Investment Recommendation

Strong and stable cash flows, dominant market position, low capex requirements, dense kiosk network and shareholder friendly management make Outerwall an asymmetric risk reward bet at the current price. I recommend a strong buy with a price target of $91.4 i.e. potential upside of at least 39.3% from its current stock price of $65.2. (as of 03/31/15)

Investment Summary

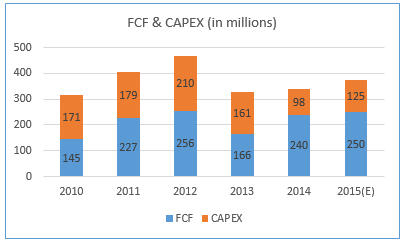

Healthy cash flow generating business and management's commitment to buy back the shares make Outerwall an excellent bet at current price. Outerwall generated $240.5 million of free cash flows during last fiscal year FY'14. Company is expected to generate free cash flow in range of $205 - $245 million for FY'15. Management has reiterated its commitment to return 75%-100% of annual free cash flows to company's shareholders. Management has reduced approximately 38.7% of the firm's outstanding shares in last three years through debt and cash flow and intends to continue doing so. If this continues then the current rate at which management is buying back shares and rate at which company is generating free cash flows, then management will be able to buy back all its existing 18.92 million shares in next 5 years. Though this is just a mathematical endeavor, the buyback program will accelerate the returns for the company's shareholders. If the stock price drops significantly from the current price, it will only fast-track the buyback process making it even more enticing for the shareholders.

Redbox's DVD rental business has got strong moat around itself and will take much more time to erode than what market is currently anticipating. The main concern of the market is that customers will

abandon DVDs in favor of VOD (Video- on-Demand) and online streaming services such as Netflix. Market belief that movie distribution channels will be captured by Netflix, Amazon Instant Videos, iTunes and VOD with no place for Redbox is completely unsubstantiated in my opinion. Netflix and Redbox has little content overlap with former focused on extensive library of old movies, TV shows and original programming while later focused on new and high quality (Blu-ray) movie releases. Since the movie studios enjoy the monopoly in the movie content space by holding copyrights over the content, they restrict the supply by managing distribution window and thus maximizing every ounce of revenues from different movie distribution channels. Netflix itself agrees that it cannot license everything and still maintain the low prices and hence its focus is to license content that can gather maximum viewership and still hold on to low price point. Hence, I believe Netflix and Redbox are targeting two different consumer segments. Thus, consumers who prefer to see new movie releases with good quality will have to either opt for theatre, VOD, Amazon Instant Videos, iTunes or DVDs.

While VOD ($6 per movie), Amazon Instant ($4.99) and iTunes ($4.99) on the other hand will be not able to compete Redbox ($1.5 - $2.0) on pricing point. Since 70% of the studio's post box office profits come from sales of DVDs, studio profits will suffer dramatically if DVD business were to decline precipitously. Hence, I believe that pricing gap between these services and Redbox will continue at least for near term.

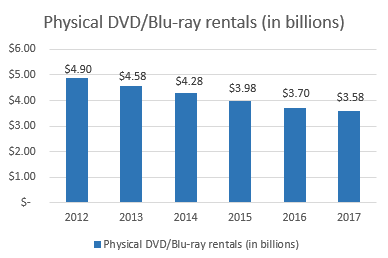

Physical DVD rental business is definitely on secular decline, however, Redbox has got long tail for the reasons mentioned above with enough strength to sustain it cash flow generating capabilities.

