Lost in the headlines of yet another eventful week on Wall Street was news of the first BRIC summit, held this week in Yekaterinburg, Russia. BRIC ETFs have been risen sharply in the first half of 2009, but investors looking for good news out of the summit to continue the rally were largely disappointed, as the meeting failed to yield any substantive action points or resolutions. Worse yet, obvious conflicts between the members seem to indicate that future collaboration may be largely for show, as the differences between member nations are abundant.

BRIC countries include Brazil, Russia, India, and China. The term was introduced by Goldman Sachs in 2001 to collectively describe the four fast-growing emerging markets that were hot investment options at the time. It was theorized that given the tremendous growth rates of these four small (at the time) economies, the BRIC countries could eclipse the combined economies of the world's richest countries by 2050. While BRIC leaders have previously held less formal meetings during UN conferences, this week's summit in Russia market the first effort of these disparate nations to formally organize themselves and convert their collective economic resources to geopolitical clout.

Conflicts AboundThe BRIC countries have evolved into four extremely different nations, not only in terms of population and location, but in terms of economic and international policies as well. Such differences appeared to prevent any meaningful resolutions from emerging from this week's summit. Their differences are perhaps best highlighted by the clash between countries over the role of the U.S. dollar as the world's reserve currency. When Russia and Brazil called for the BRIC to try to loosen the grip of the dollar on the world's financial system, China passed up the opportunity to show its support for such an effort, likely out of concern for the value of its huge holdings in U.S. government bonds. Recent Treasury Department data indicates that China has $767.9 billion of U.S. Treasuries, making it the world's largest holder.

Russia and China also clashed over policies towards metals-rich central Asia. China recently announced plans to give $10 billion of loans to the region, potentially embarrassing Russia, whose promises of support and aid have been downsized or delayed as a result of the financial crisis. "While both China and Russia are keen to keep the U.S. and Europe out of the region, Moscow is none too keen to be displaced as the political power in the region by its eastern neighbour," said Chris Weafer, a chief strategist at Uralsib, a Moscow brokerage.

Pointless Endeavor?The BRIC countries have agreed to work together to ensure that the interests of developing countries continue to receive appropriate attention at G8 and G20 summits. But such a resolution seems obvious and vague, and no specific details emerged on how these countries might work together to further their collective economic development. While they have agreed to convene again next year in Brazil, future meetings seem more likely to result in clashes of political and economic policies than empowering resolutions. Aligning their interests and presenting a unified front to the world's rich countries would no doubt aid the BRIC nations. But failure to reach a consensus on certain issues could result in escalating tensions that hinder development.

While this week's BRIC summit was, in my mind, a pointless endeavor, future meetings may very well prove to be destructive and destabilizing. The BRIC partnership seems forced and vulnerable. Perhaps we've made too much out of a "partnership" that was, after all, devised by an analyst with an investment bank in an economic environment very different from the current global situation. BRIC investments have flourished as these countries operated independently and took little action to further the notion of a cohesive and unified group. Attempting to do so know seems like an unnecessary step that could only backfire.

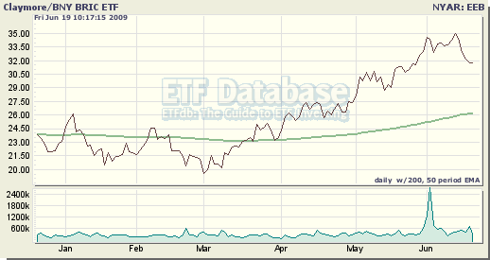

BRIC ETFs, including Claymore's EEB, are up nearly 40% on the year but were little changed following the conclusion of this week's summit.

Disclosure: No positions