The world grows madder by the day. I can't believe what I am watching. Crazy bullish brutishness. Sad bearish confusion. How can the markets go down, when central banks are buying stocks? Good question. How can markets go down when the central banks can just keep printing new money to throw into the markets?

But what does this mean for 'the long term'? Do we really have a concept of 'the long term' any longer? We seem to be so involved in surviving the present that we don't care any longer what tomorrow brings. Maybe tomorrow will never come. Maybe.

Clearly we have lost our direction, and our sobriety. Greed has been nurtured, cultivated, and given power in the world. And now Greed is running free -- so much so that it is now the assumed duty of central banks to print money and buy stocks and other assets to 'keep the world rich'. That is a huge jump from the idea that government should get out of the way so that individuals might get rich or at least be able to make a living; now the government has become 'responsible' for keeping humanity separate from poverty.

A funny thing happened on the way to this forum, however. The world suddenly became poorer and poorer, even as the government became more and more involved in keeping humanity wealthy.

Do we really think stealing money from the future will have no negative consequences? Are central bank policies designed around printing money to defeat the appearances of recessions -- are these policies really 'stealing money from the future'?

We watch Japan, a country who led us in to this epoch of deflation when her central-bank induced housing bubble popped in 1989 -- and we see a very sad fate that seems to be awaiting all nations that borrow too much, and then print too much new money, in an attempt to inflate for ever. Growth is seasonal; this seems to me to be obvious. Those leaders who wish to prove that growth is perpetual have abandoned nature for too long. Only cancer grows perpetually, until it consumes its host, causing death. That is the myth that central banks are following, and the myth into which Japan is leading the whole world. I would argue that death by cancer and militarism will perhaps also be linked. We remember that one stage of the death-cycle as outlined by Kubler-Ross in the last Night-Cycle (1965-1983) is anger -- and I might connect this 'anger' stage to military aggression and adventurism.

It might make sense to review these stages again -- clearly the world is still in the first stage, denying that it is dying and that it has to go through the spiritual death sequencing. Remember: every Night-Cycle that comes in history is essentially a spiritual experience. The period of life, of growth, of building, of expansion, gives way to its opposite. Material life (body-life) gives way to Spiritual life (non-body life) -- and the only way to navigate through the lightless environment of a Night-Cycle is with spiritual sextants, spiritual insights.

When you have been taught as a culture that the spiritual world is primitive and has been for-ever left behind in the evolutionary journey, to be suddenly confronted with death and darkness and despair, the end of a life-cycle (every cycle lives for eighteen years and then dies, and remains dead for 18 years), where all the new tools of science and reason and day-light measuring of reality no longer work -- and one suddenly confronts a reality which is alien to every modern understanding and can be understood only by the very same superstitious laws and ignorant conditions that science has proven to be unnecessary and illegitimate, that the most modern cultures have thrown away over time, considering them obsolete -- that one must not only come to recognize again the validity (this is an ego word), but even more, the necessity, of this long-discarded perspective, and, at the same time, to re-learn the heretical religious knowledge, to essentially begin with nothing (daylight knowledge that is no longer useful because it is not working), to begin as a novice in a strange land, emigrating, through desperation, from the 'dead' left brain across the land bridge (dusk and dawn) to the suddenly 'living' right brain, with one's spiritual survival depending upon how quickly and how deeply one can comprehend these new 'laws'. That is where we are now. We have crossed the so-called land-bridge, Dusk, 2010; and now we have moved into the Dark Continent where things are more like a dream (the wave network) than they are the isolated atomic object day-world of causality, which is now gone. The dream world Day World is the real world. But, in truth, the day-world vanishes also when we re-enter the dream world again every night. The Day World is composed of matter; the Night World is composed of anti-matter. The Day World of Matter is solid but empty; the Night World of Antimatter is empty but solid. Each world acts differently. Each world has different laws, different needs, and different organizations.

