In the topsy-turvy world of U.S. "newsertainment", it is common knowledge that comedian Jon Stewart of The Daily Show is one of Americans' "most admired journalists". Regrettably, the U.S. mainstream media has chosen to compete with Stewart…by producing comedy.

Their favorite front-man is famed stand-up comedian, B.S. Bernanke. Bernanke became famous for such immortal one-liners as "the Goldilocks economy", "the soft landing", "the exit strategy", and his most oft-repeated joke: "the U.S. economic recovery."

As is often the case with popular humor, "the U.S. economic recovery" has been repeated ad nauseum by the mainstream media. Inevitably, the joke quickly became boring, and is now just very, very annoying.

The U.S. recovery is like one of the Simpsons episodes featuring mythical daredevil "Captain Lance Murdock". After performing one of his heroic stunts, and inevitably ending up with his shattered body in a crumpled heap, he shakily raises one hand to give the "thumbs up" sign, and then we hear in the background the announcer proclaim, "He's all right!"

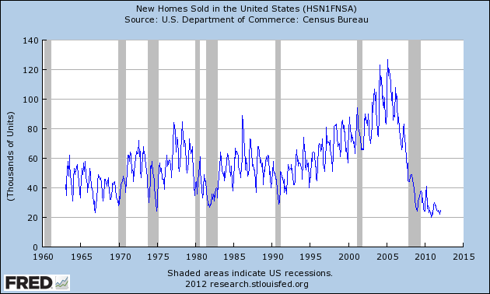

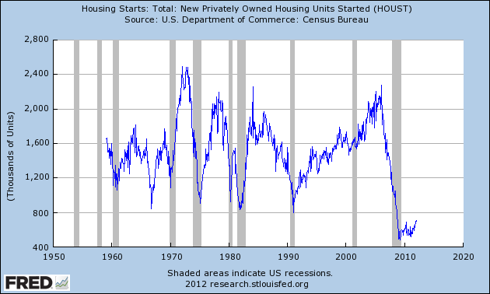

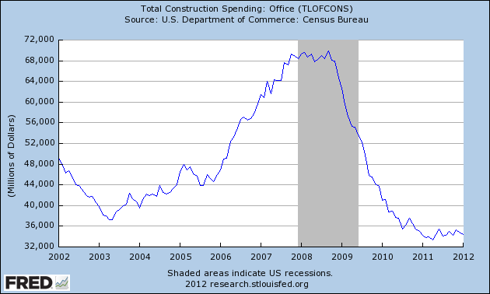

Observe the following crashes, and the "recoveries"(?) that followed:

However, even clever Simpsons' humor ceases to be funny if one is forced to watch/listen to the same joke, day after day, for nearly three years; and the U.S. mainstream media is not nearly as clever/funny as the Simpsons.

Case in point, observe Bloomberg's latest version of this tiresome joke:

Service producers are taking over from manufacturing as the driver of the almost three-year-old U.S. economic expansion.

The end of the recession in June 2009 triggered the biggest surge in production in a decade, propelled by rising demand from overseas and the need to replenish inventories and upgrade equipment. That is now giving way to increasing sales at places like restaurants, transportation companies and temporary-help agencies, leading to gains in employment that have bolstered the world's largest economy.

Let's dissect the first part of the joke first: "services" are taking over from "manufacturing" as the supposed drivers of this mythical economic recovery.

To begin with, its absurd to suggest there has been any growth at all in U.S. manufacturing. Manufacturing is the most energy-intensive part of an economy, but the U.S. economy is using less and less energy, and even less electricity than it used prior to the Crash of '08.

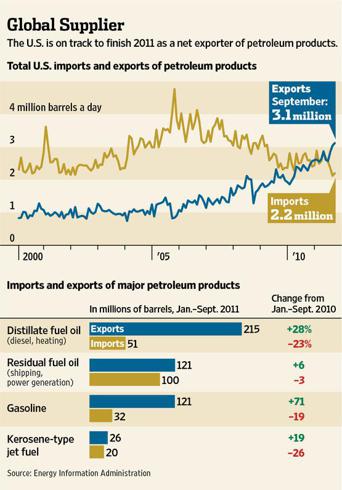

As recently as April 2007, CNN was reporting that a "refining crunch" (i.e. a lack of refining capacity) was so severe that it had become a primary driver of U.S. gas prices. However, by July 2010 (more than a full year after the start of the supposed recovery) Reuters was reporting that U.S. refineries needed to continue cutting capacity. Yet even with the cuts in output, by the beginning of 2012 the Wall Street Journal proclaimed that the collapse in domestic energy demand was forcing U.S. refineries to export so much of their production that the U.S. had become a "net energy exporter."

