It is common for many investors to buy oil and gas stocks while energy costs are low. Oil has been hovering in the upper 80s while natural gas has been near 3 dollars for the past month. Demand for oil certainly isn't slowing and demand from developing nations will only increase during the next few years. Nat gas prices will likely increase over the next few years. Billionaire T. Boone Picken's is predicting that natural gas prices will reach 4.50 to 5.00 dollars in 2013 and 6 dollars by 2015. National Oilwell Varco (NOV) is one of Picken's favorite plays on this price increase. Royal Dutch Shell has begun to invest heavily in liquefied natural gas because they believe that more cars will run on nat gas in the future. The company builds oil and gas rigs and they basically have a monopoly on the industry.

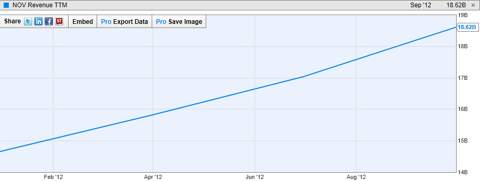

National Oilwell Varco is a company with strong fundamentals. Although some analysts believe that the rig building is dying, I think these accusations are over hyped. Varco actually has a capital equipment backlog of 11.6 billion dollars. Orders for Varco's deep water equipment is also in high demand and this trend will likely continue over the long term. The stock has a forward P/E ratio of 10.55 and a PEG ratio of .71. NOV's revenue has grown by 4 billion dollars over the past year from 14.66 billion to 18.62 billion. Varco also acquired the piping and fitting unit Schlumberger earlier this year.

Disclosure: I am long NOV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.