There has been a lot said about Greece and the PIIGS recently. Much of it discusses the problem as if it is of academic interest only, with no impact on the US. That is wrong. It may be half a world away geographically, but the issue gets nearer every day.

Today, Craig Pirrong seeks a return to market discipline . First, John Kemp, then Craig Pirrong with the last paragraph:

Greece would do everyone a favour by declaring a moratorium and forcing a rescheduling. The country faces years of misery in any case. The threat of being shut out of capital markets rings hollow. But by triggering losses on these derivative transactions and a credit events under the CDS it would help ensure a much more prudent approach in international banking markets.

Bailing out Greece so everyone can pretend the country can remain “current” on its loans when it patently cannot would simply deepen the moral-hazard crisis. If market discipline is ever to be re-established (something which everyone agrees is desirable) then at some point creditors must take a loss. Greece is a good place to start.

Yes. As I discussed in an earlier post, it is the lenders–the creditors–that are ultimately the source of moral hazard. If they are convinced that they will be bailed out, they will continue to feed the bad habits of profligate borrowers, including sovereigns. Bailing out Greece, or others, will just increase expectations of future bailouts, and we’ll be in a sort of moral hazard Groundhog Day. Only it won’t be quite so funny.

There is one problem with this: contagion. As we know from the crisis of 2008, there is a high degree of linkage between various parties, particularly the banks, and one failure is likely to cause several others. The chain of failure is unlikely to stop in Europe.

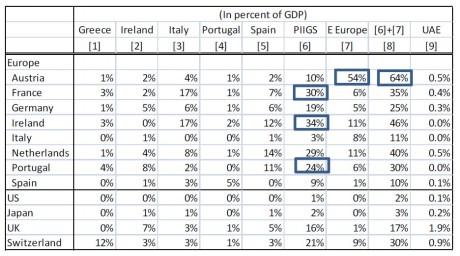

The Daily Telegraph reports a chart produced by Stephen Jen of BlueGold Capital Management:

This shows the exposure of a country's banks to the PIIGS, expressed as a percentage of GDP. So, for example, France's banks are exposed to the extent of 30% of France's GDP. Note how PIIGS such as Ireland and Portugal have high exposure to other fellow PIIGS.

What this says is that any default by Greece will cause knock on problems. These will include potential bank failures and increases in sovereign yields, firstly in the PIIGS and then around Europe. Default in Greece increases the likelihood of defaults elsewhere. Once the problems spread to the banking systems of major European countries, the US will inevitably be impacted. The transition mechanism may well be through CDS, those "financial weapons of mass destruction". There does not need to be outright default to trigger payments on CDS.

Ironically, if Craig Pirrong's call for discipline were followed, it may lead to chaos. There is much to be said for restoring discipline to the markets, but we should all be careful what we wish for.