Stocks were hammered and made headlines this morning, but I think yesterday was all about oil as well as other stuff from Greece. Of course, these factors contribute to worrying about the economy, which are distant concerns. Here is the thing. Americans do not care how much damage is being done to the oil industry as long as gas gets cheaper. For people who live in Texas, Oklahoma, or North Dakota, this is somewhat important; Living in a single-wide in Williston, ND, in the winter without a job is purgatory.

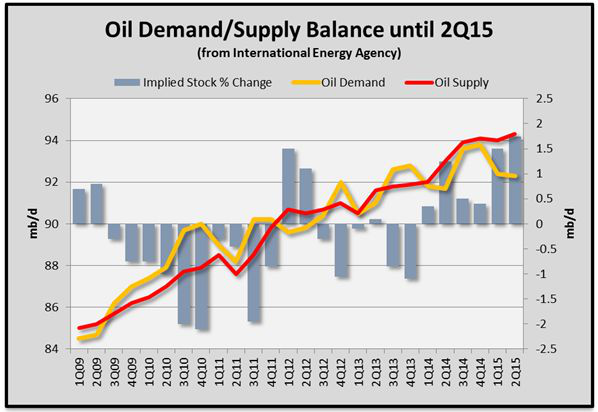

Oil supply has been running ahead of demand since late 2013, and its finally caught up to the industry with the help of a sagging global economy.

The reaction in the past to a glut would have been OPEC cutting production with most cheating. Saudi Arabia is doing its part to send prices higher by selling less crude. However, not this time as the Desert Kingdom is challenging America's energy industry and they might be winning.

U.S. rig counts continue to decline and this week hit 1,811, down 29 in the past week. Vertical, the most expensive, is at its lowest count since 1991. Permian Basin was down 5, as it is more expensive than Eagle Ford.

US Rig Count | Rigs | Change |

Directional | 175 | -6 |

Horizontal | 1,350 | -14 |

Vertical | 300 | -9 |

The oil war is joined and there are cracks in the armor. The industry continues to say it is full steam ahead and any hiccups are temporary and short-lived, but the carnage is proving not to be baked into recent losses, hinting American drillers will blink even more.

Today's Session

The markets showed signs of life in the premarket, and despite trading lower briefly, managed to open the trading day in the green. We have some important domestic economic data being released today such as the ISM Non-Manufacturing Purchasing Mangers' Index (PMI) and Factory Orders. Also, the Redbook Sales report informed us that for the week ended January 3rd, shopping slowed, with retail stores reporting year-on-year growth of 4.3% compared to the 5.3% gain in the prior week. Many retailers increased promotions significantly during the month of December, so we may see weaker sales numbers despite consumers buying more stuff.