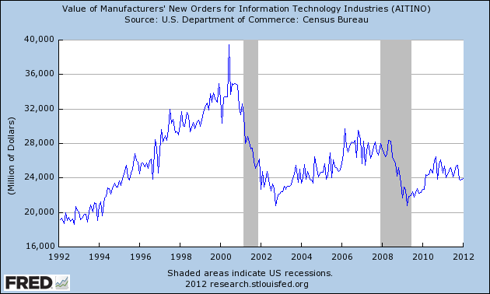

It is even more absurd to argue that there could be "new manufacturing" activity in the U.S. which doesn't require any electricity. Apologists will argue that the 21st century U.S. economy is now much more "energy efficient", because it's so high-tech. Reality dictates otherwise. The chart below shows the complete absence of any significant new spending in the most significant field of hi-tech: "information technology".

Obviously, manufacturing activity in the U.S. can only be shrinking, given the collapse in energy/electricity consumption, despite a steadily growing population. It is equally simple to debunk the only new twist to this joke: that the U.S. service sector has taken over from manufacturing as the driver of the U.S. economy.

The latest available statistics show that U.S. mall-vacancy rates remain near all-time highs. Sky-high vacancy rates in U.S. malls suggest a service sector in "depression" mode, not recovery mode. However, for any who aren't convinced by all the ghost-malls cropping up all over the U.S., there is a very simple way to resolve any possible doubt.

The service sector, by definition, is employment-intensive. It takes people to provide services. As part of the "U.S. economic recovery" jokes, we have been tortured by the worst pseudo-comedian in the U.S.: the Bureau of Labor Statistics. As its own schtick, the BLS is not only reporting month after month of "jobs growth", but steadily increasing jobs growth.

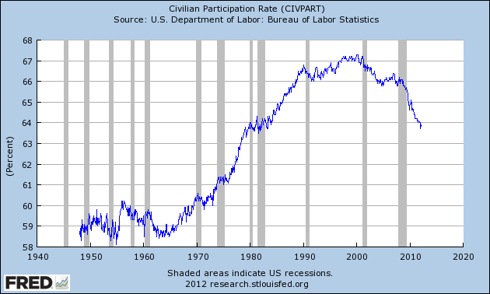

It's not even funny. Below is the U.S. civilian participation rate. It's a very simple statistic. It shows the percentage of the U.S. population who are in the work force. As the chart clearly indicates, the civilian participation rate has been plummeting much more quickly since the mythical recovery began than it did during the "recession".

This is one of the few pieces of raw data remaining in the U.S. which has not been (cannot be?) corrupted by the propaganda machine. Less and less people are working in the U.S. - and the job losses have been accelerating during this "recovery". With less and less people working in the U.S., and more and more malls closing; it is utterly ridiculous to claim that the U.S. service sector is growing. Merely selling a few more "Big Macs" to over-fed Americans just won't cut it.

We are left with the following analysis of Bloomberg's joke. It writes that growth in manufacturing and growth in services has led to growth in employment. Meanwhile, back in the real world we see that U.S. manufacturing activity must be contracting. U.S. service sector activity must be contracting. And the result of this is that less and less people have jobs each month - i.e. there has been no net "jobs growth" of any kind.

It is the hallmark of good humor that it needs to have injections of originality in order to be funny. It is here we see the complete failure of the mainstream media in the realm of comedy, as epitomized by their favorite icon: B.S. Bernanke.

Bernanke crowed that the U.S. had a "Goldilocks economy" (i.e. everything was "just right") and it immediately turned lower. Bernanke told us the U.S. economy would have a "soft landing", and the U.S. suffered the worst economic crash since (at least) the Great Depression. At the beginning of 2009, Bernanke promised an "exit strategy", while only a few weeks ago he admitted that there would be no "exit" until at least 2015 (and even that might just be another joke).

We get it. Whatever Bernanke says, we can be 100% certain to see the exact opposite. And so when Bernanke tells us day after day after day (for three years) that the U.S. economy is "recovering", we know that it is in fact continuing to plummet downward. It is a very old joke, and arguably it was never funny, especially if you're one of the 10's of millions of Americans who have been victims of the U.S. Greater Depression - through losing their homes, losing their jobs, or both.

Attention to all of the would-be comedians in the U.S. mainstream media: you need some new material!

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.