Disclosure: I am short NTE, long INTC and AMD

Over the past month, NTE was pumped up to double its usual price on a mere rumor of involvement in iPhone 5 manufacturing, promulgated by various professional penny stock promoters on Seeking Alpha, timothysykes.com, etc.

Even if the Apple rumor were true, which it probably isn't given the track record of such rumors, Apple routinely forces its manufacturers down to razor-thin margins, so there wouldn't be a major improvement in the company's bottom line.

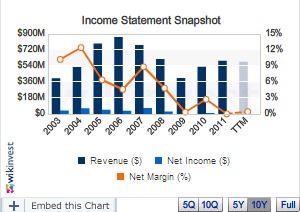

Let's delve down into the financials and see if they justify NTE's 435M market cap:

It should be obvious from this chart that it's a terrible company. The net profit margin has been on a downward spiral for a decade, and over the last 4 years it earned almost nothing. And that, of course, is assuming the financials aren't already being "massaged" to hide losses due to lax SEC oversight in China. Chinese companies aren't even required to disclose insider trades, which is very convenient for the pump and dump racket.

NTE's net profit margin would have to miraculously rise back to 9% and stay there for years to justify the current valuation. Compare this to Intel (INTC), an ironclad US quasi-monopoly on high performance CPUs with a consistent 20% net profit margin and an earnings yield (at its current bargain price of $24.19 and excluding cash from its market cap) of 11%, regularly distributed through dividends and buybacks.

Even if the Apple rumor were true, Apple certainly wouldn't allow NTE the windfall of a 9% profit margin. Apple, due to its size and ability to choose from among a legion of Chinese suppliers, has all the bargaining power and routinely squeezes suppliers down to razor-thin margins. A more realistically optimistic figure would be 2% net profit margin, which would equal 11M earnings per year as long as the deal lasts.

There are other ways that their profit margin might improve somewhat, but Chinese manufacturing is an extremely price-competitive industry with rising labor costs and large profit margins are not likely to ever return to it. NTE's small size and economies of scale will probably result in other, larger manufactuers having better profit margins while NTE struggles to stay alive (like AMD, but without its continued existence being useful as an antitrust defense).

I don't think Warren Buffett would touch this with a 10 foot pole at any price. His main criteria for investing are to look for a large net profit margin, a durable competitive advantage, and a reasonable price to earnings ratio. NTE has none of the above and probably will never have the first two. The P/E ratio might become reasonable after this bubble bursts.

Disclosure: I am short NTE.

Additional disclosure: Long INTC and a small amount of AMD at their current depressed prices of 24.19 and 3.45.