The annual shareholder meeting is to be held on June

June 19th in Vancouver bc it is a couple weeks before the perceived deadline in New Zealand for the deal to close on the Waihapa Acquistion. If this event occurs by the 30th of

June it will be a major move forward. The stock is halted June 14 so we may have some good news today!

For the reasons cited below.

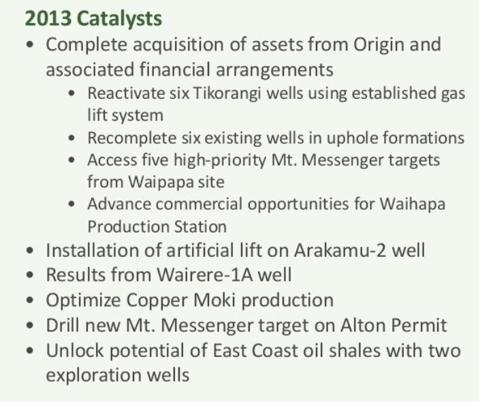

Extraction from new release with Highlights of 2013

HIGHLIGHTS

Quarterly results

- 30,179 barrels of oil ("bbl") produced and 27,246 bbl sold in Q1-2013, generating pre-tax oil sales of $3,061,064

- Positive net cash flow from petroleum operations in Q1-2013 of approximately $1.2 million

- Average field netback of $45.29 /bbl in Q1-2013, a 16% increase compared to Q4-2012

- Cash investedin resource properties, plant and equipment during Q1-2013 of $12,048,313

Cumulative results

- 43,360 bbl produced and 43,634 bbl sold year to date ( May 24, 2013 ), generating pre-tax oil sales of approximately $4.7 million

- Cumulative production of 251,581 bbl since commencement of production, generating pre-tax oil sales (including sales from pre-production testing) of approximately $26.8 million

Developments

- Engaged independent reservoir management firm to analyse Copper Moki wells and reservoir with the objective of optimizing oil recoveries

- Completed 50-km 2D seismic survey on Wairoa permit in the East Coast Basin

- Initiated consent and permitting for two East Coast Basin exploration wells

- Extended the maturity date of the HSBC operating line of credit to September 30, 2013

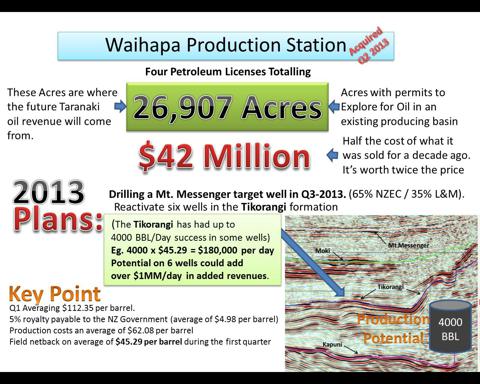

- Progressed acquisition of assets from Origin: received Overseas Investment Office approval related to Waihapa Production Station land, working with Origin to finalize certain terms of the agreement

-

Its what lies below waihapa that is exciting

[Disclaimer: Do not assume the example will become reality, but the potential does exist for these formations to add significant production]

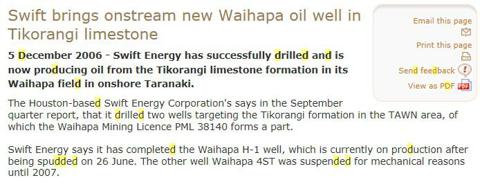

The TIKORANGI was discovered as an Oil Producing Formation in 2006.

The problem was the oilfield came on strong then tapered off, but since then it has been studied alot as to why the decline occured, the solution may be in reservoir stimulation technologies, which could be a real breakthough if applied in the Tikorangi and other layers.

www.petroleumnews.net/storyview.asp

This is an excerpt from the link above

Still there are multiple reasons to get excited about TAWN area, Taranaki and the exploration potential.

"NZEC's technical team has also identified five high-priority Mt. Messenger targets in the southwest corner of the 4 Petroleum Licenses. NZEC has completed permitting for a new site called Waipapa ( Oru Rd ) and expects that drill pad construction will be complete by mid Q3-2013, allowing the Company to access these targets shortly after the (waihapa)acquisition has closed.

