I recently started to build a short term bond ladder consisting of mostly "A" or better rated senior unsecured corporate bonds as well as U.S. treasuries.

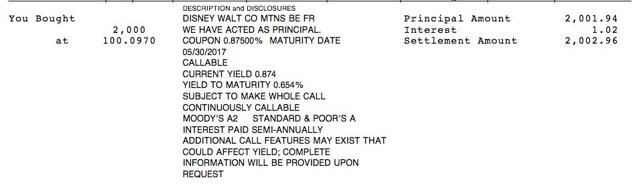

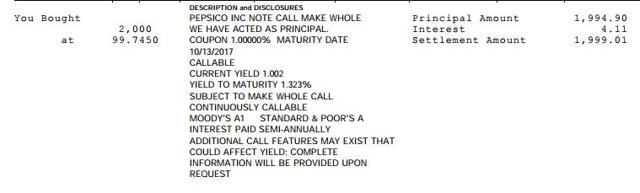

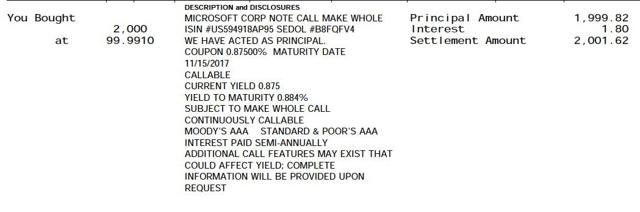

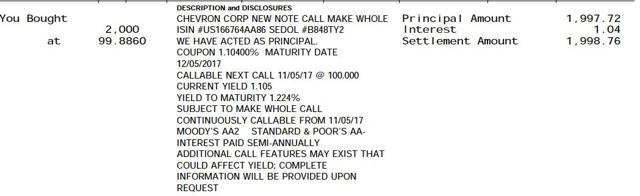

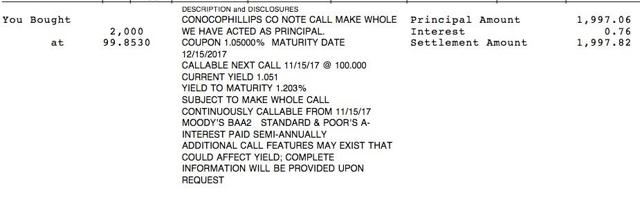

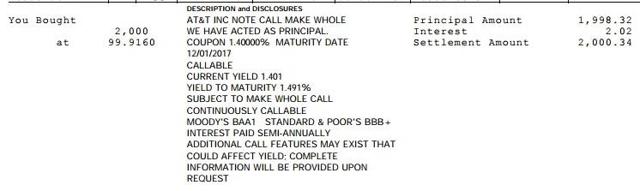

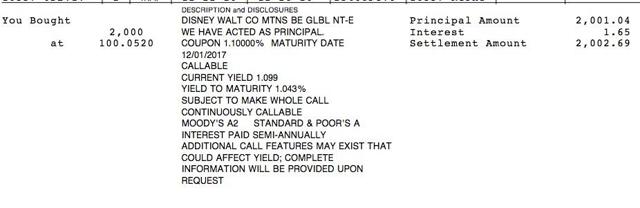

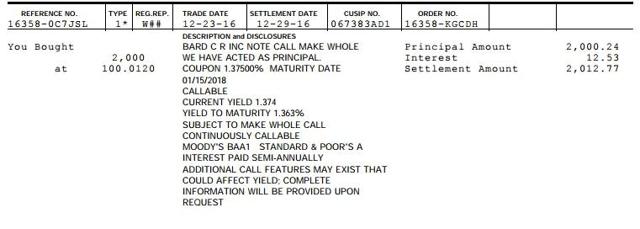

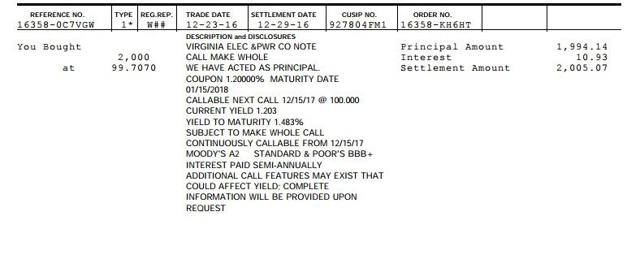

