With consolidation over the past few years, it has become a 3-horse race for pharmacy dominance. This week, we got a peak into the health of the drugstore retail sector as Walgreens and Rite Aid reported quarterly earnings.

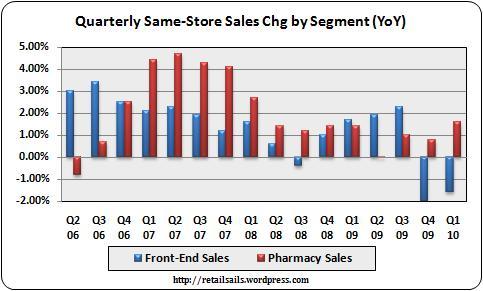

Overall, the sector has held up well, with continued sales gains throughout the recession. Growth has been driven mainly by strong pharmacy demand as all three, including CVS Caremark, depend on RX sales for over 65% of their business. Front-end sales have trailed pharmacy results but drugstores have also taken market share for items such as cosmetics and accessories.

The corner drugstore has undergone a lot of changes this decade – each of the 3 have undertaken large acquisitions in order to build out national retail networks, as well as adding related businesses from benefits management to specialty pharma services to in-store and workplace clinics. In a continually changing landscape of regulatory change and retail competition, each company is facing distinct challenges – let’s take a look at how two of the companies are responding:

Walgreens

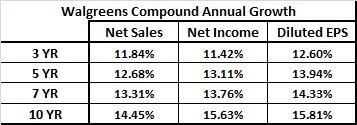

Walgreens has the largest retail network in the US, with 7,361 stores including 6,857 drugstores as well as worksite health centers, home care facilities and specialty, institutional and mail service pharmacies. With an unbelievable track record of consistent performance – 34 straight years of record sales and earnings – they have long been known for their conservative culture, profitability and organic growth. While growth has slowed somewhat during the recession, their long term results are extremely impressive:

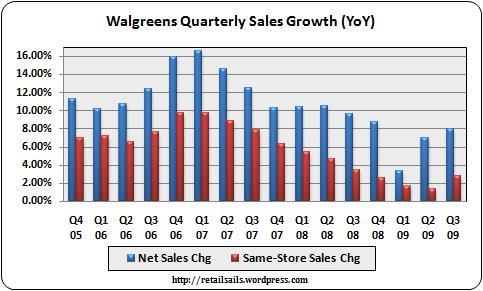

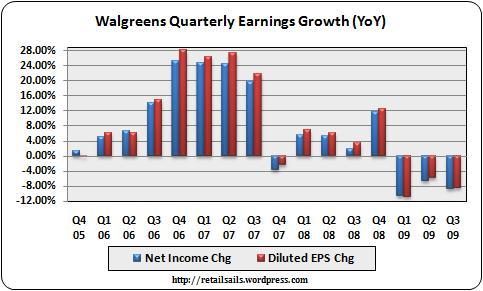

In the fiscal 3rd quarter of 2009, the company reported net sales growth of 8% to $16.21 Billion and a same-store sales increase of 2.8%, while earnings were down 8.7% over the prior year to $522 Million. Front-end same store sales were up 0.9% and pharmacy comparable sales increased 3.8%. The company has been long accustomed to posting consistent double-digit top and bottom line gains, so it’s certainly surprising to see 3 straight quarterly earnings declines:

Commenting on the results, CEO Gregory Wasson said “In the third quarter, we posted solid results in a difficult economy while recording significant restructuring costs.” They are focused on three core strategies intended to help them return to double-digit earnings growth: leveraging the largest store network in America, enhancing the customer experience, and implementing major cost reductions and productivity gains.

Cost reductions include slowing store openings from the current 9% to between 2-3% by 2011, which is expected to have a positive impact on operating profit and ROIC. They are also working on tight inventory control, with roughly 18% of total SKU count already eliminated.

As far as the customer experience, the company is rolling out Customer-Centric Retailing (CCR), which is a combination of enhanced store formats, fine-tuning the role of various categories within the store, optimizing product assortment, pricing, and promotions, and enhancing vendor relationships. The new format has been rolled out to 35 pilot stores with plans to have about 400 stores converted by this fall.