Symbolism, metaphor, poetry, analogy: these are the tools of the future, as they were the tools of the past. These tools measure the patterns of the network, much as the scientific method measures the objects of the isolated daylight world. The Day-Cycle causes the wave function to collapse, and become the object function, for the sake of object-knowledge (and objective thinking). The Night-Cycle causes the object function to collapse back into the wave-function: objective thinking vanishes. Subjective thinking -- and the relationship of patterns -- come back strong again, along with other 'primitive' instincts, such as the survival instinct, and nationalism over internationalism. Internationalism, globalism, the One World-ism: these are religions of the Day-Cycle, of objective, rational thinking. Nationalism, local-ism, the Man Worlds-isms: these are the religions of the Night-Cycle, of subjective, imaginative thinking.

I suggested last week on this site that one had to become 'a master of both worlds'. A reader suggested back that the Day-Cycle was about learning and the Night-Cycle was about 'losing this learning'. This is true in a sense. I wrote him back:

Masters of both worlds, sequentially. Not knowing flows into its opposite. But not knowing is part of the path of cleansing, unlearning, unknowing, becoming the seed-bed of a new learning, so that the alchemical rebirth process can begin. One has to understand this sequentially, stages of filling up (in one world) and emptying out (in the other). Of course, it is paradoxical, because the filling up with material knowledge IS the emptying out of spiritual knowledge, and the emptying out of material knowledge IS the filling up with anti-matter, which is another more scientific name for spiritual knowledge. We are always filling and emptying at the same time, but we don't understand it this way, because we are generally trapped in the duality, in one world or the other, and unaware of the opposite side of the equation.

My view is that we have fallen; and the object function is collapsing; and the One World view is collapsing into the Many Worlds view. Nationalism is coming back; and will come back with a fury.

I would add one thought before escaping back into the study of financial patterns. Ben Bernanke's hero, he has claimed, was Korekiyo Takahashi, the Japanese Finance Minister who 'saved' Japan from the deflation of the great 1930's depression by printing money, buying up Japanese assets, lowering interest rates, giving away money to try to keep growth or inflation or spending expanding. Bernanke tells us how Takahashi saved Japan by printing vast amounts of money -- and Bernanke tells us that he has followed Takahashi in his policies of QE and ZIRP, bond-buying, mortgage-backed securities buying. What Bernanke did not mention, however, is that Takahashi's experiment failed in Japan when he (Takahashi) attempted to unwind the central bank's balance sheet. In fact, Bernanke focused only on the first half of the dismal Japanese experiment, which led to deflation, and the grizzly murder of Takahashi when his unwinding, tightening, threatened the Japanese military establishment -- deflation, murder, and World War were the results of the great Japanese QE, ZIRP experiment in the 1930s.

Here are the Kubler-Ross stages of death. You tell me which stage we are in, if these stages are metaphorically describing the stages fo deflation we have entered:

1. Denial and Isolation -- I would argue that we are still in the denial stage, and that this global denial is leading to a grander sense of isolation, which is the root of the 'better thy neighbor' currency wars that become even grimmer as the isolation becomes greater, driven deeper by fear of death;

2. Anger;

3. Bargaining -- one could make an argument for this stage, with central bank printing being a form of our bargaining;

4. Depression;

5. Acceptance.

They say you need to trade currencies. The biggest markets in the world are currencies markets. We have a system that trades currencies. And our currency trading model is up 203% (30-to-1 leverage) in trading from 8/20/2014.

We are recommending a few new trades:

Close the short position in NZDUSD. Does this mean the US Dollar is going to weaken again? Is the Fed going to embark on more QE? I'm not sure that would be politically possible. QE is driving America toward a political civil war -- and it is splitting America deeply into rich and poor. American cities are starting to burn again. That should be taken as a real warning by our so-called leaders.

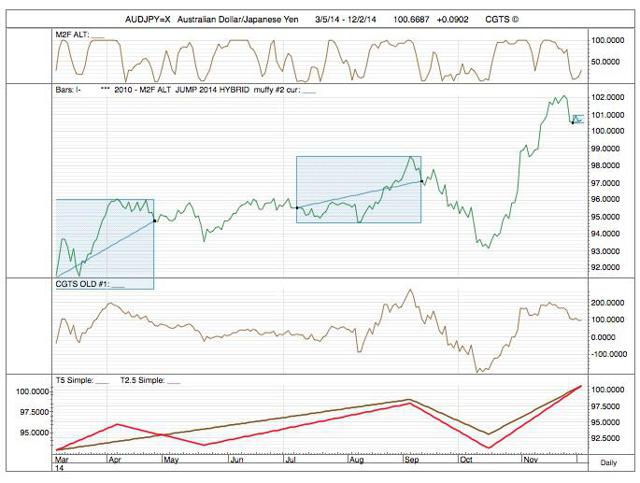

Long AUDJPY. The Aussie Dollar has not been especially strong; but the fiasco in Japan is driven by a religion of weak Japanese Yen.