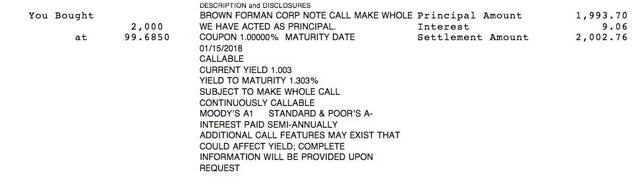

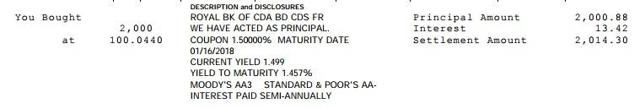

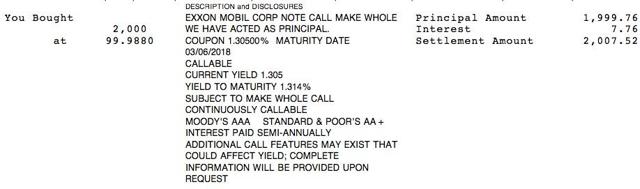

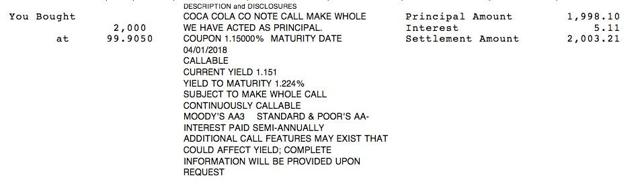

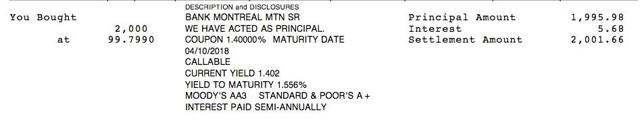

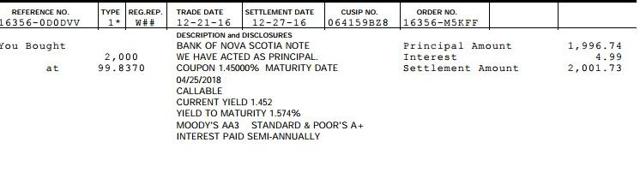

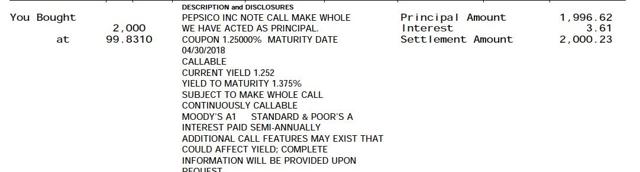

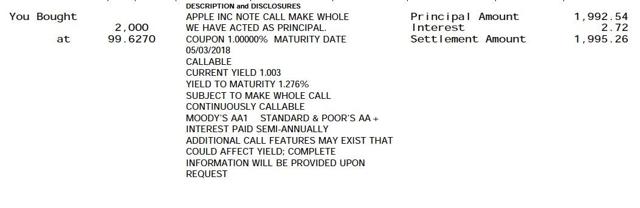

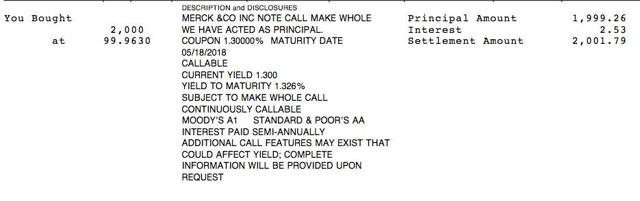

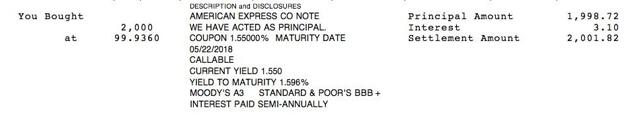

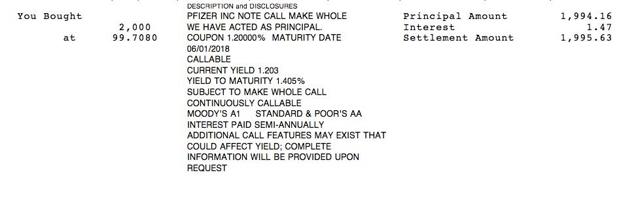

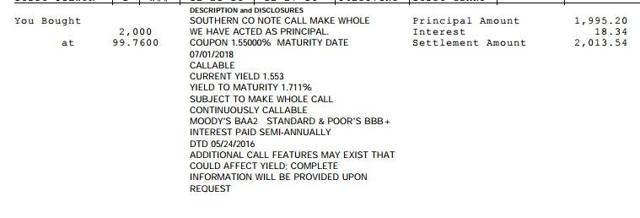

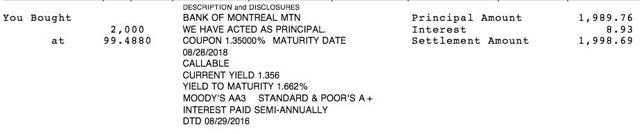