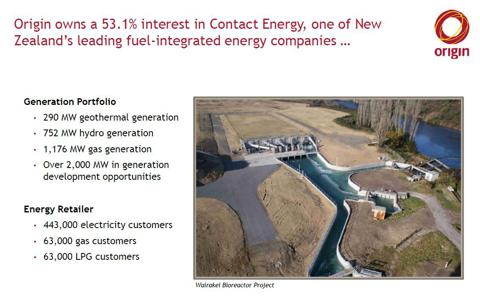

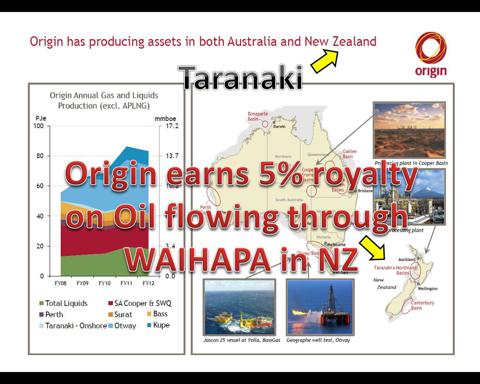

It is in Origins interest that Taranaki is explored for NGL and Natural Gas as they own half of the Electric utility in Taranaki of which some is Gas Fired.

Origin will earn 5% for life off the Waihapa Station

www.originenergy.com.au/55/Investor-presentations

This is a Major strategic decision, set to occur in Q2

newzealandenergy.com/Investor-Centre/Presentations/default.aspx

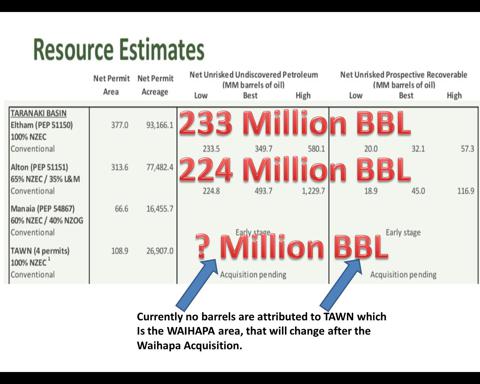

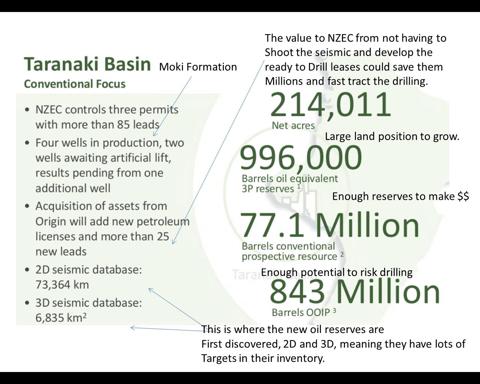

Lets see what they said about the Taranaki

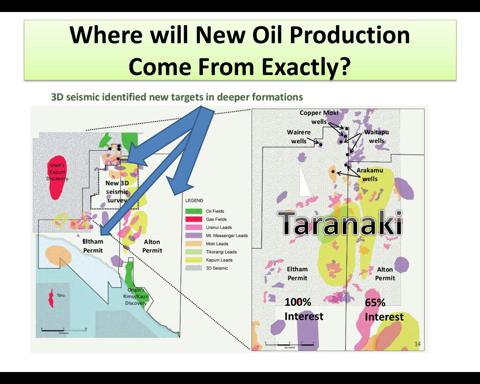

Outlook - Taranaki Basin

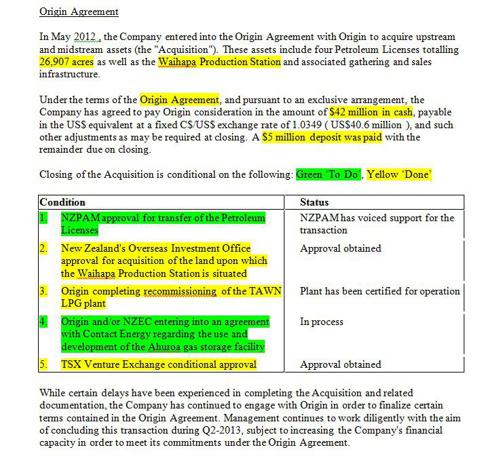

On February 25, 2013 , the Company announced the decision to delay the remaining two wells in its Eltham/ Alton drill program to focus on commercial opportunities in the pending acquisition of assets from Origin. The Company's objective is to increase near-term production and cash flow while reducing exploration expenses, and the Company believes that opportunities exist on the Petroleum Licenses to achieve this objective. While this decision in no way diminishes the Company's view of the prospectivity of the Eltham and Alton permits, NZEC intends to focus in the near-term on lower-cost opportunities that are close to infrastructure.