Short JPYCNY. No way China is going to be able to keep up with the financial suicide cult that is now driving Japan toward a lower and lower currency (monetization of debt). China is lowering interest rates. This is a full-blown currency war.

Same theme, different currency partner. Short Japanese Yen vs Indian Rupee.

Here's a snapshot of our currency portfolio traded with the CGTS currency trading program.

| Issue | Close | Position | Current | Gain | Sales | Purchase | Purchase2 | Issue3 |

| Position | Date | Date | Price | |||||

| NZDJPY=X | 93.0491 | SHORT | Flat | -3.45% | 11/3/14 | 10/20/14 | $85.25 | New Zealand Dollar/Japanese Yen |

| USDJPY=X | 119.215 | LONG | Flat | 6.86% | 11/6/14 | 10/10/14 | $107.68 | USDollar/Japanese Yen |

| JPYRUB=X | 0.4524 | LONG | Flat | 11.81% | 11/25/14 | 8/20/14 | $0.35 | Japanese Yen/Russian Ruble |

| AUDNZD=X | 1.0819 | LONG | Flat | -1.51% | 11/25/14 | 9/17/14 | $1.11 | Australian Dollar/New Zealand Dollar |

| AUDNZD=X | 1.0819 | LONG | Flat | -0.98% | 11/25/14 | 10/16/14 | $1.10 | Australian Dollar/New Zealand Dollar |

| AUDNZD=X | 1.0819 | LONG | Flat | -1.87% | 11/25/14 | 11/5/14 | $1.11 | Australian Dollar/New Zealand Dollar |

| USDZAR=X | 11.1243 | LONG | Flat | -1.18% | 11/25/14 | 11/14/14 | $11.08 | US Dollar/South African Rand |

| EURRUB=X | 66.7747 | LONG | Flat | 20.36% | 11/25/14 | 8/21/14 | $47.86 | Euro/Russian Ruble |

| USDZAR=X | 11.1243 | SHORT | Flat | 2.08% | 11/25/14 | 11/13/14 | $11.21 | US Dollar/South African Rand |

| RUBCAD=X | 0.0212 | SHORT | Flat | 19.94% | 11/25/14 | 8/21/14 | $0.03 | Russian Ruble/Canadian Dollar |

| INRAUD=X | 0.0192 | LONG | Long | 3.71% | 10/16/14 | $0.02 | Indian Rupee/Australian Dollar | |

| INRCAD=X | 0.0185 | LONG | Long | 1.58% | 10/28/14 | $0.02 | Indian Rupee/Canadian Dollar | |

| CNYBRL=X | 0.4195 | LONG | Long | 13.84% | 8/20/14 | $0.37 | Chinese Yuan/Brazilian Real | |

| CNYBRL=X | 0.4195 | LONG | Long | 27.39% | 10/30/14 | $0.33 | Chinese Yuan/Brazilian Real | |

| USDGBP=X | 0.6394 | LONG | Long | 4.14% | 9/19/14 | $0.61 | US Dollar/British Pound | |

| USDGBP=X | 0.6394 | LONG | Long | 2.55% | 10/22/14 | $0.62 | US Dollar/British Pound | |

| USDEUR=X | 0.8076 | LONG | Long | 1.86% | 10/10/14 | $0.79 | US Dollar/Euro | |

| USDCAD=X | 1.1407 | LONG | Long | 1.50% | 10/23/14 | $1.12 | US Dollar/Canadian Dollar | |

| USDARS=X | 8.5329 | LONG | Long | 0.63% | 10/10/14 | $8.48 | US Dollar/Argentine Peso | |

| CNYINR=X | 10.0646 | LONG | Long | 2.55% | 8/21/14 | $9.81 | Chinese Yuan/Indian Rupee | |

