CLARK'S GATE TIMING SYSTEM

Friday, 29 October 2010

WHAT THE CHARTS ARE SAYING

We have 3 bottom readings today; 25 top readings. Momentum continues to deteriorate; but the lack of widespread selling is quite amazing. Individual issues are being punished -- and punished badly -- for disappointing investors. Ttrading is so thin that stocks abandoned by investors do not find a pool of buyers ready to stem the fall and buy the dip.

We actually need a good correction here to clear the books, and start over again. But prices are stuck in a kind of no-man's land, unable to rise much, unable to fall. Does someone have his finger on the scale too much perhaps? Is there too much manipulation by the Lord on High, Herr Bernanke?

The lower US Dollar is negating profits made in (US Dollar denominated) stocks and indexes. We'd all be better off to have the Dollar strength and stock strength determined by a relatively neutral market and a disinterested monetary policy (from the Lords of Eastwick) -- then we could at least make our investment decisions based on what we know, and not, as now, on what we don't know and what we are trying to assume.

The TBond party seems to be winding down. Yield (and/or Inverse) TBond ETFs are bottoming and seem to be ready to announce higher interest rates as they move. Herr Bernanke seems to be less willing to fork over our money hand over fist to manage interest rates for his friends the bankers to rebuild their balance sheets.

Does this means stocks will rise, as money escapes from the bond market and moves in to stocks? If the Dollar rises, markets everywhere will fall, as the fake hot Bernanke air that has pumped up the new commodity (and commodity stocks) bubble will lose altitude rapidly.

M4 ACCUMULATION TOP AND BOTTOM WATCH LIST:

We like HMA in the bottom list. It is breaking through resistance as we speak, and seems determined to go higher.

In the top list, we have two OIL ETF's topping out. The weakest issues are HAL, MMM, TER,and VCI. Some pretty strong industrial names in this short-list, especially Haliburton and 3-M.

We include a few charts below of issues we think especially interesting.

CHARTS OF INTEREST

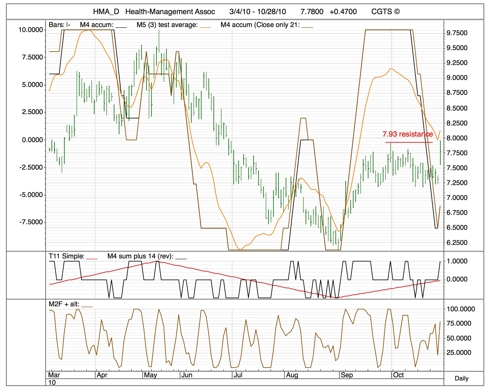

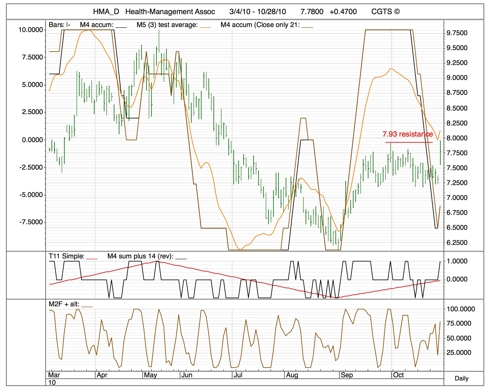

HMA, Health-Management Association.

Looks like a very good picture at the moment. A break-out to the upside. On the verge of making a new high.

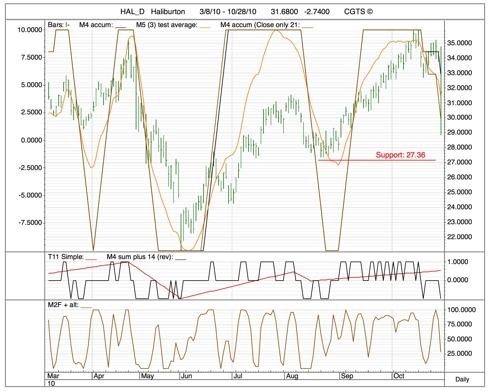

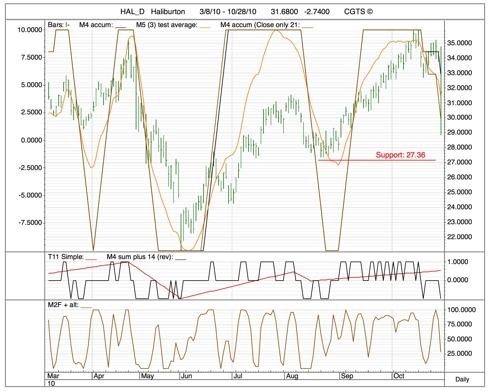

HAL, Haliburton.