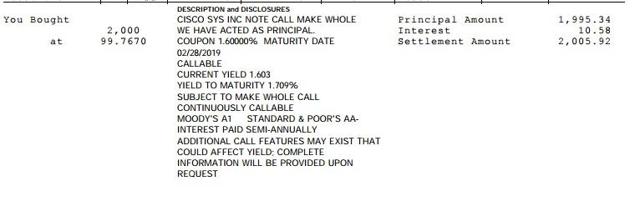

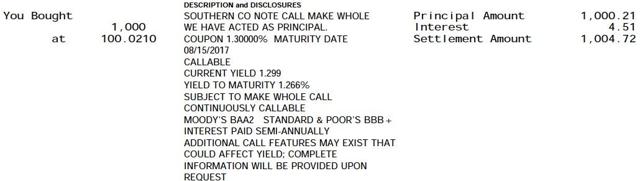

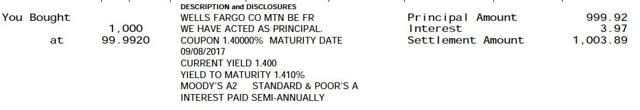

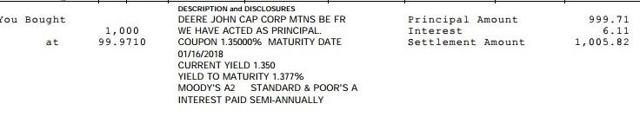

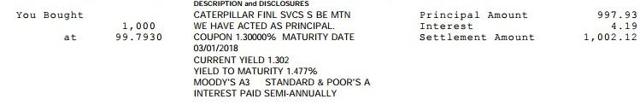

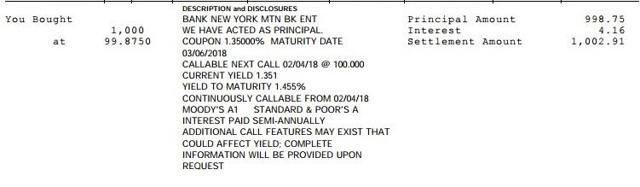

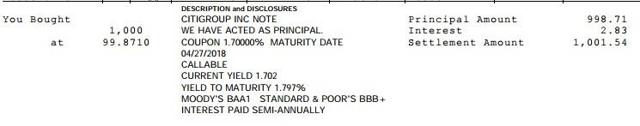

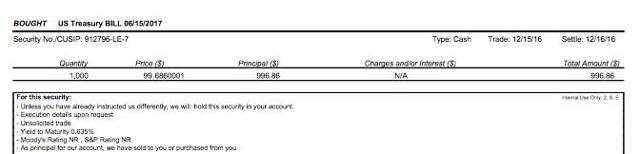

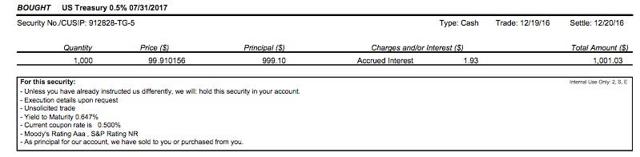

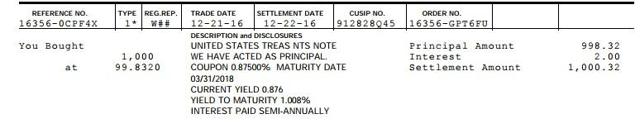

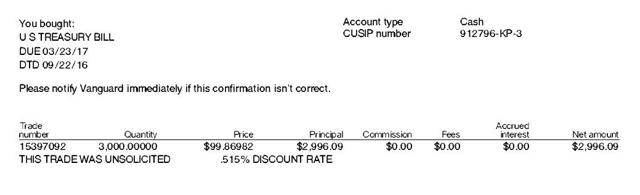

I have provided snapshots of a few sample purchases below.

