Angela Merkel yesterday casually mentioned that those who thought the EU crisis could be 'fixed' in a couple of years were deluded, that the crisis would run at least until 2018. Merkel said the world would have to 'hold its breath' (and apparently hold its nose) for at least 'five more years'.

www.upi.com/Top_News/Analysis/Walker/201.../

Shocking? Not to me. I have been writing that the REFLATION SEASON (Re-Inflation, that is, a return to statistical growth, two steps up, one step back) will begin in 2019. So my view of this, and Angela's, are beginning to converge.

What is happening today in Europe? Well, the Euro is breaking down, forming a top. Of course, I have been suggesting that US stocks/commodities are topping or have already topped. The US Dollar is bottoming. If the Dollar rallies, stocks and commodities should continue falling.

I just came across this headline today, which seems to highlight what I am thinking today:

finance.yahoo.com/news/caution-u-vote-ke...;_

Shares steady before U.S. vote, euro slips on Greece

By Marc Jones

LONDON (Reuters) -

World shares and the dollar steadied on Tuesday as investors waited for the U.S. election result, while uncertainty over Greece's next aid payment kept the euro at a two-month low.Polls indicate the election between President Barack Obama and Republican challenger Mitt Romney will be extremely close and the risk of a change in policy in the world's largest economy was keeping investors on the sidelines"With the uncertainty over the U.S. election and Greece it is likely that investors will be sitting on their hands again today," said Heinz-Gerd Sonnenschein at German bank Postbank

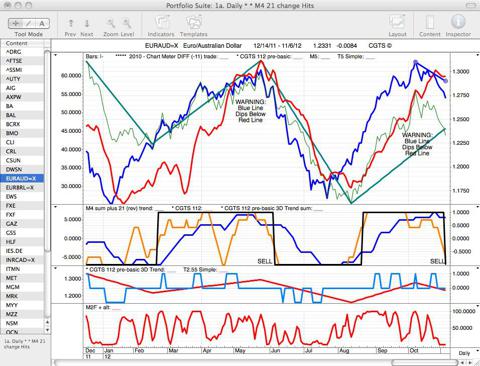

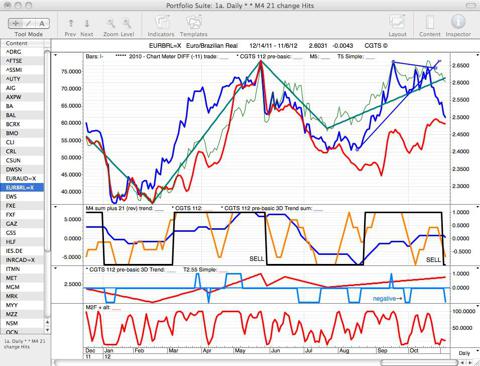

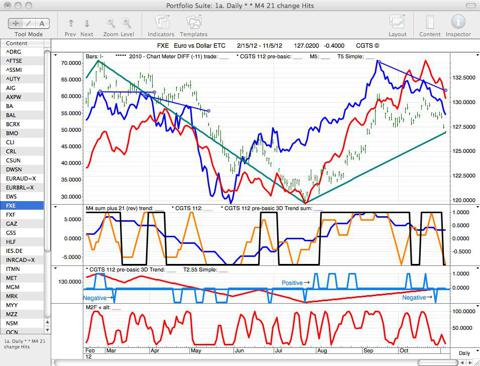

Let's look at a few charts that suggest the Euro is topping.

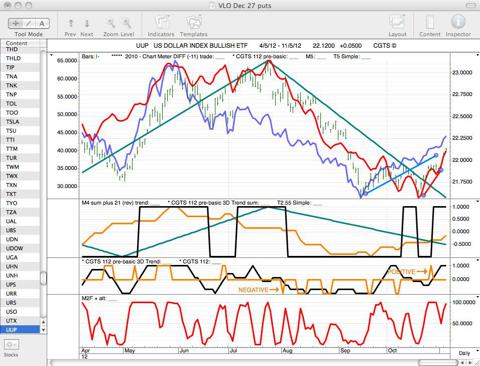

If the Euro/Dollar is weakening, we should see the US Dollar strengthening.

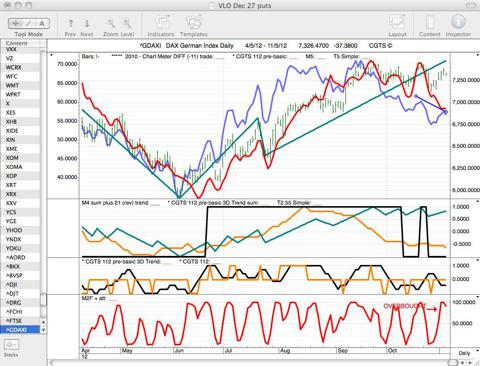

So, the Euro is breaking down -- and the Dollar is strengthening. If some form of re-awakend EU crisis is about emerge again, would we not see this coming in the European indexes?

Generally speaking, the Euro indexes are currently stronger today that the US indexes. But the French and the German indexes are beginning to crack.

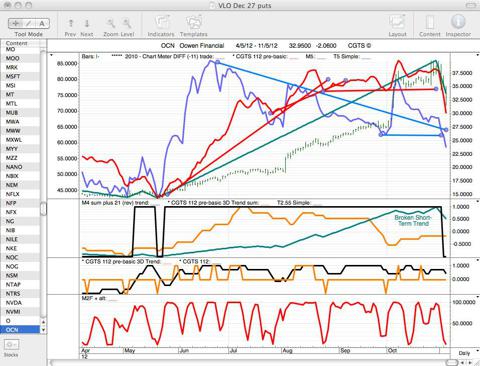

Chart of the Day: OCN, Ocwen Financial

Ocwen Financial stock broke down technically yesterday. Ocwen reported EPS less than expectations; investors sold also because of the announced merger of Met Life and JP Morgan, which many felt could crimp Ocwen's growth ; also this related story about Ocwen's liability associated with its take-over of bankrupt Residential Capital LLC, which Ocwen purchased recently as part of a bankruptcy auction.

Bankrupt Residential Capital LLC should be barred from selling its mortgage servicing unit to

Ocwen Financial Corp. (OCN) unless Ocwen agrees to honor ResCap's portion of a $25 billion legal settlement with the U.S. and 49 states, government lawyers said in court papers.

- Ocwen and its partner in the proposed $3 billion purchase must take over ResCap's part in the settlement, which ended a lawsuit against banks accused of helping cause the housing crisis, the U.S. Justice Department said in an objection filed today.

- Fulfilling the non-monetary part of the settlement "is critical to protecting homeowners and deterring future mortgage loan servicing and foreclosure abuses and fraud," Assistant U.S. Attorney Joseph N. Cordaro said in court papers filed in U.S. Bankruptcy Court in Manhattan.

- ResCap filed for bankruptcy in May with plans to sell its servicing unit, the fifth-biggest in the U.S. ResCap is a unit of Ally, a Detroit-based auto lender that is majority-owned by U.S. taxpayers. Ocwen and Walter Investment Management Corp. (WAC) won an auction for the unit last month with a bid worth about $3 billion.

I write that OCN broke down technically. This is a partial truth. OCN is still showing a strong long-term uptrend. And it is shor-term oversold.

But is has broken CGTS Trend support -- red line, top pane. And it has broken down in terms of our CGTS Pre-Basic 3D Trend, black line, second pane down, which changes trend much more rarely, perhaps two or three times a year. Also the short-term trend (green line, second pane down) has broken support.

We are anticipating OCN is topping.

Michael J. Clark

CGTS, Hanoi, Vietnam