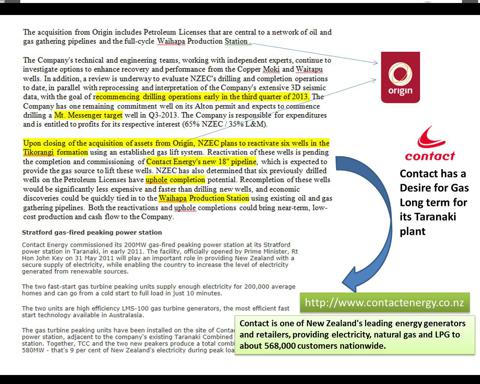

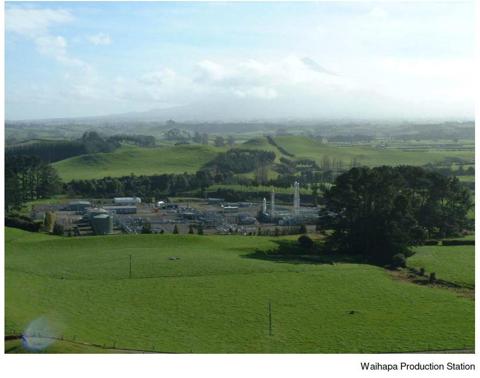

The acquisition from Origin includes Petroleum Licenses that are central to a network of oil and gas gathering pipelines and the full-cycle Waihapa Production Station .

The Company's technical and engineering teams, working with independent experts, continue to investigate options to enhance recovery and performance from the Copper Moki and Waitapu wells. In addition, a review is underway to evaluate NZEC's drilling and completion operations to date, in parallel with reprocessing and interpretation of the Company's extensive 3D seismic data, with the goal of recommencing drilling operations early in the third quarter of 2013. The Company has one remaining commitment well on its Alton permit and expects to commence drilling a Mt. Messenger target well in Q3-2013. The Company is responsible for expenditures and is entitled to profits for its respective interest (65% NZEC / 35% L&M).

Upon closing of the acquisition of assets from Origin, NZEC plans to reactivate six wells in the Tikorangi formation using an established gas lift system. Reactivation of these wells is pending the completion and commissioning of Contact Energy's new 18" pipeline, which is expected to provide the gas source to lift these wells. NZEC has also determined that six previously drilled wells on the Petroleum Licenses have uphole completion potential. Recompletion of these wells would be significantly less expensive and faster than drilling new wells, and economic discoveries could be quickly tied in to the Waihapa Production Station using existing oil and gas gathering pipelines. Both the reactivations and uphole completions could bring near-term, low-cost production and cash flow to the Company.

NZEC's technical team has also identified five high-priority Mt. Messenger targets in the southwest corner of the Petroleum Licenses. NZEC has completed permitting for a new site called Waipapa ( Oru Rd ) and expects that drill pad construction will be complete by mid Q3-2013, allowing the Company to access these targets shortly after the acquisition has closed.

Longer-term exploration plans on the Petroleum Licenses include accessing Mt. Messenger targets from existing drill pads, many of which have gathering pipelines in place, that offer lower-cost exploration potential and can be tied-in to the Waihapa Production Station on an expedited basis. NZEC is advancing a number of new commercial opportunities to use the Waihapa Production Station to its full potential and in order to maximize facility revenues, while ensuring that NZEC's gas and associated natural gas liquids production can be efficiently delivered to market.

Commercial oil discoveries on NZEC's properties and those of its peers have confirmed the prospectivity of the Mt. Messenger formation, which remains NZEC's primary exploration target in the near term. Mt. Messenger leads continue to be refined as the Company interprets its propriety database of 3D seismic. NZEC's technical team has also identified a number of leads in the deeper Moki, Tikorangi and Kapuni formations on both the Petroleum Licenses and the Eltham and Alton permits. Discoveries by other companies have demonstrated significant flow rates and long-term production from reservoirs in these deeper formations. NZEC will continue to advance these leads to drillable prospects and will move these targets higher on the Company's priority list as warranted.