| CNYINR=X | 10.0646 | LONG | Long | 0.70% | 10/10/14 | $9.99 | Chinese Yuan/Indian Rupee | |

| USDTHB=X | 32.88 | LONG | Long | 1.38% | 10/16/14 | $32.41 | USDollar-Thai Baht | |

| USDINR=X | 61.82 | LONG | Long | 0.88% | 10/10/14 | $61.24 | US Dollar/Indian Rupee | |

| AUDJPY=X | 100.6687 | LONG | Long | 0.02% | 12/1/14 | $100.58 | Australian Dollar/Japanese Yen | |

| GBPINR=X | 96.6908 | SHORT | Short | 2.33% | 9/17/14 | $99.07 | Great British Pound/Indian Rupee | |

| GBPINR=X | 96.6908 | SHORT | Short | 2.08% | 10/28/14 | $98.81 | Great British Pound/Indian Rupee | |

| EURINR=X | 76.5468 | SHORT | Short | 2.43% | 9/19/14 | $78.50 | Euro/Indian Rupee | |

| GBPCNY=X | 9.607 | SHORT | Short | 4.65% | 9/19/14 | $10.08 | British Pound/Chinese Yuan | |

| EURARS=X | 10.5656 | SHORT | Short | 1.15% | 10/10/14 | $10.70 | Euro/Argentine Peso | |

| GBPCNY=X | 9.607 | SHORT | Short | 2.10% | 10/22/14 | $9.82 | British Pound/Chinese Yuan | |

| AUDCNY=X | 5.1867 | SHORT | Short | 4.16% | 10/28/14 | $5.42 | Australian Dollar/Chinese Yuan | |

| AUDCAD=X | 0.9632 | SHORT | Short | 2.36% | 10/17/14 | $0.99 | Australian Dollar/Canadian Dollar | |

| AUDCAD=X | 0.9632 | SHORT | Short | 2.57% | 10/28/14 | $0.99 | Australian Dollar/Canadian Dollar | |

| AUDUSD=X | 0.8444 | SHORT | Short | 3.94% | 10/29/14 | $0.88 | Australian Dollar/US Dollar | |

| JPYINR=X | 0.5186 | SHORT | Short | 0.77% | 12/1/14 | $0.52 | Japanese Yen/Indian Rupee | |

| JPYCNY=X | 0.0515 | SHORT | Short | 0.89% | 12/1/14 | $0.05 | Japanese Yen/Chinese Yuan |

We have been trying for years to simply our CGTS trading systems. And we think we are there. These are wheat we call 'ion the box' systems. We use essentially two indicators, CGTS 112, and a secondary indicator that produces a kind of box in which CGTS 112 moves. When CGTS 112 moves inside the box, we are long. When it moves outside the box, we sell. We use our long-term trend indicator to help us trade in line with the long-term trend. If an issue is 'in the box' and the long-trend is positive, we are long; if an issue is 'out of the box' and the long-trend is negative, we go short.

Here is a chart showing this system. We have three 'box systems'. In the chart below, the dark brown line is the box; the orange line moves sometimes in the box and sometimes outside. The bottom pane is the long-term trend. You can also pay attention to the orange line (CGTS 112) to gauge rallies outside the box, buyer strength; or pullbacks inside the box, seller strength.

As I say, we have three 'in the box' trading systems at work now. Each one gives a different set of signals every day. Here are today's signals.

As I say, we have three 'in the box' trading systems at work now. Each one gives a different set of signals every day. Here are today's signals.