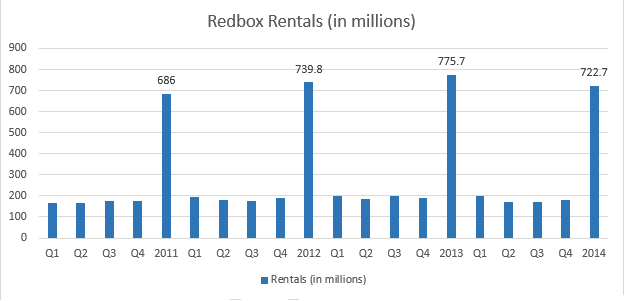

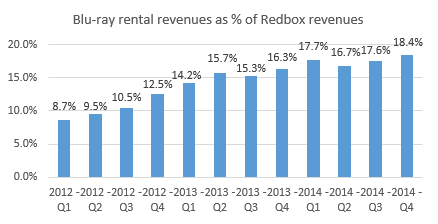

Change in product mix, increase in rental prices, increased focus on operational efficiencies and network optimizations will help offset weakening in revenue caused by declining secular trend in physical DVD space. First, management has recently increased the daily rental price for DVD from $1.2 to $1.5, for Blu-ray from $1.5 to $2 and for games from $2 to $3. Despite the increase in prices it did not notice any change in the rental transactions, in fact it had the best week of December 29th in Redbox's history. Pricing test conducted by the firm indicates that higher price point will have positive revenue impact and provide highest margin benefit. Second, it has also been continually changing its product mix with shift towards Blu-ray and video games rentals. Blu-ray rental's contribution towards Redbox's total sales has been continuously increasing from 14.2% in Q1'2013 to 18.4% in Q4'2014. And third, company's focus has now been to close down the kiosks with low traffic and increase kiosks in high traffic places.

Business Description

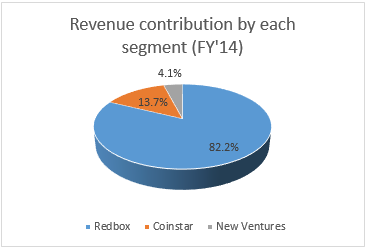

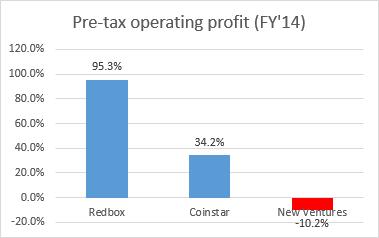

Outerwall Inc. is a leading provider of automated retail solutions that offers convenient products and services to its customers and drive incremental retail traffic and revenue for retailers. Company's core offerings include Redbox business, where consumers can rent or purchase DVD and Blu-ray movies and video games from self-service kiosks, Coinstar business, where consumers can convert their coins to cash or stored value products at self-service coin counting kiosks, and New Venture business which include ecoATM and SAMPLEit kiosks. Using ecoATM kiosks, consumers can sell their used cellphones, tablets, and music players and get instant cash. While, through SAMPLEit kiosks you pay a $1 and get sample of beauty product to try out before you make real purchase in the pharmacy.

Redbox

Redbox is a face of Outerwall generating approximately 82% of the company's total revenues for FY'14. Outerwall currently operates 43,680 Redbox kiosks, in 36,140 locations, where consumers can rent or purchase movies and video games. Redbox kiosks are located in United States and Puerto Rico (closing Redbox business in Canada FY15 Q1) and are installed in leading grocery stores, pharmacies, mass retailers, restaurants, and convenience stores such as Walmart, Walgreens, Kroger, and 7-Eleven. These kiosks usually take less than 10 square feet of space. Consumer touch screen to select the title of their liking and pay through credit card or debit card and receive movie (DVD or Blu-Ray) or game.

Company makes revenues through fees charged to the consumer for rental or purchase while pays percentage of revenue to the retailers. Redbox charges $1.5 per day for DVD rental, $2.0 for Blu-ray disc rental and $3.0 per day for video game disc rental. Redbox offers the convenience of renting or purchasing the movie / game titles at one kiosk and returning it back at any other kiosk.

Coinstar

Outerwall currently operates 21,340 kiosks in 20,250 locations. Consumers feed loose change into the coin counting kiosk, which counts the coins and then dispense vouchers redeemable for cash or in some case value products at the consumer selection. Coinstar kiosks are mainly located in United States, Puerto Rico, United Kingdom, and Ireland. 91% of the US population is within 5 miles of kiosk making it extremely convenient for customers.

80% of coin exchange market share is captured by Coinstar (excluding banks), while 33% of market share including banks. It has got exceptional pricing power. It has been able to raise the commission from 9% to 10.8% per transaction without having any major impact on the revenues. Coinstar occupies prime real estate and enjoys strong relationship with its retailers. Retailers are the joint beneficiaries of the growing Coinstar business. Apart from collecting percentage of revenues from Coinstar, statistics reveal that 50% of the cash received from converting coins is spent in store in which kiosk is located. Some of the Coinstar kiosks have started accepting gift cards of major retailers. Coinstar sells those cards to Blackhawk. Blackhawk takes the fees and remits rest of the amount to Coinstar.

New Ventures

This business segment mainly consist of ecoATM, an automated self-service kiosk, where consumers can recycle their old tablets, music players, and mobile phones for cash. Revenues are generated by selling the old devices collected at these kiosks to the third parties. As of December 31st 2014, there are currently 1890 ecoATM kiosks.