Short Term Bond Ladder Defined: The Ladder will consist of maturities between 4 weeks and through 3 years and will be significantly weighted in maturities within a rolling 18 months. So far, I have bought only two corporate bonds maturing between 7/1/18 through 12/31/2019 since I am waiting for better yields.

The 4 week portion of the ladder will consist entirely of 4 week treasury bills bought at auction. I will be using my Treasury Direct account to make those purchases and will schedule 25 reinvestments.

My first purchase of a 4 week bill occurred at last week's auction when the yield was .49%.

Announcement & Results Press Releases

Treasury Direct for Individuals

For me, the intermediate term bond ladder would consist of maturities between 1/1/2020 through 12/31/2025.

Purpose of Short Term Bond Ladder: For part of my cash allocation, the goal is to receive 1.3% to 1.5% over the 7 day compounded yield of the Fidelity Government Money Market Fund. Fidelity has forced their individual to choose between the Fidelity Government Money Market Fund or the Federal Treasury Money Market Fund as their sweep accounts.

SPAXX - Fidelity ® Government Money Market Fund | Fidelity Investments (EXPENSE RATIO .45%/Seven Day Yield as of 11/30/16=.07%)

FDLXX - Fidelity ® Treasury Only Money Market Fund | Fidelity Investments (EXPENSE RATIO .42%/Seven Day Yield as of 11/30/16 = .01% and -.01% without reductions)

Purpose of Cash Allocation: The primary purpose of maintaining a large cash allocation is capital preservation. About ten years ago, I shifted from an asset accumulation phase to an asset preservation goal. I will also maintain a large cash allocation to buy assets opportunistically without having to sell something down in price to buy something else viewed as having a better risk/reward balance.

The last substantial drain in the cash allocation to buy stocks started in late February 2009 when it became crystal clear to me that stocks were substantially undervalued and the possibility of Financial Armageddon had been taken off the table through extraordinary actions by Central Banks and Governments.

Orders: When placing an order, I enter in the purchase box "2". While the price is shown near 100, that is 1/10th of the par value, so 2 bonds at $100 would cost $2000 in principal amount.

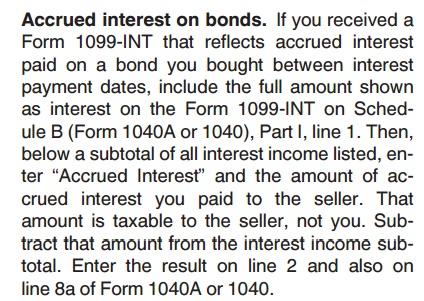

Accrued Interest: The buyer has to pay accrued interest to the seller. All of these bonds make semi-annual interest payments. When the next interest payment is made, I will receive the entire interest payment.

Accrued Interest Paid to Seller Adjustment Schedule B: Fidelity will include the entire first semi-annual interest payment as interest income when reporting to the IRS. A deduction for accrued interest paid to the sellers will be made by my CPA in Schedule B.

2015 IRS Publication 550 (investors need to be familiar with the tax issues summarized in that publication)

Bond Lots/Price/Commission:The snapshots show the purchase of two $1,000 par value bonds. All of the purchases were made at below par value. The price shown is at 1/10th of par value and has been adjusted up to reflect the brokerage commission. All of the purchases were made in my Fidelity taxable account where the commission charge is $1 per bond. I would not be making these purchases using Vanguard's $2 per bond commission or Schwab's $1 per bond commission with a $10 minimum.

Page 2 Left Side Fidelity Brokerage Commissions Fee Schedule.pdf

Vanguard Brokerage trading fees & commissions | Vanguard

Investing Costs: Charles Schwab: Fees and Minimums

I could uses IB but have not bought a bond in that account yet:

Commissions | Interactive Brokers

These brokers do not charge a commission for U.S. treasuries bought at auction or in secondary market.

Some brokers charge for treasury purchases including for example TD Ameritrade who charges a $25 fee. So that broker is avoided when making bond trades altogether.

Current Yield and Yield-to-Maturity: The current yield and YTM shown in the brokerage confirmations are calculated based on my total cost which includes the brokerage commission.

Bond Rating: All of the bonds are rated "A" or better by at least one rating agency.

Action At Maturity: As these bonds mature, and there will be several maturing each month, I anticipate now that the proceeds will be used to buy similar bonds yielding more. If rates are less, I will probably just keep the proceeds in the MM fund until I see a better opportunity somewhere in the world.

