This week's analysis of the most heavily traded bond issues and their best value rankings has been posted. Here are a few highlights.

- An Excel spreadsheet down-load capability has been added to The Corporate Bond Investor Service.

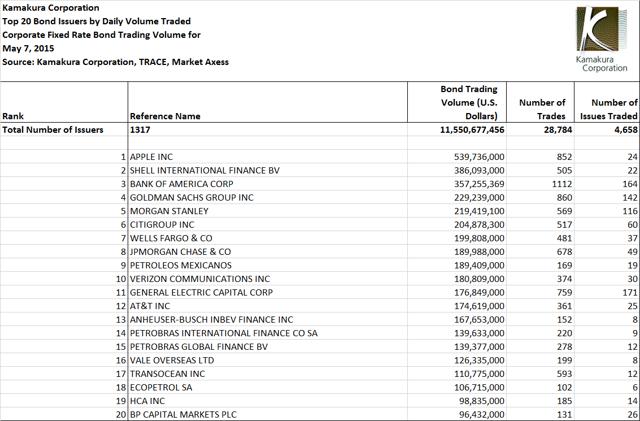

- Apple Inc. (AAPL) led bond trading volume on May 7 in the wake of its $8 billion package of bond offerings. This analysis was released by Kamakura Corporation this morning. Shell International Finance B.V. followed right behind (RDS.A) (RDS.B)

- There were 427 senior non-call fixed rate debt issues that traded at least $5 million in daily volume.

- Only 48 of those bond issues had non-investment grade legacy ratings.

- 91 of the issues had maturities of 10 years or longer.

- 67 of the issues had maturities of 20 years or longer.

- With the revision of the Kamakura Risk Information Services default probabilities to incorporate all publicly traded firms from January 1990 to May 2014, the full credit crisis experience has revealed some important insights that are reflected in this week's best value rankings.

- In particular, financial services firm default probabilities and the default probabilities of highly leveraged firms are higher for long maturities than they were in the previous version.

- This puts financial services bond issuers on the lower rungs of the best value bond laddering.

In analyzing the best trades of the day, we used these criteria:

Bond type: Fixed rate

Callability: Non-call

Seniority: Senior debt

Trade Volume: $5 million or more

Maturity: 1 year or more, 10 years or more, and 20 years or more

Ratings: Ignored

Survivor Option:Excluded

The most heavily traded bond issuers on May 7, 2015 are listed here: