On Friday, there were a lot of discussions about the unfairness of small investors having to wait and buy Alibaba (BABA) at $92.70 a share, instead of being able to purchase it at $68 a share or cheaper. I was shocked at how many of the people I thought were capitalists sounded like Elizabeth Warren. Jack Ma and early investors did not risk it all and build a company according to those who normally criticize everything about being progressive. The thing is that this line of thinking can be applied to why some people fly coach, others fly first-class, and a select few fly in private jets?

The investors that got BABA at $68 a share most likely do a lot of business with brokers; they do not show up twice a year to demand the hot IPO. They are not lucky, and it is not unfair. Ironically, there was little demand for Facebook when it hit $30 a share, and anyone could have bought the stock. The stock market is not about luck, it is about taking advantage of opportunities. The stock market requires a kind of commitment that does not make it comparable to a roll of the dice.

In the meantime, we are all lucky in the sense that we have certain gifts bestowed upon us from birth and life's experiences. Casual observers of the stock market would do well to remember that. Getting rich in the stock market is a long-term and often-painful process. Count your natural blessings and be grateful. As for the stock market, create and manage a portfolio and you can reach your goals, and occasionally get a piece of the hot IPO action.

The Bifurcation

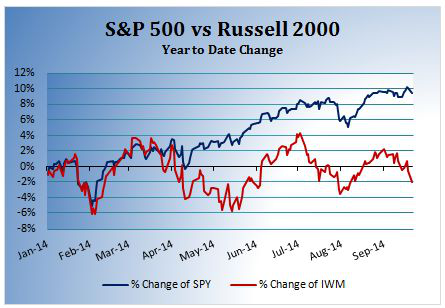

There has been a serious Bear market in our midst for quite some time, and it is getting worse. Coming into the week, 47% of NASDAQ stocks were down more than 20%, and more than 40% of Russell 2000 stocks were in bear market territory. In fact, the spread between the S&P 500 and small cap index is at a two- year high. While the rally has held for large cap names and blue chips in the Dow, it is a completely different story for small caps. These things are not discussed when people suggest that it has been easy and simply throwing a dart would suffice. On the other hand, it has meant trading more or riding the waves. The problem is that most investors would like to be investors.

By the way, some amazing values are being created right now in tech and small cap names. The problem is picking the exact bottom; those that can handle gyrations without sending me nasty emails on every dip should be rubbing their hands together.

Today's Session

This is what we've waiting for, This is it, boys, this is war.

This is what we've waiting for, This is it, boys, this is war.

The President is on the line

As ninety-nine red balloons go by

-Nena

Airstrikes against ISIS and Khorasan locations in Syria and Iraq commenced overnight. America and allies, including Arab states Bahrain, Saudi Arabia, UAE, Jordan and Qatar, focused on training compounds, control facilities, a financial center, supply trucks and armed vehicles. The action saw the debut of the $150 million F-22 Stealth fighter from Lockheed Martin and heavy use of General Dynamics' Tomahawk missiles.

Gold is up slightly, but by less than one percent. I think there are greater issues facing the market including the White House's new stance on inversion deals which hurts a few companies directly, but the use of executive fait spooks the overall market. I am still more concerned about overall action in the market beyond geopolitical concerns and more White House power-grab.