A number of authors have suggested that credit default swap pricing be used as a basis for setting deposit insurance premiums for banking firms or setting compensation for bank chief executive officers. We re-examine these proposals in this note, the seventh of a semiannual series of reports on credit default swap trading in U.S. bank and bank holding company reference names. This note updates the prior Kamakura Corporation report on credit default swap trading on U.S. banks for the 233 weeks ended December 26, 2015. We find that MBIA Insurance Corporation and Bank of America Corporation were the institutions traded most heavily in the credit default swap market over the July 10, 2010 to June 26, 2015 period. This updated report also confirms the conclusions of the six prior reports: that there is trading only in the largest or most troubled bank holding companies in United States and that the credit default swap market does not provide a credible basis for pricing deposit insurance or executive compensation at U.S. banks.

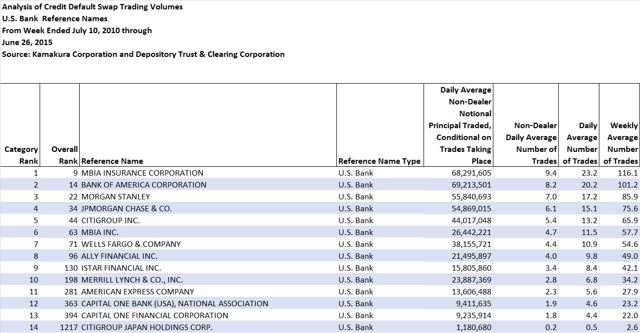

Using data reported by Depository Trust & Clearing Corporation during the 259 weeks ending June 26, 2015, there were credit default swaps traded on only 14 reference names among U.S. banking firms. No new U.S. bank reference names were traded during the last 26 weeks. The 14 traded reference names are given here:

|

|

|

|

|

|

|

|

|

|

|

|

|

These 14 reference names represent 11 consolidated corporations. Six of the 14 reference names are affiliated with companies named in lawsuits alleging manipulation of the credit default swap markets. We have omitted, somewhat arbitrarily, names like Goldman Sachs (GS), MetLife (MET), and Prudential Financial (PRU) on the grounds that they were not considered banks prior to the financial crisis and that they had the financial strength to weather the crisis without bank holding company status. During the 259 weeks of data on all live trades in the DTCC credit default swap trade warehouse, there were no trades on any other of the 6,369 banks insured by the FDIC in the United States as of July 1, 2015.

Credit default swap trading volume on the 14 firms listed above is based on data from the Depository Trust & Clearing Corporation and calculations by the Kamakura Corporation. We assume that each firm has a percentage of dealer-dealer trades equal to the 59.32% of all trades in the DTCC trade warehouse that were between dealers on June 26, 2015.

The trading volume for the 14 reference names is summarized here:

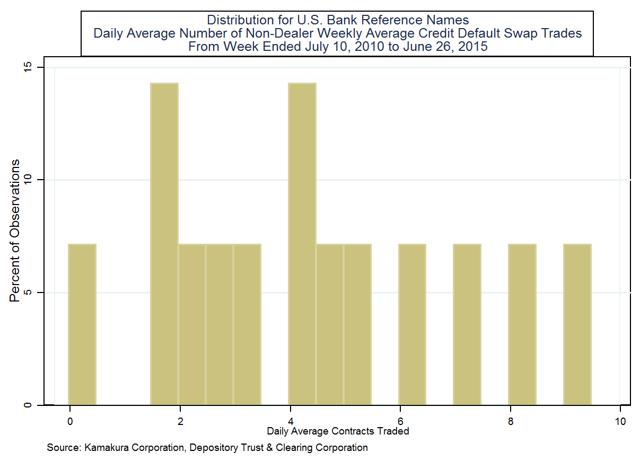

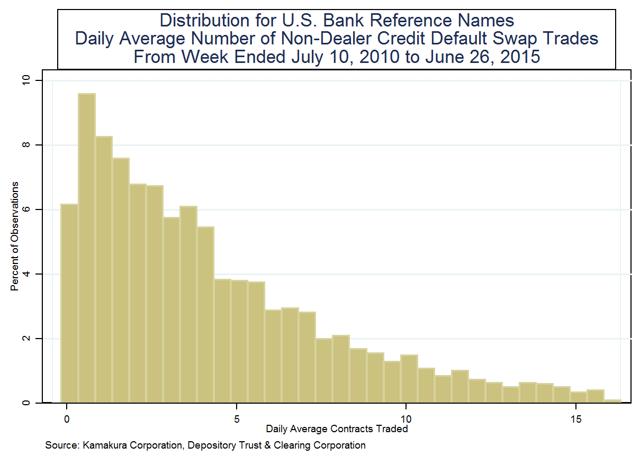

There was an average of only 4.4 non-dealer credit default swap trades per day during the 259 weeks ended June 26, 2015 for the 14 banking entities listed above. None of the banks listed above averaged more than 10 non-dealer trades per day over the 259 week period studied. Five of the 11 firms listed are in a conflict of interest position as major dealers in the credit default swap market: Bank of America, Citigroup, JPMorgan Chase, Morgan Stanley, and Wells Fargo. Dealer-dealer trades made up 59.32% of live trades in the DTCC as of June 26, 2015. The dealers would be setting deposit insurance rates for themselves if credit default swap pricing were used to determine FDIC insurance premiums. Similarly, dealers would be setting compensation for the bank CEOs who determine the bonus pool for credit default swap dealers. The histogram below shows the distribution of the 14 observations on the daily average number of non-dealer trades over the full 259 week period:

There were 14 names x 259 weeks or 3,626 potential observations of credit default swap contract volume on U.S. banks. 3,259 of the observations were non-zero. 367 of these observations, 10.1% of the total, were for zero contracts traded during the week.

