by Divya Lulla

A SNL Financial Exclusive

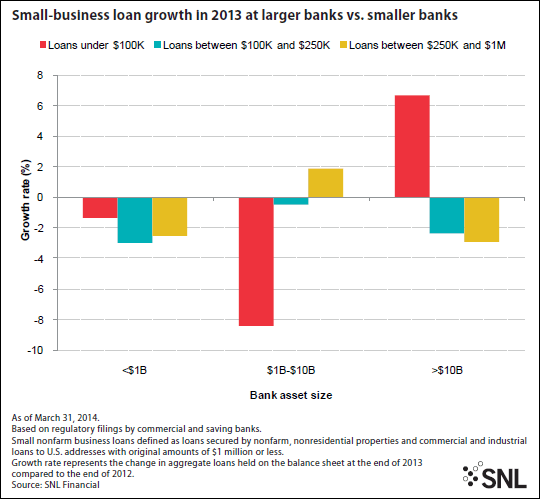

Small nonfarm business loans at U.S. banks and thrifts stood at $582.65 billion at the end of 2013 - down 0.69% from $586.68 billion at the end of 2012.

The decline was not, however, across the board. Total small business loans at banks with assets between $1 billion and $10 billion grew by 0.11% during 2013, and banks with more than $10 billion in assets saw small business loans increase by 0.37%. However, banks and thrifts with total assets of less than $1 billion recorded a 2.43% year-over-year decline in small nonfarm business loans

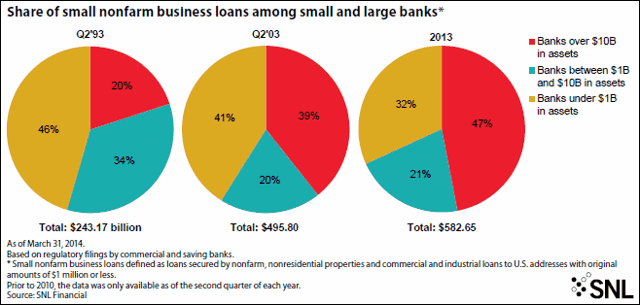

Over the last 20 years, the largest banks have steadily grabbed a larger slice of the small business loan pie. Banks with more than $10 billion in assets held 47% of all nonfarm small business loans at the end of 2013, up from 39% at June 30, 2003, and 20% at June 30, 1993. Midsized banks with assets greater than $1 billion but less than $10 billion saw their portion fall to 21% at the end of 2013 from 34% in 1993. The portion held at the smallest banks, those with less than $1 billion in assets, fell to 32% at the end of 2013 from 46% in 1993.

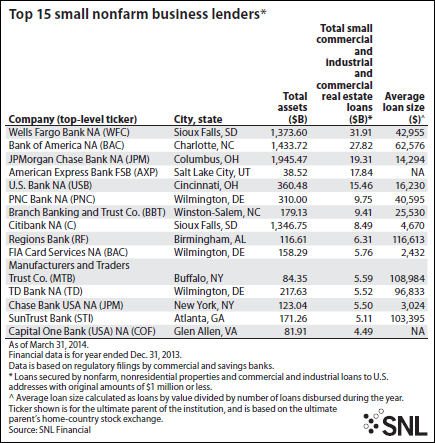

Wells Fargo Bank NA ended 2013 with $31.91 billion in small commercial and industrial loans and commercial real estate loans - the most of any bank or thrift in the US. In second place, Bank of America NA held $27.82 billion in small business loans at the end of 2013, followed by JPMorgan Chase Bank NA at $19.31 billion.

Among the top 15 small business lenders, Regions Bank held the highest average small business loan size at $116,613 at year-end 2013. Average loan size is calculated as loans by value divided by the number of loans disbursed during the year.

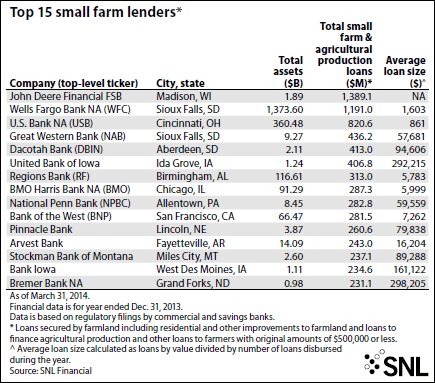

Regions Bank also featured on the list of the top 15 small farm lenders, with a total small farm loan portfolio of $313.0 million at Dec. 31, 2013. John Deere Financial F.S.B., a banking subsidiary of Deere & Co., took first spot with $1.40 billion in small farm loans at the end of 2013. Eight of the top 15 small farm lenders were midsized banks with assets between $1 billion and $10 billion at Dec. 31, 2013.

Grand Forks, N.D.-based Bremer Bank NA was the only bank on the list with assets below $1 billion, and its average loan size of $298,205 was the highest in the group.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.