This is an excerpt from a blog published earlier today: Stocks, Bonds & Politics: Sold 221+ CSQ at $11.17 and Bought 200 ZTR at $13.72

I focus on income generation and capital preservation. I am no longer in the asset accumulation phase.

Needless to say, the income generation objective has become increasingly difficult over the past several years. There is no real risk free yield to be found. That is not a news flash. Most of my higher quality and better yielding bonds have been called.

The capital preservation objective is made more difficult due to its incompatibility with the income generation objective. There is no alternative to income generation other than to assume greater risk.

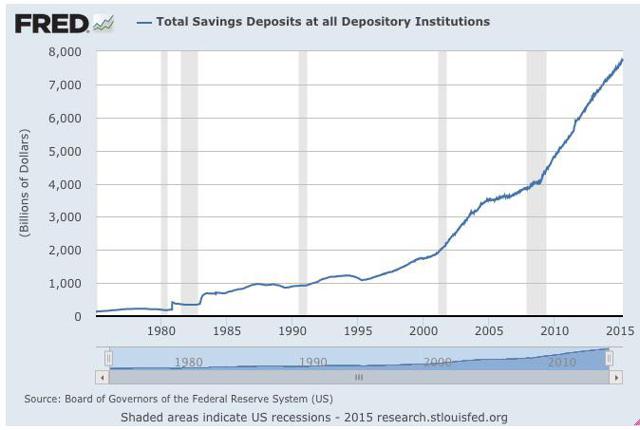

On 3/9/2009, there was $4.3364 trillion stashed in U.S. savings accounts, earning a negative real rate of return before taxes. That sum has grown to $7.756 trillion as of 3/16/15:

Total Savings Deposits at all Depository Institutions-St. Louis Fed

Sourced: FRB: H.6 Release--Money Stock Measures, Release Dates

Several online banks pay APY from .75% to 1%: Bankrate.com

For most American households, there is a huge risk in accepting such a low rate of return for any significant period of time.

It takes 69.66 years for money to double at 1% before taxes and inflation. Estimate Compound Interest

While a 1% annual yield from a FDIC insured savings account is probably "risk free" in one sense, the return of your principal, that rate of return involves a huge amount of risk for most families when considering the long term goal of building a sufficient asset base to pay retirement expenses and other major expenses that may need funding prior to retirement.

For example, Fidelity estimated in 2014 that medical costs for a couple retiring that year at 65 would average $220,000 through their retirement years, which "does not include any costs associated with nursing-home care, and applies only to retirees with traditional Medicare insurance coverage." It would not include the expenses for 24/7 caregiver services that has allowed my 92 year old mother to stay in her home for the past five years either.

One political tribe wishes to end traditional Medicare, generally for those who are 55 years old or younger. The CBO estimated that one such plan, passed in the House back in 2011, would just about double the medical insurance costs compared to traditional Medicare. Kaiser Family Foundation-Figure 1 at page 3.

It is not like the government has a plan to fund medical expenses for the baby boom generation through an anticipated long, average life expectancy for that generation.

And, medical costs have traditionally risen at a much faster rate than inflation (Figure 3), though the rate of increases have been lower in recent years than the historical long term trend. I would not count on costs remaining subdued when planning to meet this future expense category.

I am just talking about one future expense category here and the uncertainty in planning for it now, given the desire among many to shift more responsibility for paying medical costs to individuals and away from the government and the government's future fiscal condition that does not look sound given the accelerating debt load (currently over $18.1 trillion) and unfunded liabilities. I suspect that it is going to be much harder to meet this one expense category for those who are now younger than 55 than for those near Medicare eligibility now or already on traditional Medicare.

As is apparent from my articles and Instablogs here at SeekingAlpha, along with my mostly long 2000+ blog posts at my website going back to October 2008, I rely on a very large assortment of securities to generate income. I will frequently move in and out of securities based on assessments of capital preservation considerations. Two different securities may go down when stocks and/or bonds correct, but one may go down less for a variety of reasons. I use a variety of techniques to mitigate risks.