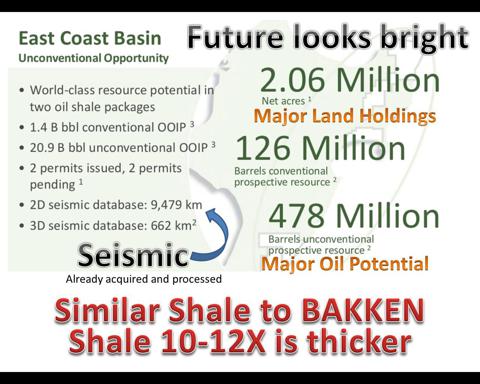

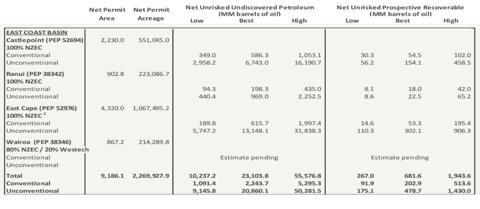

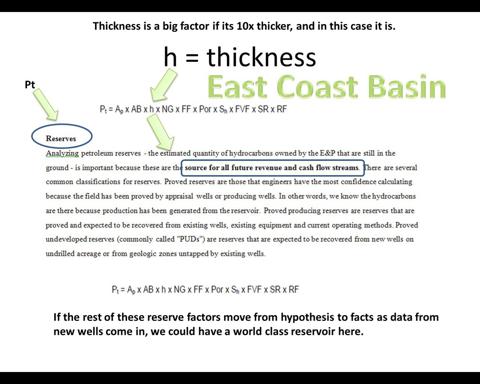

East Coast Basin

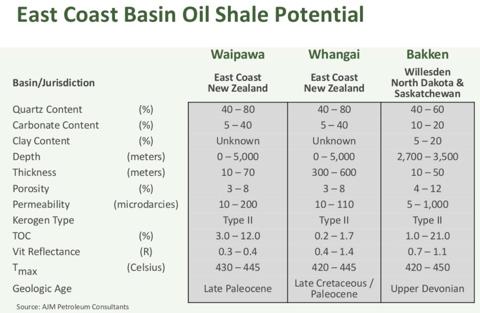

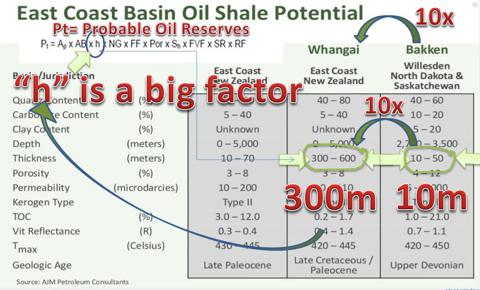

The East Coast Basin of New Zealand's North Island hosts two prospective oil shale formations, the Waipawa and Whangai, which are the source of more than 300 oil and gas seeps. Within the East Coast Basin , NZEC holds a 100% interest in the Castlepoint Permit, which covers approximately 551,042 onshore acres (2,230 km2), and a 100% interest in the Ranui Permit, which covers approximately 223,087 onshore acres (903 km2) and is adjacent to the Castlepoint Permit.

On September 3, 2010 , NZEC applied to the Minister of Energy to obtain a 100% interest in the East Cape Permit. The application is uncontested and the Company expects the East Cape Permit to be granted to NZEC upon completion of NZPAM's review of the application. The East Cape Permit covers approximately 1,067,495 onshore acres (4,320 km2) on the northeast tip of the North Island .

In addition, NZEC has entered into a binding agreement with Westech to acquire 80% ownership and become operator of the Wairoa Permit, which covers approximately 267,862 onshore acres (1,084 km2) south of the East Cape Permit. Preliminary approval of transfer of ownership was obtained from NZPAM on December 20, 2012 and formation of a joint arrangement with Westech is subject to completion of a joint operating agreement and final NZPAM approval.

The Wairoa Permit has been actively explored for many years, with extensive 2D seismic data across the permit and log data from more than 15 wells drilled on the property. Historical exploration focused on the conventional Miocene sands. NZEC's technical team has identified conventional opportunities as well as potential in the unconventional oil shales that underlie the property. NZEC's team knows the property well and provided extensive consulting services (through the consulting company Ian R Brown Associates ) to previous permit holders, assisting with seismic acquisition and interpretation, wellsite geology and regional prospectivity evaluation.

In addition, NZEC's team assisted with permitting and land access agreements and worked extensively with local district council, local service providers, land owners and iwi groups, allowing the team to establish an excellent relationship with local communities.

* this image is not part of the Q1 Result, just a way of looking at the shale numbers going forward.

* this image is not part of the Q1 Result, just a way of looking at the shale numbers going forward.

Exploration and Outlook

NZEC has cored two test holes on the Castlepoint Permit. The Orui (125 metres total depth) and Te Mai (195 metres total depth) collected core data across the Waipawa and Whangai shales. NZEC also completed a test hole on the Ranui Permit. Ranui-2 was drilled to 1,440 metres, coring the Whangai shale across several intervals. In Q2-2012, NZEC completed 70 line km of 2D seismic data across the Castlepoint and Ranui permits.

