Can we learn anything from Japan's recent housing bubble collapse? Perhaps not. If we were to overlay an image of the American stock bubble collapse it might be interesting to survey similarities and differences.

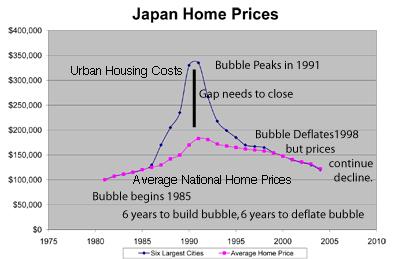

America's housing bubble began in 2002 or 2003. Japan's began in 1985. A housing bubble is, by definition, a condition wherein prices rise significantly above historical averages. We know that prices will come back to the averages eventually. According to the chart, it took 6 years to build, and 6 years to un-build Japan's housing bubble. If America's housing bubble followed this pattern (why should it?), this could suggest 2002 - 2007 was the six years to build, and that 2007 - 2013 would be the six years to de-construct.

However, the chart also shows that, with Japan's deflation, average prices are still going down through 2005. This means Japan's housing decline lasted 20 years. If the American housing bubble were to follow the Japanese housing bubble, step for step, this would project out to house prices still declining in 2022.

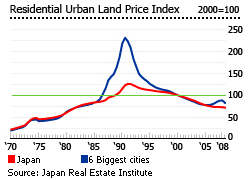

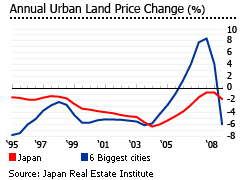

Japanese urban land prices did attempt to make a bottom in 2004 -- and actually increased for two years. In late 2007, however, they started down again; and they are still declining.

Even if we cannot assume Japanese and American housing bubble decline cycles are related and project similar patterns -- each society has different resource bases, demographics, and levels of political flexibility -- these graphs do certainly show that housing bubble deflations in advanced technological societies can last for several DECADES.

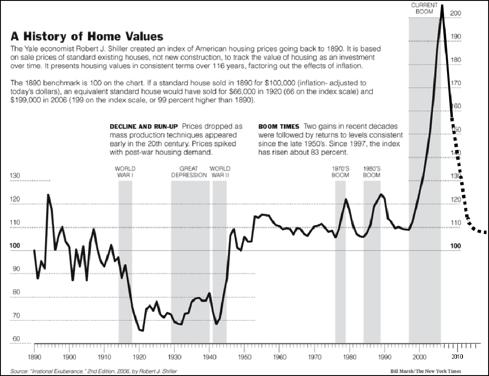

The size of America's housing bubble is shown in the following Case-Schiller chart of historical housing prices. One will also note that beginning in the 1920, housing prices, after a significant rally before World War I, stayed below average for nearly three decades. Average Japanese house prices rose 240% during their housing boom. American houses, depending upon location, rose from 150 - 350%. Historic norms of appreciation in American housing were between 2.5 - 3% before this debt-fueled bubble was formed.

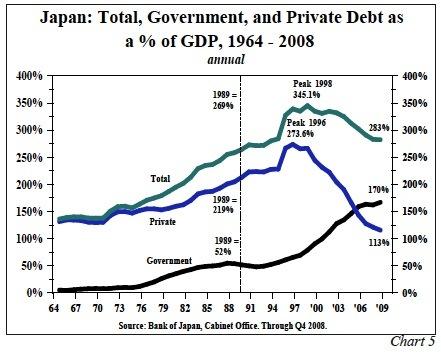

Deflation of Japan's housing bubble, which began in 1990, and the deflation of the Japanese economy, at the precise moment when Japan was on the top of the world economically, threatening to take over the entire world with its code of business efficiency and discipline, was caused by what? By debt. In 1989, Japan was building a huge debt bubble, similar to the bubble that America built in the first part of this decade. Japanese debt, total and private, as a percentage of Gross Domestic Product, was more than 250% in 1989, when the economy began to suffocate, and peaked in 1997 at 345%, before beginning its decline.

