Canaccord Genuity analyst Ryan Meliker warns investors not to read too much into the latest reports from real estate investment trusts in the lodging industry. They reported an avearge 14.6% rise in revenue per available room (also called RevPAR) for the week ended Sept. 5. It seems that the timing of the Labor Day holiday […]

Sourced through Scoop.it from: blogs.barrons.com

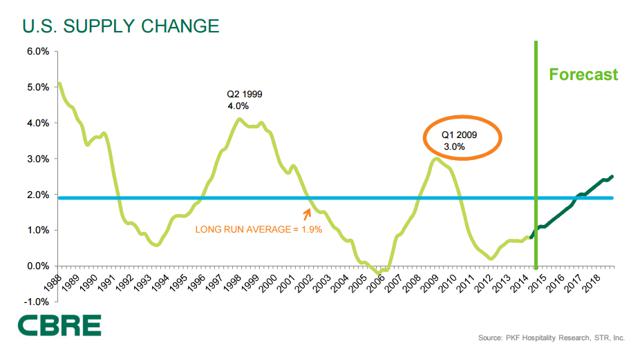

When it comes to lodging, supply still has to catch up with demand, which is causing the industry itself to continue to enjoy strong fundamentals. All of this is in contrary to what took place with their stocks within the past month. Record figures have been posted for aspects such as occupancy and there have also been significant increases in revenue per available room (RevPar). It has been estimated by CBRE that by the time 2017 rolls around, equilibrium between supply and demand will likely be reached.

Stocks in lodging, just like any other REIT sector, dropped and have been down by approximately 15 percent this year alone, which has practically created a great buy opportunity. Out of the 18 total lodging stocks that we typically track, only the following two had a positive performance:

*Strategic Hotels & Resorts (BEE)

*Apple Hospitality REIT (APLE)

On the other hand, however, the following two stocks were down by more than 25 percent:

*Ashford Hospitality Trust (AHT)

*Host Hotels & Resorts (HST)

The market was quick to realize losses in lodging stocks were excessive. In the end of August, the sector saw a decrease of approximately 6 percent and a rebound of the same order of magnitude within the same week.

Disclaimer: This newsletter is not engaged in rendering tax, accounting, or other professional advice through this publication. No statement in this issue is to be construed as a recommendation to buy or sell any security or other investment. Please do your own due diligence before making any investment decision. Some information presented in this publication has been obtained from third-party sources considered to be reliable. Sources are not required to make representations as to the accuracy of the information, however, and consequently the publisher cannot guarantee accuracy.

Disclosure: The author has no positions in any shares mentioned, and no plans to initiate any positions within the next 72 hours.