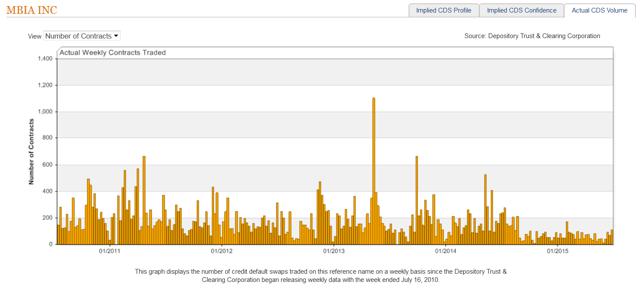

Trading Volume for MBIA Insurance Corporation

The largest single week of trading recorded was for 959 contracts, the equivalent of 52.8 non-dealer trades per day during that week. That volume was for MBIA Insurance Corporation during the week ended May 10, 2013. The graph below shows the number of contracts traded weekly on MBIA Insurance Corporation for the 259 weeks ended June 26, 2015:

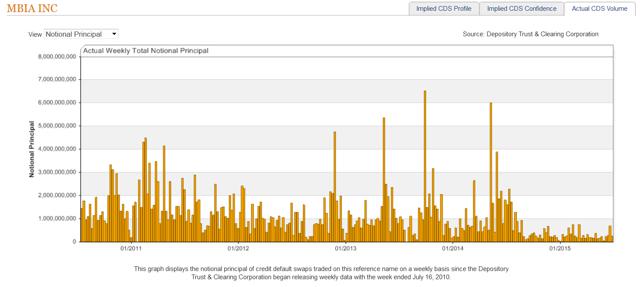

The next graph shows the notional principal of credit default swaps traded on MBIA Insurance Corporation from the week ended July 10, 2010 to the present:

Trading volume in the parent company MBIA Inc. is summarized in the chart showing all U.S. bank reference names. Details are available upon request.

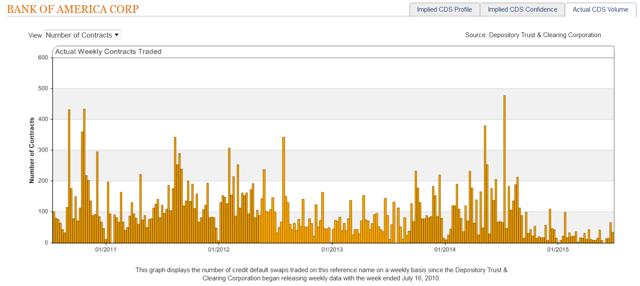

Bank of America Corporation

The number of credit default swaps traded on Bank of America Corporation traded during the 259 week period is summarized in this chart:

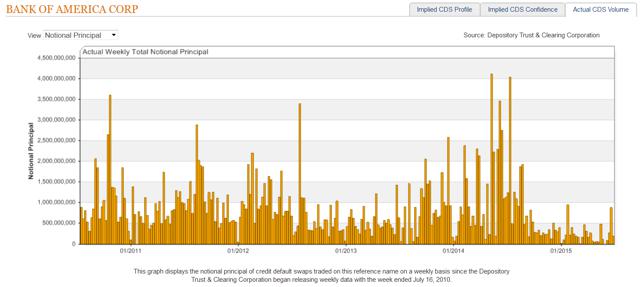

The total notional principal associated with those trades on Bank of America is shown in the chart below:

Trading volume in Bank of America Corporation subsidiary Merrill Lynch is available upon request.

Analysis of All Weekly Observations

Next we look at all of the individual weekly observations for the 14 reference names over the 259 week period, not just the average of the 259 weeks of data for the 14 firms. The distribution of the daily average non-dealer trades is shown here:

The data in the chart reveals these facts:

- The median number of non-dealer trades per day for these U.S. banks was 3.4 per day over all weekly observations.

- The average number of non-dealer trades per day was 4.8 trades.

- For 75% of the observations, there were 6.4 non-dealer trades per day or less.

- For 95% of the observations, there were 14.1 non-dealer trades per day or less.

- For 99% of the observations, there were 24.0 non-dealer trades per day or less.

Conclusions

Our conclusions from our prior report on the 233 weeks ended December 26, 2014 remain unchanged. Credit default swaps are not a practical basis for pricing bank deposit insurance or setting bank executive compensation for a number of reasons:

- The use of credit default swaps is analytically incorrect as a method of determining the probability of default for any reference name, as pointed out by Robert Jarrow in the Journal of Fixed Income.

- The number of reference names traded over the 259 weeks ended June 26, 2015 is only 14, but 6,369 banks in the United States were insured by the FDIC as of July 1, 2015.

- Almost half of the reference names traded are major dealers in the credit default swap market, so they are in a conflict of interest position.

- The conflict of interest of having bank chief executive officers and credit default swap dealers set each other's compensation is particularly stark.

- There is a risk of collusion among dealers that is similar to the risks of collusion in the Libor market, and lawsuits alleging such collusion have been filed by institutional investors in both the United States and in Europe.

- Credit default swap pricing on senior debt is affected by the probability of a bail-out of senior debt holders, so CDS pricing understates the true risk of failure for a bank that is "too big to fail."

Donald R. van Deventer

Kamakura Corporation

July 6, 2015