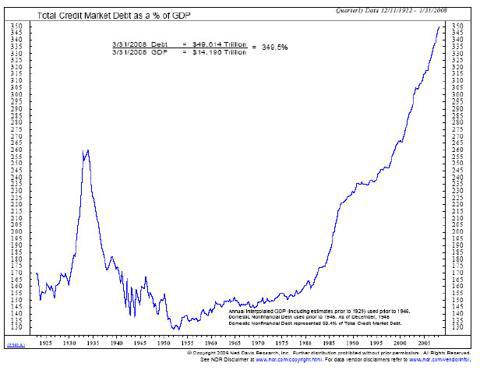

Is it rare for a nation to have a total debt vs GDP this large? Well America's own debt vs. GDP recently crossed 350% for the first time since the Great Depression. In fact, the chart below shows just how rare the occurrence is.

It's no simple occurrence that high debt-to-GDP ratio and economic deflation are connected in time. An unmanageable debt-load causes deflation.

In much the same way that the universe expands and expands and expands until it can't expand any further -- the gravity of matter in the universe becomes stronger than the force of expansion -- gravity of matter being debt in this instance -- then it begins to collapse back on itself, creating a Black Hole (a Depression in Space-Time) wherein matter implodes and is transformed into anti-matter. The gravity of the Black Hole (the Depression) is so great that all light or matter within its reach is sucked in and destroyed. That is the most perfect visual and conceptual description of deflation and economic depression I have ever come across.

Japan still has not recovered from its deflation. There is no reason to believe an export-driven economy like Japan will recover from deflation without a general recovery in America and Europe. Deflationary periods require the working off of debt -- not the hiding of debt and the prayers of bankers and politicians than positive thinking and denial will solve the problem. Japan, like our current policy-makers, tried to hide bank debts on their banks books (no mark-to-market either) and wait out the storm. But this kind of storm doesn't fix itself -- it won't be waited out. It is only fixed in one way -- by the unwinding of debt. By the recognition of and the destruction of debt from the nation's economic ledger. The sins and excesses of the father must be recognized and corrected -- or be passed on to the sons for seven generations.

In 1989, the Japanese Nikkei Index was trading at 38,000. Today it is trading at 10,000. This is a decline of 74%. In 2001 and again in 2007, the American S & P 500 Index was trading at 1500. A corresponding decline in this index, relative to the Nikkei Index, would reduce the S & P 500 Index to 395 (it is currently trading at 1044). This would result in a further decline of another 62% in this index.

DEBT DEFLATION AND THE FUTURE: THE TRUTH ACCORDING TO JOHN MAULDIN

John Mauldin, a prescient writer and analyst of world markets and economies, writes:

"Problem[s] from the credit crisis are worldwide. To think they are not interconnected would be naiveté in the extreme. What happens in Japan and Spain and the US will affect your part of the world, some more than others."

Mauldin points out that "total U.S. debt as a percent of GDP surged to 375% ... well above the 360% average for 2008."

That means that we are still adding to our debt. The debt hasn't topped out, is not yet starting to decline -- mainly because of an increase in government spending as a last-ditch effort to deny the reality of the reality of the coming U.S. deflation and depression.

Mauldin writes:

"Economic performance could not be sustained as debt repayment became more burdensome": that is, the gravity of matter became greater than the force of expansion. Icarus's wings did not melt -- but it became harder and harder for him to continue to soar above the Earth. The force of gravity overpowered him. And he fell backward. The adventure of expansion had ended.Therefore, the economy became more leveraged even as the recession progressed. An over- leveraged economy is one prone to deflation and stagnant growth. This is evident in the path the Japanese took after their stock and real estate bubbles began to implode in 1989.... While the Japanese increased leverage for nine years after the bubble highs, neither highly inflated stock and real estate prices nor economic performance could be sustained as debt repayment became more burdensome.

Is World Deflation Here?