In this post, I discuss buying 200 shares of the CEF Zweig Total Return Fund (ZTR) to replace 221 shares of the CEF Calamos Strategic Total Return (CSQ). This is a minor reallocation in my portfolio. I own an extremely well diversified and balanced worldwide portfolio. I am not concerned about the cash flow generated by a few securities, but only the aggregate flow of income being thrown off by the entire portfolio.

Both funds have similar yields and pay monthly distributions. One reason for this exchange was my opinion that ZTR was overall less risky. The two most important reasons supporting that opinion are the differences in bond quality and the use of leverage, as explained more fully below.

I suspect that the next year or two may not be advantageous for the use of leverage to juice income and capital appreciation. I have consequently become more cautious with leveraged CEFs.

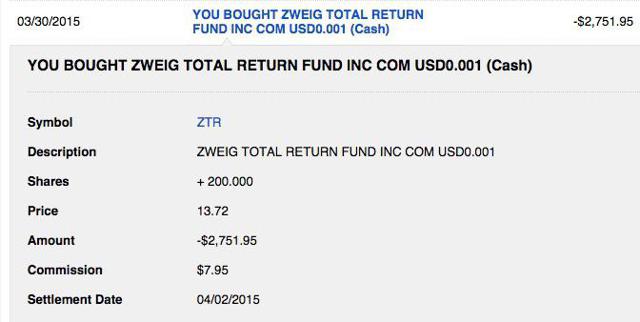

Bought 200 ZTR at $13.72 (see Disclaimer):

Snapshot of Trade:

Security Description: The

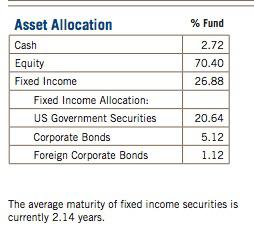

Zweig Total Return Fund Inc (ZTR) is currently an unleveraged balanced closed end fund. The fund may use margin and will generally short a few stocks.As of 12/31/14, the asset allocation had the following weightings:

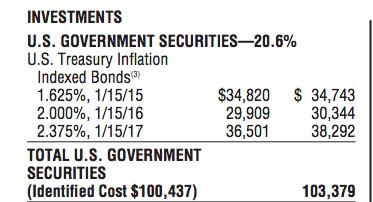

The entire "U.S. government securities" allocation was invested in TIPs, and one of those matured on 1/15/15:

Those bonds have minimal, if any, appreciation potential either.

There was a 6.2% allocation to investment grade corporate bonds with maturities between 3/15/18 and 9/15/23. I would anticipate that the fund will simply hold those bonds until maturity.

The common stock allocation was at 70.4% as of 12/31/14. I would categorize the portfolio selections as mostly falling into what I would label large cap value.

In recent years, the monthly dividend has not been supported by a return of capital ("ROC").

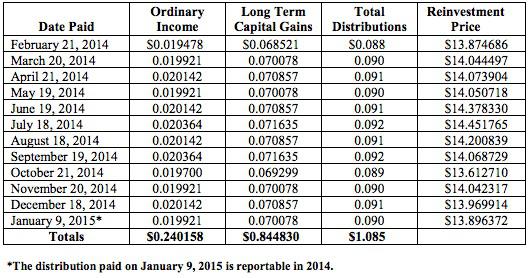

Dividend Sourcing 2014 and 2013:

Page 23: The Zweig Total Return Fund, Inc

In order to avoid ROC, however, the fund has to support the dividend with realized capital gains, as shown in the preceding snapshot.

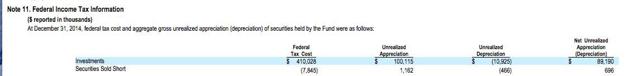

Unrealized Appreciation: As of 12/31/14, the fund had net unrealized appreciation of $89.19M.

This fund at least has the capability of earning its dividend by harvesting unrealized capital gains, but that sourcing may not survive the next correction.

