Volatility is increasing in popularity as an asset class and trading vehicle, and for good reason. These are the Top 6 Reasons to Trade Volatility:

1. Mean ReversionVolatility has been shown to be a mean-reverting asset class (if you want to nerd out, see thisarticle). What does that mean? When volatility is higher than average, it's expected to come down. When volatility is lower than average, it's expected to move up. In other words, volatility moves towards the average. This is arguably the most predictable aspect of volatility. The trick, however, is that spot VIX is mean-reverting, but volatility futures are not (in turn, ETNs based on futures are also not mean-reverting). Why is this? Because the volatility futures curve already prices in the expectation of mean-reversion. So, the only way to capture the effects of mean-reversion is to trade spot VIX. The problem, though, is that spot VIX is not investable! See how VIX Strategies overcomes this problem and captures the effects of mean-reversion.

2. Volatility Risk PremiumHistorically, people have usually been willing to pay others to assume their risks (think of insurance). This is no different with stocks - investors (hedgers) are willing to pay a premium, above and beyond a "fair" price, to offset the risk of their stock portfolios to others. This premium can been seen in the tendency of implied volatility (IV) in S&P 500 options to overestimate realized volatility, and VIX futures to overestimate spot VIX. When this premium is positive, it can be captured by going short volatility, and when this premium is negative, it can be captured by going long volatility. The trick is figuring out when the premium is expected to be positive and when it is expected to be negative. The reward for being on the "right-side" of the volatility risk premium, however, can be great (see here).

3. Contango / BackwardationI don't want to bore readers with a bunch of technical stuff, so there is a short version and a long version for this one.

Short version: contango and backwardation are an added characteristic of volatility futures (and other futures) that are not present in traditional vehicles such as stocks, bonds, real estate, options, etc., that often create attractive trading opportunities. For example, a simple (but not advisable) strategy is to go short when futures are in contango, and go long when futures are in backwardation. For a detailed analysis of the impact of contango, see thisarticle.

Long version: Contango and backwardation refer to the price of a futures contract relative to spot. Contango describes a futures contract that is higher than the spot price, and backwardation describes a futures contract that is lower than the spot price. Contango represents a negative drag on long contract holders (as the contract approaches maturity, the contract will decrease in value until it equals the spot price). If a contract is in contango, long contract holders are implicitly betting that the future spot price will be higher than the current futures price. In turn, the spot price has to increase by more than the futures price for the long contract holder to make money. Vice versa for short contract holders when the contract is in backwardation. Getting to the point here - contango and backwardation are an added characteristic of volatility futures (and other futures) that are not present in traditional vehicles such as stocks, bonds, real estate, options, etc., that often create attractive trading opportunities. For example, a simple (but not advisable) strategy is to go short when futures are in contango, and go long when futures are in backwardation. For a detailed analysis of the impact of contango, see this article.

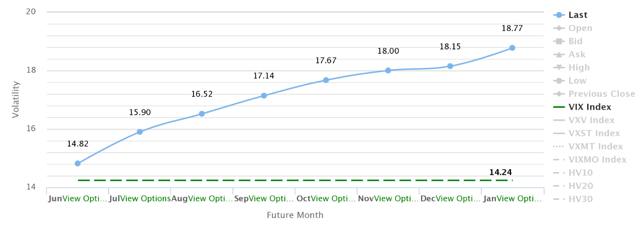

Below is a graph of the VIX futures curve on 6/2/2015 when the VIX was in contango.

"Volatility mean reverts but contango losses are forever…" -Eli Mintz http://vixcentral.com/

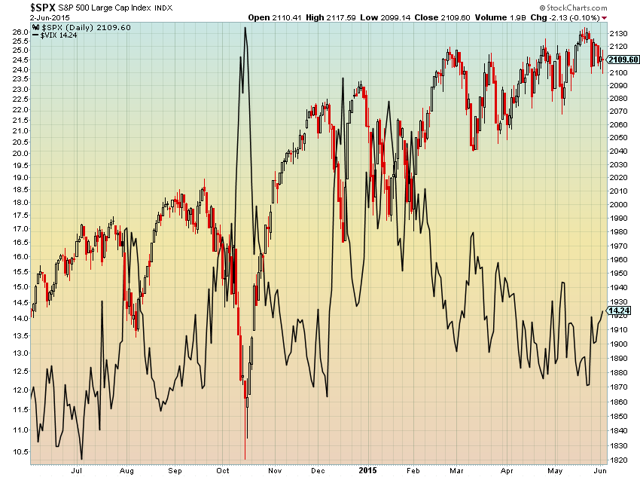

4. Negative CorrelationHistorically, the VIX (spot) has about a -80% correlation with the S&P 500 (see here). This makes volatility a useful asset class for hedging stock portfolios.

Below is a graph of the S&P 500 vs VIX:

5. Liquidity and ScalabilityIt's no secret that trading costs add up quickly and often create a material drag on performance. Reducing trading costs wherever possible can save you thousands over the long-run. One of the best ways to do this is to avoid illiquid trading vehicles with large bid-ask spreads. Thankfully, many volatility instruments, including S&P 500 index options, are extremely liquid, and often have bid-ask spreads of a penny. It's not uncommon for the popular XIV (short volatility) ETN to trade over 20M shares a day, or for front month ATM S&P 500 index options to have open interest of over 20k. This means you can trade volatility strategies in size with relative ease and little slippage.

6. Volatility is VolatileTake a look of a chart of the VIX - it's clear that the swings are quite extreme on a percentage basis. This scares away many people from including volatility vehicles in their portfolio. Nonsense. Simply put, volatility (to be clear, in this case, we mean the volatility of volatility) creates opportunity. In turn, volatility products are often popular among speculators.