Mauldin writes in his newsletter to investors:

We can believe that we will escape the reality of gravity (the grave). This is a form of denial, in my view. Elizabeth Kubler-Ross (and others) investigated the stages of death in the 1970's (and Night-Cycle, 1965-1983). She determined there were five stages of the death/grieving process.Eastern Europe, Spain and Ireland are now all experiencing the beginning of deflation. We believe that we will see much more deflation to come, which will have broad ramifications across the European banking sector. The periphery countries are net debtors, and the rest of Europe is the net creditor. When a debtor can't pay, the creditor suffers. Germany, France and others will need to cope with re-capitalizing the periphery and Spain. In the words of Plautus, "I am a rich man as long as I don't pay my creditors." A deflationary spiral means that most of the debt will need to be written off, and the creditors will have to absorb the losses.

Spain is not the only country facing deflation. It is a problem for the entire European periphery. Ireland, for example, has the highest rate of deflation in the world. Prices in Ireland are falling at an annual rate of 5.9%, well ahead of the drops in other countries - only Thailand, at 4.4%, comes even close.

We believe that Ireland's experience is what Spain will see more of in the months ahead as the economy slowly adjusts to new realities. Almost all of Ireland's banks have been taken over by the government, and Ireland is struggling to decide how best to dispose of its bad assets. We believe Spain will be much more like Ireland than any of its European neighbours.

Oddly, even though inflation is negative, and unemployment is high, unions are still winning pay rises. Most wage agreements in Spain are reached through collective bargaining on an industry level. So far, wage increases are happening above the ECB's 2% target inflation rate.

Given how far out of line wages are with unit labor costs and the reality of deflation in Spain, we see Spain's unemployment level heading towards 25%. With a 25% unemployment rate and a debt deflationary dynamic, how exactly do the banks think they'll be paid back? Who will earn the money to pay the mortgage payments, and how will housing be affordable when wages have been deflated? Assuming the worst has passed in Spain does not pass the common sense test.

We believe Spanish politicians and international investors have grossly misjudged Spain, but events will force them to change their mind. In retrospect Spain will be viewed much like sub-prime where all the banking results looked good, until they didn't. This is typical of bubbles, and Spain will be no different.

Spain, and the rest of the European periphery, can solve their problems either through massive productivity gains, which is highly unlikely, or through a reduction in wages and prices in the order of 20-30%, which is what will happen slowly and painfully. You could call such a reduction of wages and prices an "internal devaluation".

1) Denial: this is the stage we are currently in. This explains the cheerleading of all the stock-jocks on television -- Cramer's Critters and fellow urchins-- and the insistence of financial analysts that it is good news when Caterpiller loses $700 billion dollars in a quarter because it 'might have been worse. MUCH worse!'.

2) Violence. We are not there yet. This will be reached when bears are beaten and publicly humiliated for stating their opinions, are accused of being anti-American. I am hoping it does not spread to scape-goating Americans of non-white racial strains -- although I did see on a financial board this week an Indian-American (I believe) writer questioning the patriotism of a Korean-American writer, and the assumption that he was 'pro-China' because he was Asian.

3) Bargaining. This is a bargaining with God. I will give back all the money I stole from investors if you take away this cancer, dear God. This will happen on a large social scale. It will be interesting to see how this stage plays out. Will bankers promise the next congress that they will never again plunder American consumers with obscene credit card rates if congress doesn't take away their right to destroy the global economy every 18 years through massive housing graft?

4) Acceptance. Ok...Ben Bernanke will admit to the press corps that his attempt to inflate another bubble DID NOT work and that the economy is NOT RECOVERING; and then he offers to swallow his sword, resign his position, and take a $5 million job with John Paulson in England working for his hedge fund. That is what 'swallowing my sword' means to the American Ruling Class: taking a job that pays more in the financial industry, the industry he was supposed to be regulating and disciplining in his current position. Not much incentive in disciplining and regulating the same people who are going to pay you millions of dollars when you leave your temporary government employment is there?

5) Depression. This is the last stage of death. This means the leaders, the ones who saw the depression first, will be proclaiming the New Day. This means fellows like Cramer will perhaps commit suicide on television, understanding that depression is inevitable and can no longer be denied.