Breakdown. Take profits. Should test support at 27.36. If that support breaks, then good short-sell candidate.

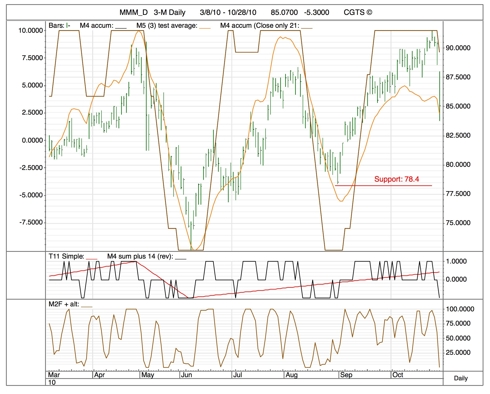

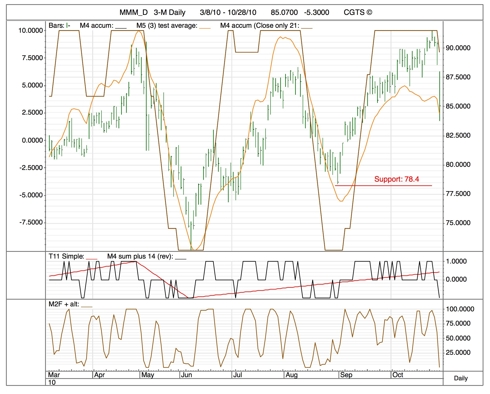

MMM, 3-M.

Disappoint this market, and you'll see a very quick-paced destruction. MMM has a long way to fall. Support at 78.4.

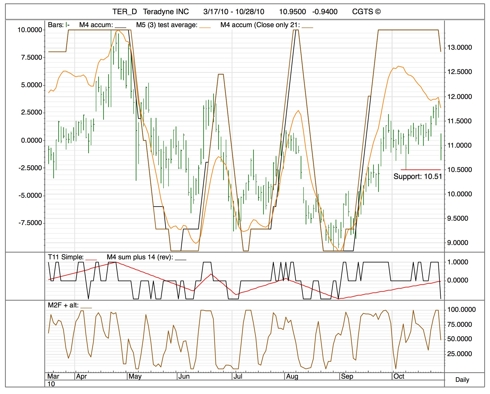

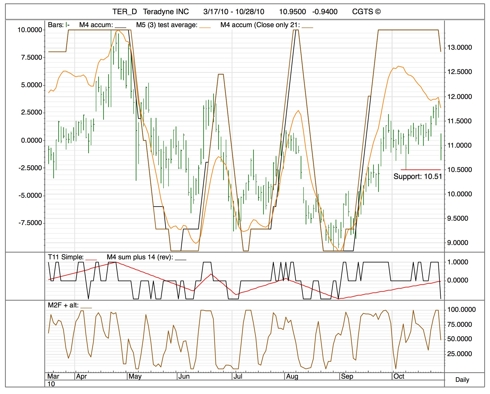

TER, TERADYNE INC.

Another victim of a negative outlook for the 4th quarter. Support at 10.51 probably won't hold.

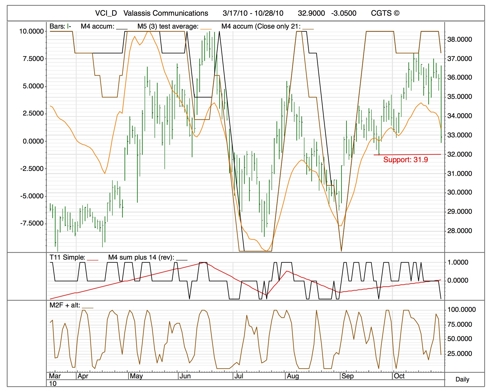

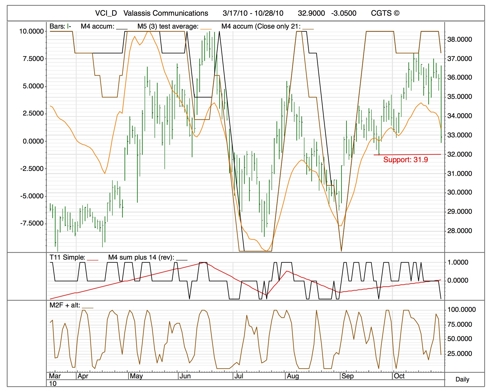

VCI, Valassis Communications.

