HPQ 3D Is In Its Sights

Investment Thesis

HP with Meg Whitman at the helm has started to right the ship. Its revenues stabilized. It continues to increase dividends. It is entering the 3D market, where it will be a clear market leader given its experience and leadership in technology hardware. Finally, HP is cheap at its current share price with roughly 50% upside to its no growth fair value of $45 per share.

Company Description

Hewlett-Packard (HP) (NYSE: HPQ: $31.48) is a leading global provider of products, technologies, software, solutions and services to individual consumers, small- and medium-sized businesses, and large enterprises, including customers in the government, health and education sectors.

HP's offer a wide range of products including: computing and other access devices; imaging and printing-related products and services; enterprise IT infrastructure, including enterprise server and storage technology, networking products and solutions, technology support and maintenance; multi-vendor customer services, including infrastructure technology and business process outsourcing, application development and support services, and consulting and integration services; and IT management software, information management solutions and security intelligence/risk management solutions.

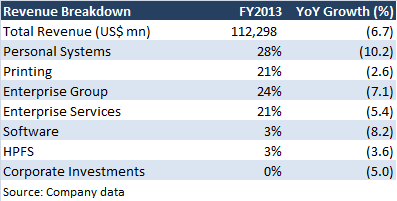

The company has seven business segments: Personal Systems, Printing, the Enterprise Group Enterprise Services, Software, HP Financial Services, and Corporate Investments. The company's Fiscal Year 2013 revenue breakdown by business segment is illustrated below.

FQ1 2014 Earnings Report

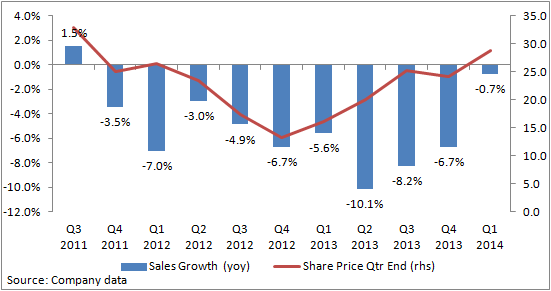

On February 20, 2014, HP reported first fiscal quarter 2014 results. The company's revenues stabilized after 2 years of declines. The company's share price followed the decline in revenue growth and anticipated the stabilization of revenues.

The stabilization of revenues came with increased profitability. Earnings per share and cash flow from operations grew 17% year on year.

Meg Whitman

In June 2011, Meg Whitman was appointed to HP's board of directors. In September 2011, HP's board of directors appointed Ms. Whitman to the CEO position. As illustrated above, Ms. Whitman stabilized revenues by refocusing efforts on research and development and reaffirming HP's commitment to the PC division. Ms. Whitman increase dividends and share buybacks. She also is identifying new areas of growth as illustrated by HP's planned move into the 3D market.

Dividend Increase

On March 19, 2014, HP's Board of Directors authorized a 10.2% increase in the company's regular quarterly cash dividend to $0.16 per share, effective when the Board of Directors declares the next dividend, expected in May 2014. The dividend increase represents a trend of growing dividends, with dividends growing at around 10% per year over the past few years. In fiscal year 2013, HP's quarterly dividend of $0.145 was a 9.85% increase over fiscal year 2012's quarterly dividend of $0.132, which was a 10% increase from fiscal year 2011.

HP has continued buyback shares. From the first fiscal quarter in 2011 to the end of the first fiscal quarter in 2014, HP has bought back 12.65% of shares. This is an extra 4% in dividends per year from share repurchases.

Assuming the 4% repurchase yield continues, at the current price, the total dividend and repurchase yield is 6%.

Entering 3D Printing

HP announced it will be entering the 3D printing industry. It plans to offer its first product in June 2014. HP's expects a higher quality faster product. HP experience in hardware and its ability to outspend all existing 3D player will allow it to take significant share from the existing players. 3D is a huge opportunity for HP with the 3D printing market expected to reach $8.41 billion by 2020.

Valuation

HP is very cheap. Valuing HP using a DCF, and assuming an 8% discount rate, no revenue growth, and an operating margin of 8%, HP's FY2014 fair value is closer to $45 or about 50% upside from the current share price. With HP righting the ship, these assumptions seem conservative.

Technical Analysis by Harry Boxer

From its 2010 high near $55, HP experienced a serious decline to the bottom of its 5-wave move near $11 last November. Over the next 9 months, the stock experienced a sharp V bottom type reversal and surged back to near $28 to near an important overhead resistance zone. The following pullback retraced about a third of its run, but held support. HP then embarked on its latest run from near $20 to today's high near $32.40 (a new 2½ year high). The Tech Trader believes HP has a lot more left and now project targets at $37, $47 and eventually $54.

Conclusion

HP with Meg Whitman at the helm HPQ has started to right the ship and it's revenues have stabilized. The company continues to increase dividends. It is entering the 3D market, where it will be a clear market leader given its experience and leadership in technology hardware. Finally, HP is cheap at its current share price with roughly 50% upside to its fair value of $45 per share.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Subscribers to my Market Newsletter may own shares in HPQ.I was assisted in writing this article by my associate Marc Melendez.