Bond Search at Fidelity: At Fidelity, a bond search can be conducted at two different pages.

Fixed Income Investments and Bonds - Fidelity (Allows for search by name)

CUSIP Lookup and Bond Yields - Fidelity (Requires CUSIP for an individual bond search, but allows for searches by maturity date which is a good option when building a ladder)

When entering a search name, it is best to enter a broad term like "Bank", "American" or "Health" sometimes since sometimes the names are abbreviated and the search result could return no results. The word "Bank" would also give you an array of bonds from different issuers.

Bond Search at FINRA: Bond trades are reported to FINRA. A bond search can be done in two ways.

That link allows for a search by name or CUSIP. An advanced search allows for entry of specific criteria like credit rating and maturity dates. FINRA also uses abbreviations in the name which frequently hinders the search.

At that link, just enter the stock symbol (e.g. XOM) and then click go which will take you to the EXXON page. There is a tab for "Bond Issues" which will take you here where you will need to click "More bond information" to get the full list for an active issuer. After clicking that link, I am taken here. Since I am looking for short term maturities at the moment, I would click "Maturity" which will sort the list from the shortest maturities to the longest.

In one of the snapshots below, there is a purchase of 2 Exxon bonds maturing on 3/6/18 and I see that bond on the list. I click the link for that bond and am taken to this page which has various information about that bond, including trades, a chart, ratings and usually a link to a prospectus: Bonds Detail. The prospectus link is not there for this one.

Without the prospectus link, and I will always look at prospectuses to confirm basic material information, I can quickly find the prospectus by looking at the offering date which was 3/3/15. I would then go to the SEC's search page and enter Exxon: SEC.gov | Company Search Page

Exxon's SEC Filings: EDGAR Search Results

Scroll Back to March 2015 and Look for a 424B2 filing. There will probably be two around that time. One will be a preliminary prospectus and the later one would be the final prospectus.

That prospectus includes a number of different bonds including a floating rate note due 3/6/2022. Looking at that one, it pays a .37% spread to the 3 month Libor rate. Generally floating rate notes are available only in very large purchase amounts. Exxon has two notes with that maturity date. The FINRA pages do not have a link to the prospectuses, nor does it provide specific information on which one is the floater

This one has the correct $500M in principal amount outstanding for the 2022 floater and the correct issue date; so I assume that it is the floater. It is trading near par value. The other one has the correct issue date but the principal amount is shown at $1.150B. It is trading now slightly under par value (12/23/16 morning).. That one would be a fixed coupon bond with a 2.397% coupon that is covered by the same prospectus as the floater. So the bond ghouls are pricing the floater higher than the fixed coupon maturing on the same date. The floater pays quarterly. The floater trades infrequently.

I am also sprinkling some 1 corporate bond purchases. The following are just a sample:

For 1 bond purchases, I may buy one more bond when and if the price is lower.

I am working toward 4 or 5 bonds maturing each month.

Treasuries are maturing in every month starting in January 2018 with 4 week bills through April 2018, with some 1 bond purchases that have later maturity dates.

E.G.

Those two purchases were in a Schwab brokerage account where I can buy treasuries commission free.

The following secondary market purchase was made in the Fidelity taxable account with no brokerage commission:

And, lastly, this treasury bill was purchased at auction through my Vanguard taxable account with no brokerage commission:

There is no reason to pay a commission to brokers like TD Ameritrade to buy Treasuries at auction or in the secondary market when so many other brokers charge nothing. In addition, the individual investor can open a Treasury Direct account and buy at auction for as little as $100 per transaction with no commissions.

Disclaimer: I am not a financial advisor but simply an individual investor who has been managing my own money since I was a teenager. In this post, I am acting solely as a financial journalist focusing on my own investments. The information contained in this post is not intended to be a complete description or summary of all available data relevant to making an investment decision. Instead, I am merely expressing some of the reasons underlying the purchase or sell of securities. Nothing in this post is intended to constitute investment or legal advice or a recommendation to buy or to sell. All investors need to perform their own due diligence before making any financial decision which requires at a minimum reading original source material available at the SEC and elsewhere. A failure to perform due diligence only increases what I call "error creep". Stocks, Bonds & Politics:ERROR CREEP and the INVESTING PROCESS. Each investor needs to assess a potential investment taking into account their personal risk tolerances, goals and situational risks. I can only make that kind of assessment for myself and family members.