Valassis reported stronger earnings than expected, raised its estimates for the next quarter, and was punished by investors. Support at 31.9 is probably in trouble. Note that VCI gave a false top reading in March of this year and then again in early October. We like M4 Sum Plus (Pane Two, black line) to give 2 consecutive days of -1 readings as a confirmation of a top. A one days spike down is not enough. Both of the false tops were accompanied by an M4 Sum Plus spike down but neither by two consecutive days of the negative reading. So, tomorrow we will know more about this top reading. If tomorrow's M4 Sum Plus reading is -1, then this top is probably a 'real' top. By the same token a 'top' reading accompanied by a negative trend reading (Second Pane, red line) is also generally a trustworthy reading.

SPECIFIC TRADING IDEAS

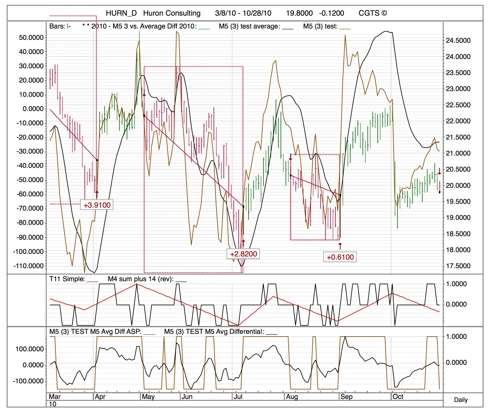

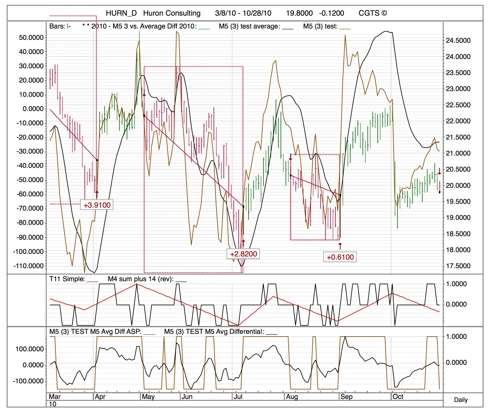

One trading idea today. Shortsell HURN, Huron Consulting.

More information on the CGTS systems can be found at:

home.mindspring.com/~mclark7/CGTS09.htm

MICHAEL J CLARK

Clark's Gate Timing System

Hanoi, Vietnam

84 4 221 92210

Disclosure: No positions to disclose.

Friday, 29 October 2010

WHAT THE CHARTS ARE SAYING

We have 3 bottom readings today; 25 top readings. Momentum continues to deteriorate; but the lack of widespread selling is quite amazing. Individual issues are being punished -- and punished badly -- for disappointing investors. Ttrading is so thin that stocks abandoned by investors do not find a pool of buyers ready to stem the fall and buy the dip.

We actually need a good correction here to clear the books, and start over again. But prices are stuck in a kind of no-man's land, unable to rise much, unable to fall. Does someone have his finger on the scale too much perhaps? Is there too much manipulation by the Lord on High, Herr Bernanke?

The lower US Dollar is negating profits made in (US Dollar denominated) stocks and indexes. We'd all be better off to have the Dollar strength and stock strength determined by a relatively neutral market and a disinterested monetary policy (from the Lords of Eastwick) -- then we could at least make our investment decisions based on what we know, and not, as now, on what we don't know and what we are trying to assume.

The TBond party seems to be winding down. Yield (and/or Inverse) TBond ETFs are bottoming and seem to be ready to announce higher interest rates as they move. Herr Bernanke seems to be less willing to fork over our money hand over fist to manage interest rates for his friends the bankers to rebuild their balance sheets.

Does this means stocks will rise, as money escapes from the bond market and moves in to stocks? If the Dollar rises, markets everywhere will fall, as the fake hot Bernanke air that has pumped up the new commodity (and commodity stocks) bubble will lose altitude rapidly.

M4 ACCUMULATION TOP AND BOTTOM WATCH LIST:

We like HMA in the bottom list. It is breaking through resistance as we speak, and seems determined to go higher.

In the top list, we have two OIL ETF's topping out. The weakest issues are HAL, MMM, TER,and VCI. Some pretty strong industrial names in this short-list, especially Haliburton and 3-M.