Data as of Date of Trade 3/30/15:

Closing Net Asset Value Per Share: $15.36

Closing Market Price: $13.71

Discount: -10.74%

Average Discounts:

1 Year: -9.58%

3 Years: -10.67%

5 Years: -9.94%

Sourced: CEFConnect (expense ratio .92%)

Sponsor's website:

Zweig Total Return (ZTR)ZTR Page at Morningstar (currently rated 2 stars with no analyst report)

Prior Trades: I have had two prior round trip:

Item # 1 SOLD: 209+ ZTR at $13.88 (1/20/14 Post)-Item # 2 Bought 200 ZTR at $12.835 (3/12/13 Post)

Item # 1 Sold Roth IRA: 100 ZTR at $14.43 (7/26/14 Post)-Item # 4 Bought 100 ZTR at $12.82-ROTH IRA (7/6/13 Post)

When I sold that 100 share lot at $14.43, the net asset value per share was then $15.82, creating at that time a 8.99% discount based on the closing price of $14.4.

Total Trading Gains=$345.06 plus dividends

Dividends: The Zweig Total Return fund is currently paying a variable monthly dividend pursuant to a managed distribution plan. Over the past 12 months through January, the monthly distributions have ranged from $.088 to $.092 per share:

If I took the 2014 total of $1.085 per share, and assumed that 2015 will have the same penny rates which may not be the case, then the dividend yield would be about 7.91% at a total cost per share of $13.72.

Rationale: I decided to sell my remaining shares in the

Calamos Strategic Total Return Fund (CSQ) and to use the proceeds to buy ZTR for several reasons.The Zweig Total Return fund has been earning its dividend over the past two years, whereas the Calamos fund has significantly supported its dividends with ROC.

The ZTR bond allocation has a short duration and consists of investment grade bonds concentrated in two soon to mature TIPs, whereas CSQ's bond allocation is concentrated in BB and B rated junk bonds.

At the time of my purchase, ZTR's discount to net asset value was higher than the 1, 3 and 5 year averages and was larger than the discount then prevailing for CSQ.

The FED will likely start raising the federal funds rate later this year, which will raise the borrowing costs of leveraged CEFs. ZTR is not currently using leverage, whereas CSQ had a leverage ratio of 26.98% as of 2/28/15, Calamos Investments - Strategic Total Return Fund That kind of leverage adds significant risks that I am reluctant to take now given current stock valuations and bond yields on top of a likely increase in borrowing costs.

ZTR has been repurchasing its shares. In 2014, the fund repurchased 845,400 shares at an average discount to net asset value per share of -10.12%. Note 6 at page 21, The Zweig Total Return Fund 2014 Annual Report.

I was able to exit the 221 share CSQ position at a good total return (snapshot of realized gain in blog=$630.79, bringing the total 2014-2015 trading profit up to $1,316.47).

Risks/Issues: With any CEF, the price and the price in relation to net asset value is determined by market participants. Consequently, the market price may decline even when the net asset value per share goes up and vice versa.

By buying shares when the discount exceeds the 1, 3 and 5 year averages, I mitigate the risk some that the discount will expand after my purchase.

The fund changed its distribution from quarterly to monthly in 2012 and reduced the annual managed distribution rate. The quarterly dividend amount was then a destructive return of capital. Another 2012 change was to reduce the amount of cash in the portfolio which had been large.

Disclaimer: I am not a financial advisor but simply an individual investor who has been managing my own money since I was a teenager. In this post, I am acting solely as a financial journalist focusing on my own investments. The information contained in this post is not intended to be a complete description or summary of all available data relevant to making an investment decision. Instead, I am merely expressing some of the reasons underlying the purchase or sell of securities. Nothing in this post is intended to constitute investment or legal advice or a recommendation to buy or to sell. All investors need to perform their own due diligence before making any financial decision which requires at a minimum reading original source material available at the SEC and elsewhere. Each investor needs to assess a potential investment taking into account their personal risk tolerances, goals and situational risks. I can only make that kind of assessment for myself and family members.