Investment Thesis

Redbox still has a strong moat around its business and uniquely positioned to take advantage of long tail in the physical rental business. Redbox has created moat through extensive distribution network (low cost kiosks), high quality new movie contents and low pricing. It has captured best retail space in US market and will be almost impossible for any other player to capture that retail space. Low capex model and contracts with studios allow Redbox to offer new movie contents at very low price point as compared to its competitors. The US DVD/Blu-Ray rental industry has gone dramatic change in last few years with advancement in technology and growth in internet users. The growth in digital video rental consisting of online streaming and internet video on demand has been the growth drivers for the industry.

The physical DVD/Blu-ray rental sales are under secular decline and will reduce to $3.58 billion in 2017 from current $4.28 billion market. However, I believe physical disc still holds prominence and the decline in this space won't be similar to falling off-the cliff rather it will have soft landing. The number of DVD / Blu-Ray rentals through Redbox have been increasing steadily since 2011 till 2014 Q1. Last three quarters of 2014 saw a decline in rentals. However, the decline was mainly because of the weak release slate. The US/Canada box office receipt for 2014 declined to $10.4 billion from $10.9 billion in 2013.

I believe that the decline in physical DVD rental to be not abrupt mainly because of following key reasons.

a. There is a common myth in the market that Redbox will take the course of Blockbuster and will go bankrupt in coming years. The market share of Redbox will be completely taken away by Netflix, Hulu and Amazon Prime. However, the truth is that there is little overlap between Redbox's contents and Netflix and other online streaming service's contents. Redbox is able to deliver DVDs to its customers either on the date of DVD release or 28 days after the DVD release. On the other hand, Netflix and Amazon Prime do not have access to the new releases and have to wait more than the Redbox before they can deliver the content to their customers. Hence, direct competitors of Redbox would be Amazon Instant video, iTunes, and Cable Video on Demand. However, as shown in the figure in "Threat from substitutes" section, there is huge price gap between Redbox price and price from other digital streaming services. The main value proposition of Redbox is that it is the only player in the physical DVD and Blu-Ray rental space providing new releases to its customers at price range $1.5 - $2 per night. This price gap will be difficult to beat (as explained in investment summary section) and hence will take longer than expected to capture the market share of Redbox.

b. There is a common myth in the market that Redbox will take the course of Blockbuster and will go bankrupt in coming years. The market share of Redbox will be completely taken away by Netflix, Hulu and Amazon Prime. However, the truth is that there is little overlap between Redbox's contents and Netflix and other online streaming service's contents. Redbox is able to deliver DVDs to its customers either on the date of DVD release or 28 days after the DVD release. On the other hand, Netflix and Amazon Prime do not have access to the new releases and have to wait more than the Redbox before they can deliver the content to their customers. Hence, direct competitors of Redbox would be Amazon Instant video, iTunes, and Cable Video on Demand. However, as shown in the figure in "Threat from substitutes" section, there is huge price gap between Redbox price and price from other digital streaming services. The main value proposition of Redbox is that it is the only player in the physical DVD and Blu-Ray rental space providing new releases to its customers at price range $1.5 - $2 per night. This price gap will be difficult to beat (as explained in investment summary section) and hence will take longer than expected to capture the market share of Redbox.

c. High quality video streaming needs access to high speed broadband. As per the statistics from ITU (International Telecommunication Union), only 15 of the 100 fixed broadband subscribers in US have access to internet having speed above 10 MBPS. High quality streaming needs around 13 MBPS of internet speed. Hence, market segment consisting of customers who wants high quality picture will prefer Blu-Ray rentals through Redbox. Capturing this segment by Netflix or any other online streaming service will be challenging. Blu-ray's contribution to Redbox's total revenue has been increasing steadily since last 4 years and as of Q4 2014, revenues from Blu-ray was 18.4% of the total Redbox revenue.

d. One of the reasons that has been prevalent in market for online streaming services to completely capture Redbox's market share is renting movies through kiosks is less convenient than watching movie online. Though there is some truth in the reasoning, it is not completely true. Redbox kiosks are conveniently located at major retailers in US and on average two Redbox kiosks are at 5 minutes distance apart. Statistics show that 45% - 50% of DVDs are returned to different kiosk than from the kiosk where it was rented.

Cash cow businesses and reduced capex requirement will make cash flows sustainable despite declining revenues. At current stock price of $65, FCF yield of company comes out to be approximately 20%. Redbox and Coinstar have been the cash cow businesses for Outerwall. Management has been focused on fine tuning the location of kiosks so as to improve the revenue per kiosk growth and thus reducing the capex base. Capex requirement for Redbox and Coinstar will be minimal going forward since there won't be any further new kiosk installations. As per the management guidance, capex requirement for Redbox and Coinstar will be approximately $20 million each for 2015. Capex for Redbox will represent 1% of its revenues while capex for Coinstar will represent 6% of Coinstar's revenues. FCF will get further boost from the price increase at Redbox that happened end of last year and the increasing change in product mix.

