 2006 was the only year more profitable than 2013 among the years SNL Financial analyzed.

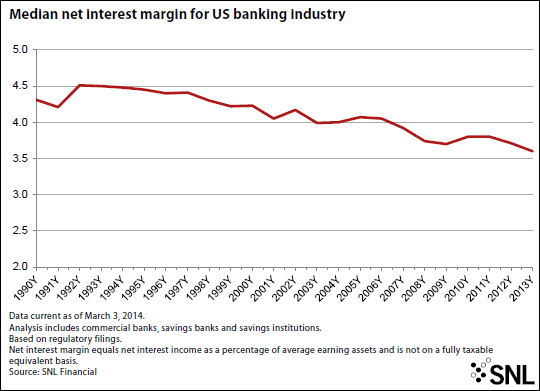

While the dollar amount of profits soared in 2013, the industry's net interest margin remained low. The aggregate net interest margin was 3.22% in the fourth quarter, a slight uptick from 3.21% in the third quarter, but down from 3.31% in the year-ago period. Comparatively, the aggregate net interest margin in the early to mid-1990s was above 4% among commercial banks. Savings institutions, which by nature of their charter rely on lower-earning assets, saw their aggregate net interest margin range between 2.27% and 3.07% in the 1990s.

On a median basis, which removes the skewing effect of the largest banks, the net interest margin for all commercial banks, savings banks and savings institutions is the lowest of all of the years tracked by SNL at just 3.60%. In 1992, by comparison, the median was 4.51%.

FDIC Chairman Martin Gruenberg commented on the small increase in the fourth-quarter net interest margin in remarks about the agency's fourth-quarter quarterly banking profile, released Feb. 26.

"The steeper yield curve in 2013 helped net interest margins, as banks generally borrow short and lend for longer terms," he said in a news release. "Margins increased across all size groups in the fourth quarter except for the largest group of banks, where they generally have declined since 2010 due to growth in low-yield reserve balances held at Federal Reserve banks."

On a quarterly basis, net interest income of the banking industry grew to $106.64 billion from $104.54 billion in the prior quarter and $105.86 billion a year prior. Meanwhile, provision expenses were up to $7.01 billion in the fourth quarter from $5.80 billion in the third quarter. Provision expenses in the last quarter of 2012 were $15.15 billion.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.