Apparently, it doesn’t matter what you’re into, fundamentals, technical analysis, or the Stock Trader’s Almanac, because suddenly everyone is a chart watcher. When markets opened on Monday morning, the indices all sprang off their 50-day simple moving averages (SMA) in perfect unison and didn’t look back for the rest of the week. It makes you wonder if all those “bears,” calling for a serious correction a week ago, were simply speaking out of the corner of their mouths in hopes to get a jump on their bullish competition. For the week, the Dow Jones Industrials rose 3.98%, the S&P 500 gained 4.51% and the NASDAQ added 3.99%, proving that as we head into the end of the year, investors are bullish on Q3 earnings and this is one undeniably strong market.

As we look ahead, we are planning for one more up-leg to this cyclical bull market and thought it would be helpful to detail our reasons for remaining so bullish in here. They include:

1. Large-cap tech moves to fresh 52-week highs: One of the most impressive aspects to last week’s action were the moves in large-cap tech names such as AAPL, AMZN, BIDU, CRM, EBAY, GOOG, IBM and SY. With these tech bellwethers rising to fresh 52-week highs, on massive volume, we are looking for further institutional inflows to these names. This should create a herd-like mentality around this group going into year-end.

2. The global economy is improving: This past week saw persistent signs that the worldwide economy is beginning to strengthen. These include:

· The Australian job market has begun to add jobs, giving Australia’s central bank the confidence to initiate the first hike in interest rates, around the world, since the onset of the financial crisis.

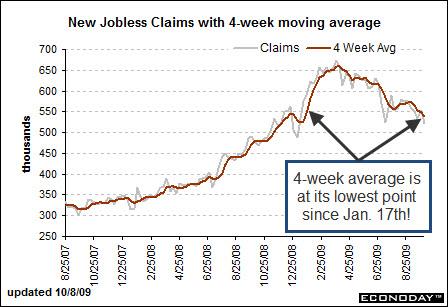

· Weekly jobless claims in the U.S. fell to the lowest levels since January. The drop in claims was the fourth in the past five weeks, with the four-week average falling to 539,750 – the lowest since January 17th.  Source: Barron's Econoday

Source: Barron's Econoday

· Friends at a top tier law firm in Brazil are working extended hours in Sao Paolo. Deals are happening at a rapid pace, indicative of a Brazilian economy that is leading all others on this side of the hemisphere.

While the improvement in the global economy may prove to be short-lived as worldwide stimulus efforts subside, for now, it is enough to provide investors with the confidence to put more money to work.

3. Q3 Earnings: Next week will be a pivotal week for investors as market leaders like Goldman Sachs, Google, IBM, Intel and J.P. Morgan all report earnings. Expect these reports to please and to inspire investors to put idle cash to work for the following reasons.

4. Psychology: As we move into the final months of the year, hedge fund and pension fund managers, who are trailing the indices, will be motivated to put all their money to work as we move through the late September highs. Don’t underestimate the impact this buying power can have on equities as we move into November and December.

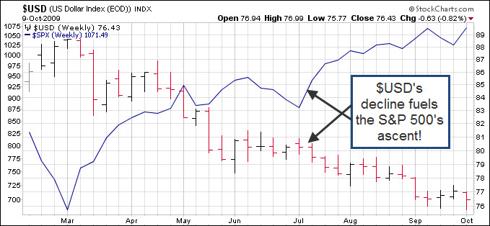

5. Liquidity: With market professionals gaining access to cheap dollars via the new carry trade, look for the U.S. Dollar (USD) to continue moving lower and for all other investment classes to move higher. This trend should stay in place through the beginning of next year.

Source: StockCharts.com

6. Strong and improving technicals: The technical undercurrents continue to improve. This bodes very well for the market’s odds of moving to new highs soon. Strength can currently be observed in the following areas:

· 52-Week New Highs/New Lows: Last Thursday saw almost 200 stocks making new highs on the NASDAQ, the highest total since this bull market began. Expect this trend to continue and expand, providing the necessary leadership needed for a new up-leg.

· The Advance/Decline Line recently forged to higher highs. The strength in the A/D line is a major positive for equities. With most stocks in strong technical shape, it will be hard for the bears to gain the upper hand in the short term.

· The $VIX, a measure of fear and optimism amongst options traders, is in its own bear market and appears poised for a push to fresh 52-week lows. Since topping last November in the 80’s, at the height of the financial crisis, the $VIX has made a series of lower highs and lower lows. A move by the $VIX into the high teens will usher in lower volatility, giving heretofore nervous investors more comfort in putting money to work.

7. Seasonality: As we move further into October, the bears will ultimately lose the seasonality argument that calls for a serious correction at this time of year. Bullishness will prevail as investors breathe easier with a market that can forge fresh 52-week highs during the most difficult part of the year, traditionally, for equities.

8. New leadership: A new up-leg will fail without new leadership. Fortunately, we are seeing new leadership emerge, in the form of new institutional favorites like: ARST, CREE, EBIX, FIRE, RHT, RAX, RINO and VECO. If the market was weakening, these stocks would not be breaking to new highs as they have during the past few weeks.

9. Windows 7: The biggest technology catalyst in years is finally upon us with the October 22nd release date of Microsoft’s Windows 7. Expect this well-reviewed OS update to provide a big boost in business spending, an upswing for the PC sector, and increased sales for stores like Best Buy and RadioShack.

10. Strength in the semiconductors: After spending the past week underneath its 50-day SMA, the Semiconductor HOLDRS ETF (SMH) jumped back above this level on Friday afternoon with huge volume. Known as an early-cycle group, expect further strength in this sector to propel the NASDAQ toward 2300 by year-end.

For all of these reasons, we are an aggressive buyer of equities on any and all pullbacks over the next few days. We will be deploying our remaining cash reserves on any profit-taking in the near-term, looking to be fully-invested as a new up-leg begins in earnest.

Disclosure: No positions in Dow, S&P 500, or NASDAQ related equities or ETF’s.