DVD rental increased to $1.5 from $1.2 per night, Blu-ray rental increased to $2 from $1.5 per night while game rental increased to $3 from $2 per night. As of now price increase didn't see any negative impact on the rental behavior of the customers. There has been increasing shift towards Blu-ray rentals from DVD rentals.

Shareholder friendly management with focus on returning back 75% to 100% of free cash flow to the existing shareholders. Management tried few auto retail solutions before it decided to return the excess cash back to shareholders. Management has shown its prudence by showing commitment to buy back shares because at this moment I believe that's the best utilization of cash. Redbox kiosks and Coinstar kiosks have reached a saturation point. By doing share buy backs management has not only accelerated the returns for its shareholders, but also reduced the risk tremendously. By buying back shares it is avoiding the ill fate of the companies that make value destroying investments which would eventually empty the coffers of the company. Below I created few scenarios to show how the distribution of cash flow will accelerate returns to the shareholders.

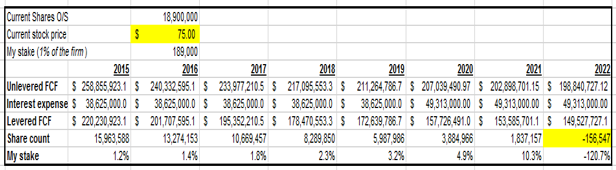

Case 1: Stock price moves up from current price of $65 to $75

If the stock price goes up to $75 and management continues buying back company's shares (100% of FCF) at $75, it will exhaust all its shares by 2022. If you own 1% of stake in the firm and you do not sell your shares, you will end up having access to company's entire cash flow at year 2022 and going forward.

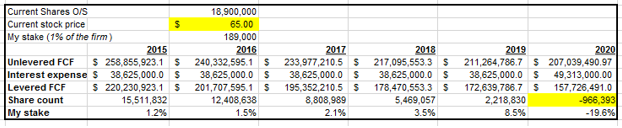

Case 2: Stock price moves up stays are current price of $65

If the stock price stays are $65 and management continues buying back company's shares (100% of FCF) at $65, it will exhaust all its shares by 2020. If you own 1% of stake in the firm and you do not sell your shares, you will end up having access to company's entire cash flow at year 2020 and going forward.

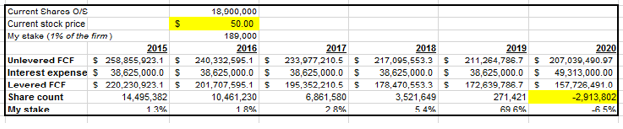

Case 3: Stock price declines by 25% to $50

If the stock price declines to $50 and management continues buying back company's shares (100% of FCF) at $50, it will exhaust almost all its shares by 2019. If you own 1% of stake in the firm and you do not sell your shares, you will end up having access to company's entire cash flow at year 2020 and going forward.

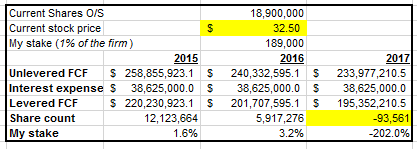

Case 4: Stock price declines by 50% to $32.5

If the stock price declines to $32.5 and management continues buying back company's shares (100% of FCF) at $32.5, it will exhaust almost all its shares within 2.5 years. If you own 1% of stake in the firm and you do not sell your shares, you will end up having access to company's entire cash flow at year 2017 and going forward.

Yes, this is just a mental exercise and I do not know how the story will unfold. But this is to demonstrate how share buy backs will accelerate returns to the shareholders in this case. If the share prices drop precipitously the story gets even more enticing for the investors.

If the management decides to distribute all its free cash flow through dividends then at current market cap of $1.24 billion, dividend yield comes out at 18%. Either way it's a won-win situation for the investor.

Valuation:

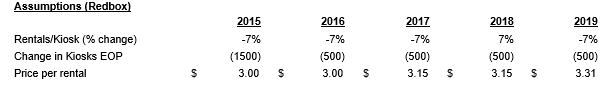

Base case: Under the base case I assume that current rate of decline in DVD rental will continue going forward. The shift of consumers towards digital services for movie rental will follow the current trend. Since last four quarters, rentals per kiosk have been on decline with an average decline of 7%. I have assumed this rate to continue for next 5 years. Management has provided guidance under which number of Redbox kiosks will be trimmed by 1500 by end of FY'15. I assume that management will keep continue trimming its Redbox kiosks albeit at lesser rate from FY'16 - FY'19. Price per rental will increase mainly due to - a. increased prices b. continued shift towards Blu-ray.

