.

Overview: The long-term timer has transitioned from CASH to LONG, meaning that equity can be raised to 100%.

Timer Status:

Short-term timer: LONG

Intermediate-term timer: LONG

Long-term timer: LONG -- just transitioned tonight from CASH.

Percent stocks that are rated "Long": 62.7% out of 3025 stocks

Long-Cash Ratio: 1.684, 16 continuous days of positive advances.

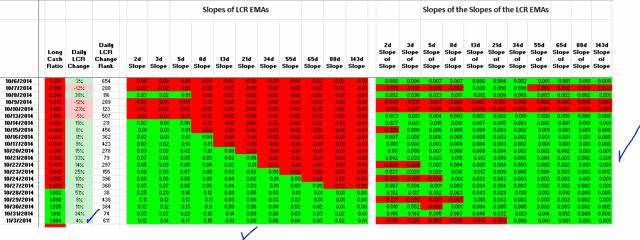

Slope Table:

You can see on the right that the slope of the slopes, or the day-over-day acceleration of the number of stocks that are transitioning from a "CASH" recommendation to a "LONG" recommendation continues the advancement on the majority of measured time frames.

A warning is that when we do have a pull back or pause, the acceleration that is negative spans further into the measured time frames, indicating that we're slowing more and more. While we are moving forward, we are doing so at a slightly slower rate (red) than the previous day, hence, a turning point should be anticipated.

The left side of the table is a beautiful example of what we want to see in a good market. The staircase example of greens/reds shows the steady pace of the markets, and allowed plenty of time to get on board.

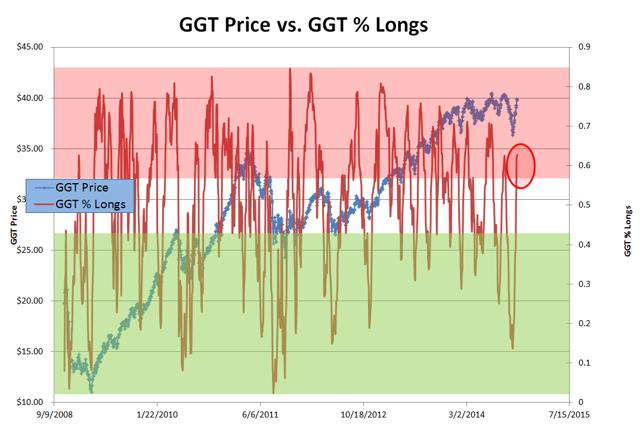

Percent Longs

Historically, we're in a zone where we could see a pullback. You can also see from the above chart that we're par with where we pulled back last time. You can also see that we're below where we historically pull back, so who knows what's going to happen? Your crystal ball is as good as mine, and as you can see, a reversal from this area would not be a major surprise. We've moved steadily upward for 16 days and a slight pullback of 1-2% would be quite healthy.

Strategy

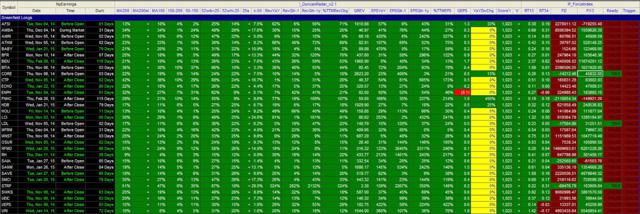

I'm 75% in cash right now, and I intend to buy breakouts when the market pulls back. The easiest way to do this is using Alexander Elder's (modified) method to enter. Applied to my Greenfield Leader's list, this is what I get:

On the right side of the table you see three stocks: CORE, LDL, and STRP. Each have a positive slope for price on the 13d and 34d time frames (green), and the 2-day force index (price * volume averaged for 2 days) is NEGATIVE while the 13-day force index is positive. This means the following:

13d and 34d EMAs with a positive slope: short and long-term up trends

13d FI > 0: up trend and stock has had volume associated with it

2d FI < 0: short-term pullback, generally on decreased volume

When this occurs, I buy the breakout.

The breakout for CORE is as follows. Today's high was $58.66. Adding 0.1% to this gives me $58.72. If I get a price that is larger than $58.72 after 9:45 a.m. ET, I'll enter another position in CORE (I already have a position, it's up +6%). Do all of this with a BUY STOP, GTC.

~~~~~~~~~~~~~~~~~

1) Start with quality stocks -- Greenfield Leader's list is as good as they come

2) Consider Elder-eligible stocks

3) Buy breakouts, so that you're buying strength

For the various portfolios that I am running, most are doing extremely well:

All of these stocks are taken from the lists in the stock file in the shared Dropbox folder, which about 110 of you review more/less nightly. I expect you're doing about the same as above in your positions ...

~~~~~~~~~~~~~~~

Standard disclaimers apply. You are responsible for your own investment decisions, and I am not. Please take ownership for your actions, and please do your own diligence.

Regards,

pgd