While Walgreens has not been immune to cutbacks in consumer spending and structural changes in the industry, for over 3 decades they have shown they can adapt to a rapidly changing environment and always come out ahead. With new CEO Gregory Wasson and other new executive hires including retail and healthcare talent, the company is well positioned for the future.

Here a couple of quotes from Wasson on the conference call regarding the consumer:

“We continue to see consumers save more, use less credit, and spend closer to payday. This is challenging to all retailers, including us, but we are well-positioned to continue to grow.”

“Today’s consumer is more value-driven than in the past and this may be a permanent shift.”

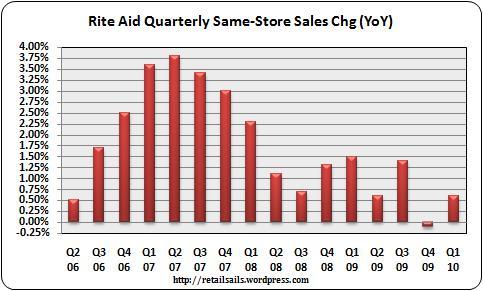

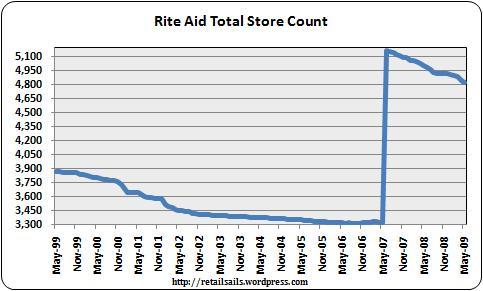

Rite Aid is the smallest of the three drugstore retailers with 4,825 stores, and has been trying to play catch-up ever since an accounting scandal nearly led them into bankruptcy in the late 90’s. They have posted nearly $4 Billion in losses over the past 2 years as they have struggled with the integration of Brooks Eckerd Stores which was acquired in 2007. Long relying on acquisitions for growth, the company has suffered under a mountain of debt. However, the most recent quarter brought some signs of hope.

For the 1st quarter of fiscal 2010, Rite Aid reported that total net sales decreased 1.2% from the prior year to $6.531 Billion. Comparable same-store sales were up 0.6%, driven by a 1.6% increase in pharmacy same-store sales, while front-end same-store sales decreased by 1.6%. The company posted a loss of $98.4 Million (0.11 diluted EPS), which was a significant improvement from the $156.6 Million loss in the prior period.

More importantly, the company made significant progress on the debt front. On the conference call, CEO Mary Sammaons explained:

“Thanks to a substantial increase in cash flow from operations we were able to pay back debt on our revolver by more than $300 million. This is the first time we’ve been able to reduce our debt so significantly since the Brooks Eckerd acquisition.”

“This refinancing gives us more time to improve our results with the initiatives we have planned as well as those that are in place and have already started to work. We are confident we will also be able to extend the maturities on our accounts receivable refinancing before it matures in September 2010. When that’s done we expect to have no significant debt coming due over the next three years.”

Rite Aid closed 86 stores during the quarter and had 179 fewer stores than the year-ago period. The sales decline was primarily driven by the reduction in store count, while soft front-end sales also contributed. Overall store count has been steadily declining since the purchase of Eckerd stores:

While continuing to focus on balance sheet liquidity, the steps they have already taken will enable them to concentrate more on improving inventory efficiencies, as well as customer loyalty through programs such as the RX Savings card program. Card enrollment has grown from 1.7 million to 2.6 million users in just the past 3 months.

Rite Aid has been lagging behind its peers for over a decade and it will not be easy to right the ship in such a tough retail environment. One quarter of improvement certainly does not mean the company is out of the woods yet. However this is the first time they have shown a real window of hope since the Eckerd acquisition, so keep a close eye on Rite Aid’s performance over the next few quarters to see if they have finally turned the corner.

Like all retailers, the drugstore segment is facing strong headwinds from a frugal consumer in a tough recessionary environment. Pharmacy demand shows no signs of slowing down, and because of the convenience factor front-end sales will continue to help drive sales gains going forward. Both Walgreen and Rite Aid spoke of health care costs and regulatory reform on the conference calls, and this will certainly play a large part in shaping the industry for the foreseeable future. For retail drugstore companies, the only thing that stays the same is everything is always changing.

Disclosure: No Positions