We include a few charts below of issues we think especially interesting.

| THURS | TOP/BOTTOM WATCH | |||

| 28-Oct | ||||

| BOTTOM WATCH | ||||

| SYMBOL | CLOSE | T11 Diff | M4 Sum Plus | Issue Name |

| ESI_D | 64.49 | -0.289 | -1 | Intl Educational Svc |

| HMA_D | 7.78 | 0.037 | 1 | Health-Management Assoc |

| TSLA_D | 21.19 | 0.065 | 1 | Tesla Motors Daily |

| TOP WATCH | ||||

| SYMBOL | CLOSE | T11 Diff | M4 Sum Plus | Issue Name |

| ^BVSP_D | 70,320.13 | 112.297 | -1 | Sao Paolo Brazilian Index |

| AA_D | 12.65 | 0.06 | -1 | Aluminum Company of America |

| AMSC_D | 34.29 | 0.164 | -1 | American Superconductor |

| ARO_D | 24.87 | 0.087 | -1 | Aeropostale Daily |

| COP_D | 59.58 | 0.131 | -1 | Conoco Philips Daily |

| DBO_D | 25.575 | 0.055 | -1 | OIL POWERSHARES DB |

| ELY_D | 6.7 | 0.011 | -1 | Calahan Golf |

| EQR_D | 48.75 | 0.105 | -1 | Equity Residential |

| FISV_D | 54.14 | 0.127 | -1 | Fiserve Inc |

| HAL_D | 31.68 | 0.074 | -1 | Haliburton |

| MMM_D | 85.07 | 0.102 | -1 | 3-M Daily |

| OIL_D | 23.17 | 0.056 | -1 | Oil ETF |

| SHLD_D | 71.98 | 0.223 | -1 | Sears Holdings |

| SLG_D | 66.02 | 0.193 | -1 | SL Green Realty |

| TER_D | 10.95 | 0.048 | -1 | Teradyne INC |

| VALE_D | 31.8 | 0.102 | -1 | VALE S.A. |

| VCI_D | 32.9 | 0.088 | -1 | Valassis Communications |

| ^KS11_D | 1,879.12 | 1.938 | 1 | Kospi South Korean Index |

| BMO_D | 58.73 | 0.136 | 1 | Bank of Montreal |

| EWV_D | 41.58 | -0.112 | 1 | Short MSCI Japan ETF Daily |

| HOT_D | 55.17 | 0.228 | 1 | Starwood Hotels |

| IO_D | 4.95 | 0.037 | 1 | Ion corp |

| ITMN_D | 14.51 | 0.076 | 1 | Intermune Inc |

| O_D | 34.42 | 0.063 | 1 | Realty Income Corp |

| UPS_D | 67.66 | 0.133 | 1 | United Parcel Service Daily |

CHARTS OF INTEREST

HMA, Health-Management Association.

Looks like a very good picture at the moment. A break-out to the upside. On the verge of making a new high.

HAL, Haliburton.

Breakdown. Take profits. Should test support at 27.36. If that support breaks, then good short-sell candidate.

MMM, 3-M.

Disappoint this market, and you'll see a very quick-paced destruction. MMM has a long way to fall. Support at 78.4.

TER, TERADYNE INC.

Another victim of a negative outlook for the 4th quarter. Support at 10.51 probably won't hold.

VCI, Valassis Communications.

Valassis reported stronger earnings than expected, raised its estimates for the next quarter, and was punished by investors. Support at 31.9 is probably in trouble. Note that VCI gave a false top reading in March of this year and then again in early October. We like M4 Sum Plus (Pane Two, black line) to give 2 consecutive days of -1 readings as a confirmation of a top. A one days spike down is not enough. Both of the false tops were accompanied by an M4 Sum Plus spike down but neither by two consecutive days of the negative reading. So, tomorrow we will know more about this top reading. If tomorrow's M4 Sum Plus reading is -1, then this top is probably a 'real' top. By the same token a 'top' reading accompanied by a negative trend reading (Second Pane, red line) is also generally a trustworthy reading.

SPECIFIC TRADING IDEAS

One trading idea today. Shortsell HURN, Huron Consulting.

More information on the CGTS systems can be found at:

home.mindspring.com/~mclark7/CGTS09.htm

MICHAEL J CLARK

Clark's Gate Timing System

Hanoi, Vietnam

84 4 221 92210

Disclosure: No positions to disclose.