| CGTS BOX 1 | Column1 | Column2 | Column3 | Column4 | Column5 |

| Current | New Trade | New Trade | |||

| Ticker | Close | Trade | Today | Yesterday | Company |

| EDC | 24.87 | Short | Enter Short | * Emerging Markets Bullish ETF 3x | |

| LBJ | 14.33 | Short | Enter Short | * Latin America Stocks Bullish ETF 3x | |

| LODE | 1.03 | Short | Enter Short | Comstock/Goldspring Mining | |

| AGQ | 42.04 | Short | Ultra Silver Leveraged ETF (Bull) | ||

| AXAS | 3.18 | Short | Abraxis Petro | ||

| AXPW | 1.321 | Short | AXION | ||

| CBI | 46.89 | Short | Chicago Bridge and iron | ||

| GASL | 5.85 | Short | * Natural Gas Stocks Bullish ETF 3x | ||

| JNUG | 3.5 | Short | * Junior Gold Miners Bullish ETF 3x | ||

| KBR | 17.01 | Short | KBR INC | ||

| NOG | 7.48 | Short | Northern Oil and Gas | ||

| RUSL | 6.39 | Short | * Russia Stocks Bullish ETF 3x | ||

| USLV | 22.7 | Short | * Silver Stocks Bullish ETF 3x | ||

| XOP | 49.89 | Short | Spider Oil Gas Exploration ETF | ||

| YGE | 2.56 | Short | Yingli Green Energy China | ||

| ^VIX | 12.85 | Flat | Exit Short | CRB Volatility Index Daily | |

| COCO | 0.11 | Flat | Exit Short | Corinthian Colleges | |

| TYD | 43.7 | Flat | Exit Short | * 7-10 Year Tresury Bull ETF 3x | |

| CDE | 4.19 | Flat | Coeur D'Alene Daily | ||

| CHK | 19.85 | Flat | Chesapeake Energy | ||

| ERX | 65.22 | Flat | * Energy Stocks Bullish ETD 3x | ||

| FLR | 61.58 | Flat | Fluor Corp | ||

| KLAC | 68.84 | Flat | KLA-Tenacor Corp | ||

| MATL | 62.5 | Flat | * Basic Materials Stocks Bullish ETF 3x | ||

| NFX | 26.5 | Flat | Newfield Explorations | ||

| NUGT | 13.31 | Flat | * Gold Miners Stocks Bullish ETF 3x | ||

| SSRI | 5.38 | Flat | Silver Standard Resources | ||

| USDCAD=X | 1.141 | Flat | US Dollar/Canadian Dollar | ||

| BRZU | 11.04 | Flat | Exit Long | * Brazil Stocks Bullish ETF 3x | |

| DSLV | 67.69 | Flat | Exit Long | * Silver Stocks Bearish ETF 3x | |

| DUST | 24.97 | Flat | Exit Long | * Gold Miners Bearish ETF 3x | |

| JDST | 17.19 | Flat | Exit Long | * Junior Gold Miners Bearish ETF 3x | |

| DUG | 52.84 | Long | Short Oil and Gas ETF Daily | ||

| ERY | 20.92 | Long | * Energy Stocks Bearish ETF 3x | ||

| RUSS | 22.18 | Long | * Russian Stocks Bearish ETF 3x | ||

| ANV | 1.66 | Long | Enter Long | Allied Nevada Gold Corp | |

| BZQ | 73.8 | Long | Enter Long | Short Brazil Shares ETF | |

| EDZ | 35.5 | Long | Enter Long | * Emerging Markets Bearish ETF 3x | |

| FRO | 1.41 | Long | Enter Long | Frontline Limited Shipping | |

| JGBT | 25.375 | Long | Enter Long | * Japanese Govt Bond Futures ETF 3x |

One of our favorite trades for today is:

Short KBR. We are buying March puts on KBR. We will sell these puts when our CGTS 112 indicator moves back inside the upright box. See chart below.