A review of the geochemical and physical properties of the two shale packages, coupled with information from seismic data, has focused NZEC's exploration strategy for the East Coast Basin . NZEC plans to drill one exploration well on both the Ranui and Castlepoint permits in Q4-2013.` The Company has met regularly with local communities to discuss its exploration plans, and has initiated the permitting and consent process for the drill locations.

The Company recently completed and is processing a 50-km 2D seismic program on the Wairoa Permit that will help to identify exploration targets on the property, and will finalize its exploration plans for the permit after reviewing all of the seismic and well log data.

The Company's application for the East Cape Permit is uncontested and NZEC expects the permit to be granted upon completion of NZPAM's review of the application.

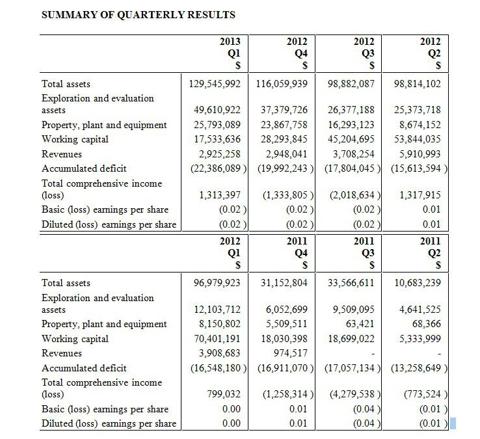

SUMMARY OF QUARTERLY RESULTS

| 2013 Q1 $ | 2012 Q4 $ | 2012 Q3 $ | 2012 Q2 $ | |||||

| Total assets | 129,545,992 | 116,059,939 | 98,882,087 | 98,814,102 | ||||

| Exploration and evaluation assets | 49,610,922 | 37,379,726 | 26,377,188 | 25,373,718 | ||||

| Property, plant and equipment | 25,793,089 | 23,867,758 | 16,293,123 | 8,674,152 | ||||

| Working capital | 17,533,636 | 28,293,845 | 45,204,695 | 53,844,035 | ||||

| Revenues | 2,925,258 | 2,948,041 | 3,708,254 | 5,910,993 | ||||

| Accumulated deficit | (22,386,089 | ) | (19,992,243 | ) | (17,804,045 | ) | (15,613,594 | ) |

| Total comprehensive income (loss) | 1,313,397 | (1,333,805 | ) | (2,018,634 | ) | 1,317,915 | ||

| Basic (loss) earnings per share | (0.02 | ) | (0.02 | ) | (0.02 | ) | 0.01 | |

| Diluted (loss) earnings per share | (0.02 | ) | (0.02 | ) | (0.02 | ) | 0.01 |

| 2012 Q1 $ | 2011 Q4 $ | 2011 Q3 $ | 2011 Q2 $ | |||||

| Total assets | 96,979,923 | 31,152,804 | 33,566,611 | 10,683,239 | ||||

| Exploration and evaluation assets | 12,103,712 | 6,052,699 | 9,509,095 | 4,641,525 | ||||

| Property, plant and equipment | 8,150,802 | 5,509,511 | 63,421 | 68,366 | ||||

| Working capital | 70,401,191 | 18,030,398 | 18,699,022 | 5,333,999 | ||||

| Revenues | 3,908,683 | 974,517 | - | - | ||||

| Accumulated deficit | (16,548,180 | ) | (16,911,070 | ) | (17,057,134 | ) | (13,258,649 | ) |

| Total comprehensive income (loss) | 799,032 | (1,258,314 | ) | (4,279,538 | ) | (773,524 | ) | |

| Basic (loss) earnings per share | 0.00 | 0.01 | (0.04 | ) | (0.01 | ) | ||

| Diluted (loss) earnings per share | 0.00 | 0.01 | (0.04 | ) | (0.01 | ) |

About New Zealand Energy Corp.

NZEC is an oil and natural gas company engaged in the production, development and exploration of petroleum and natural gas assets in New Zealand .

NZEC's property 2.25 million acres portfolio collectively covers approximately (including pending permits) of conventional and unconventional prospects in the Taranaki Basin and East Coast Basin of New Zealand's North Island .

NZEC is listed on the TSX Venture Exchange under the symbol "NZ" and on the OTCQX International under the symbol "NZERF".

Disclosure: I am long OTCPK:NZERF.