Coinstar kiosks have reached a saturation point. Transaction volumes declined by 4% yoy for FY'14. I assume that the transaction volume to follow similar trend going forward.

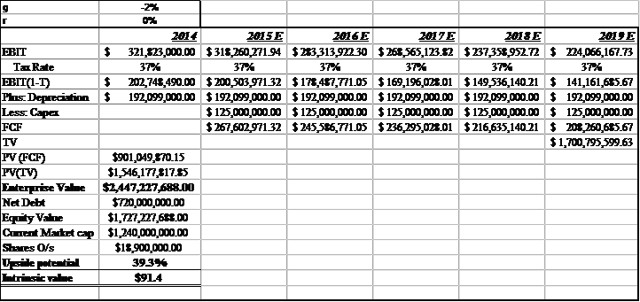

With above assumptions and terminal growth rate at -2% and discount rate of 10%, intrinsic value of the stock comes out at $91.4 i.e. potential upside of 39.3% from current stock price of $65.

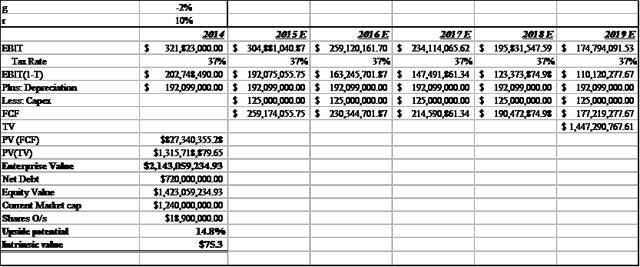

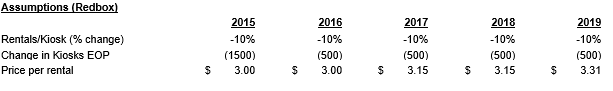

Bear case: Under the bear case I assume rentals per kiosks will decline at a faster rate of 10%. Consumers will start abandoning DVD rentals over VOD and other online rental services more rapidly. Assumptions for change in number of kiosks and price per rental will stay same. Assumption for Coinstar's transaction volumes stays same as in base case.

With above assumptions and terminal growth rate at -2% and discount rate of 10%, intrinsic value of the stock comes out at $75.3 i.e. potential upside of 14.8% from current stock price of $75.3.

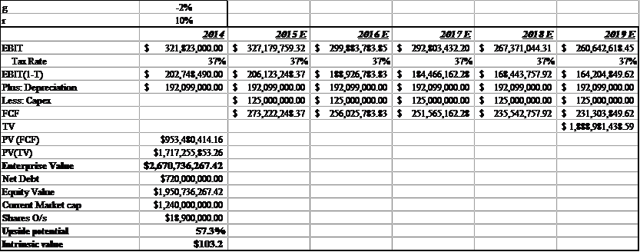

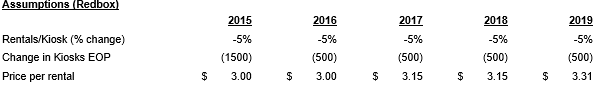

Bull case: Bull case represents a scenario in which Redbox will keep doing well. Rental volumes will still decline yoy though at a much slower rate. Redbox's DVD / Blu-ray rental per kiosks will decline by 5% yoy and Coinstar's transaction volume will decline by 3% yoy for next 5 years.

With above assumptions and terminal growth rate at -2% and discount rate of 10%, intrinsic value of the stock comes out at $103.2 i.e. potential upside of 57.3% from current stock price of $65.

Investment Risks

Below are few of the key risks that might cause hindrance in reaching stock to its intrinsic value of $91.

- The rental volume of DVD and Blu-ray rental fall off the cliff in next couple of years. Consumers stop watching movies on their DVD players and start preferring digital streaming. This will have substantial impact on the Redbox's and hence Outerwall's revenues.

- Management decides to stop distributing free cash flow to its shareholders and starts investing that cash flow into other ventures. This will decelerate rate of returns for the investors and management might end up squandering the cash.

- Company recently increased rental prices of its DVD, Blu-ray and games. If the increase in prices is not very well taken by the consumers then the revenues will have negative impact.

- One of the key differentiator between Redbox and digital streaming websites is new movie content. If studios decide to increase the release window for Redbox or reduce the window for streaming websites like Netflix, consumers might stop using Redbox.