| Column1 | Column2 | Column3 | Column4 | Column5 | Column6 |

| CGTS Box 3 | |||||

| Current | New Trade | New Trade | |||

| Ticker | Close | Trade | Today | Yesterday | Company |

| KBR | 17.01 | Short | Enter Short | KBR INC | |

| AGQ | 42.04 | Short | Ultra Silver Leveraged ETF (Bull) | ||

| AXAS | 3.18 | Short | Abraxis Petro | ||

| USLV | 22.7 | Short | * Silver Stocks Bullish ETF 3x | ||

| NG | 2.75 | Flat | Exit Short | NovaGold | |

| AXPW | 1.321 | Flat | AXION | ||

| CDE | 4.19 | Flat | Coeur D'Alene Daily | ||

| FLR | 61.58 | Flat | Exit Long | Fluor Corp | |

| IMMR | 8.32 | Flat | Exit Short | Immersion Robotics | |

| OCN | 21.81 | Flat | Ocwen Financial | ||

| PEIX | 11.99 | Flat | Exit Long | PACIFIC ETHANOL | |

| ERX | 65.22 | Flat | Exit Long | * Energy Stocks Bullish ETD 3x | |

| DSLV | 67.69 | Long | * Silver Stocks Bearish ETF 3x | ||

| DUG | 52.84 | Long | Enter Long | Short Oil and Gas ETF Daily | |

| DUST | 24.97 | Long | * Gold Miners Bearish ETF 3x | ||

| ERY | 20.92 | Long | Enter Long | * Energy Stocks Bearish ETF 3x | |

| EWZ | 39.515 | Long | Enter Long | Brazil ETF | |

| JCI | 49.94 | Long | Johnson Controls | ||

| JDST | 17.19 | Long | * Junior Gold Miners Bearish ETF 3x | ||

| FMCC | 2.28 | Long | Enter Long | Freddie Mac Daily | |

| TXT | 42.16 | Long | Enter Long | Textron Corp | |

| CGTS Box 4 | |||||

| Current | New Trade | New Trade | |||

| Ticker | Close | Trade | Today | Yesterday | Company |

| SPXS | 20.76 | Short | Enter Short | * S&P 500 Bearish ETF 3x | |

| SPXU | 38.26 | Short | Enter Short | * Short S&P 500 Index ETF 3x | |

| EDC | 24.87 | Flat | Exit Long | * Emerging Markets Bullish ETF 3x | |

| ERX | 65.22 | Flat | Exit Long | * Energy Stocks Bullish ETD 3x | |

| AGQ | 42.04 | Flat | Ultra Silver Leveraged ETF (Bull) | ||

| AXAS | 3.18 | Flat | Abraxis Petro | ||

| CDE | 4.19 | Flat | Coeur D'Alene Daily | ||

| DSLV | 67.69 | Flat | * Silver Stocks Bearish ETF 3x | ||

| DUG | 52.84 | Flat | Short Oil and Gas ETF Daily | ||

| DUST | 24.97 | Flat | * Gold Miners Bearish ETF 3x | ||

| EDZ | 35.5 | Flat | * Emerging Markets Bearish ETF 3x | ||

| ERY | 20.92 | Flat | * Energy Stocks Bearish ETF 3x | ||

| FLR | 61.58 | Flat | Fluor Corp | ||

| FST | 0.61 | Flat | FOREST OIL | ||

| IDI | 0.7 | Flat | Search Media Carry-Trade ETF | ||

| JDST | 17.19 | Flat | * Junior Gold Miners Bearish ETF 3x | ||

| KBR | 17.01 | Flat | KBR INC | ||

| KLAC | 68.84 | Flat | KLA-Tenacor Corp | ||

| NOG | 7.48 | Flat | Northern Oil and Gas | ||

| NUGT | 13.31 | Flat | * Gold Miners Stocks Bullish ETF 3x | ||

| PEIX | 11.99 | Flat | PACIFIC ETHANOL | ||

| SSRI | 5.38 | Flat | Silver Standard Resources | ||

| UGAZ | 10.52 | Flat | * Natural Gas Bullish ETF 3x | ||

| USLV | 22.7 | Flat | * Silver Stocks Bullish ETF 3x | ||

| XOP | 49.89 | Flat | Spider Oil Gas Exploration ETF | ||

| YANG | 13.33 | Flat | * China Stock Bearish ETF 3x | ||

| YINN | 32.45 | Flat | * China Stock Bullish ETF 3x | ||

| EA | 43.63 | Long | Enter Long | Electronics Arts Daily | |

| EWZ | 39.515 | Long | Enter Long | Brazil ETF | |

| FMCC | 2.28 | Long | Enter Long | Freddie Mac Daily | |

| FNMA | 2.32 | Long | Enter Long | Fannie Mae Daily | |

| OREX | 6.02 | Long | Enter Long | Orexigen Pharmaceuticals | |

| UPRO | 134.42 | Long | Enter Long | * S&P 500 Ultrapro ETF 3x |

We will continue to feature these new systems, and focus our attention on these three stock trading systems, and the currency-trading system in the future.

Best trading,

Michael J. Clark, CGTS

Eugene, Oregon

cgts@mindspring.com