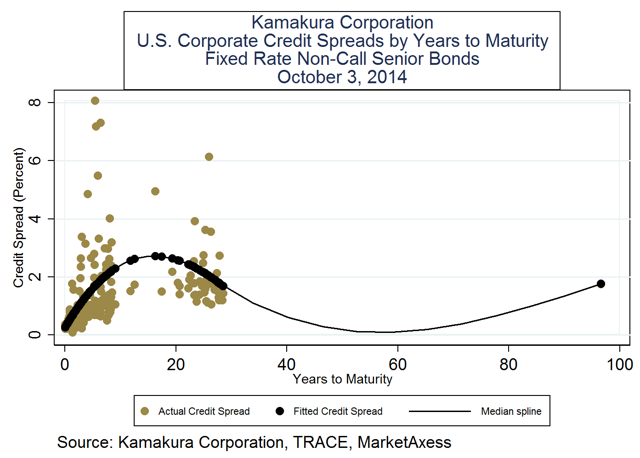

The graph shows the credit spread as a function of years to maturity on all corporate bond trades in the U.S. market which met the following conditions:

Coupon: Constant fixed rate until maturity

Maturity: 1 year or more

Trade volume: $5 million or more

Seniority: Senior debt

Callability: Non-call (except for "make whole" calls)

The credit spread is calculated by comparing the trade-weighted average yield to the matched maturity U.S. Treasury rate supplied by the U.S. Department of the Treasury to the Federal Reserve H15 statistical release. Calculations are by Kamakura Risk Information Services using data from TRACE. In a recent note, we explained why it is incorrect to use the common financial relationship that says credit spreads equal the default probability times (one minus the recovery rate). The graph above is additional evidence that this simple formula is incorrect. For more information please contact info@kamakuraco.com.