I know this week is about earnings, but we have gotten a few reads on housing, and they couldn't come at a better time. Housing simply cannot gain any traction and it is extraordinarily frustrating. New home sales have fared well. However, with existing homes and the continued reluctance of younger fence-sitters, we need to see first-time buyers climb above 30%, and eventually get north of 40% before we can call the housing market healthy.

That being said…

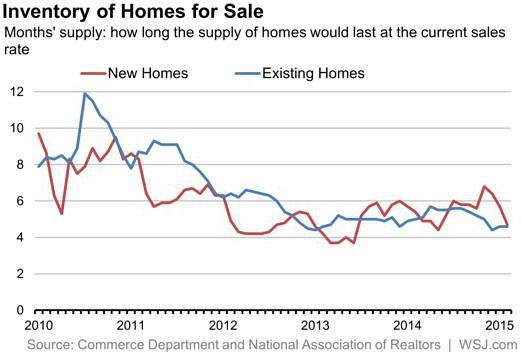

The bullish case for the housing market coming into the week included the lack of supply in absolute numbers as measured by the months' supply plunging recently for new homes and trending near post recession lows for existing home sales.

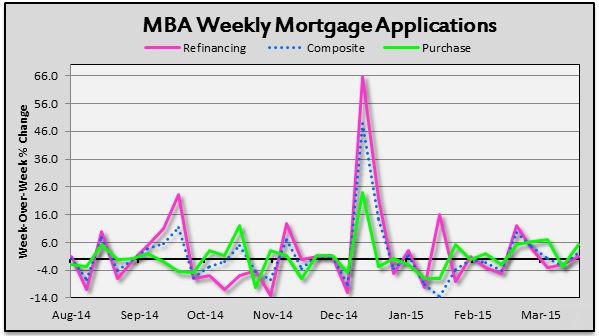

In addition, mortgage applications have begun to take off, although there have been many false starts during the past couple of years...it looks like something's in the air beyond the smell of springtime. On a year-to-year comparison, applications to purchase have gathered steam as the 30-year rate began to drift lower.

| Mortgage Application Trends Year over Year | Purchase | Refinance | 30-yr Rate |

March 20 | 3% | 35% | 3.90% |

March 27 | 8% | -47% | 3.89% |

April 3 | 12% | 35% | 3.81% |

April 10 | 8.5% | 44.2% | 3.87% |

Corporate earnings and all the excuses will take center stage; however, housing data could carry the session. Below are some of the notable companies that reported earnings this morning.

Company | Date | EPS | Consensus | Revenue ($M) | FY EPS Guidance | FY EPS Consensus |

ANGI | 22-Apr | 0.07 | B 0.07 | 84 | - | 0.14 |

BK | 22-Apr | 0.67 | B 0.07 | 3,851 | - | 2.61 |

BA | 22-Apr | 1.97 | B 0.16 | 22,149 | 8.20-8.40 | 8.49 |

KO | 22-Apr | 0.48 | B 0.06 | 10,711 | - | 1.98 |

DHI | 22-Apr | 0.40 | B 0.02 | 2,336 | - | 1.87 |

MCD | 22-Apr | 1.01 | M 0.05 | 5,959 | - | 4.91 |

OC | 22-Apr | 0.19 | B 0.06 | 1,207 | - | 2.07 |

STJ | 22-Apr | 0.93 | B 0.02 | 1,345 | 3.92-3.97 | 3.95 |

TUP | 22-Apr | 1.02 | B 0.04 | 582 | 4.60-4.70 | 4.80 |

WAB | 22-Apr | 0.99 | B 0.04 | 819 | 4.10 | 4.09 |

Today's Session

The Mortgage Bankers' Association (MBA) announced that weekly mortgage purchase applications recovered during the week ended April 17th. The composite index rose 2.3% after declining 2.3% the prior week, largely influenced by purchasing component rebounding 5% after falling 3% in the prior week - year-over-year purchase applications are up 16% for the week of April 17th. This shows that momentum is building, however, year-over-year changes provided a clearer picture of what's really going on in the market. Also, with rates remaining low at 3.83%, consumers are becoming more encouraged to refinance their homes. The refinancing component rose 1% after falling 2% in the prior week.

Improvements in the housing market were highlighted by real estate firm, ABI. On a month over month basis, the amount of new units, contracts, and types of buildings constructed improved on a monthly basis:

- New 58.2/56.6 (m/m)

- Contracts 52.3/50/0

- Commercial 53.0/51.4

- Institutional 53.2/52.2

- Multi-family 49.7/48.9

Happy Earth Day

You have no clue just how fortunate we are to be able to say these glorious words today. That's because back in 1970 when April 22nd was first designated this distinction, there were some dire predictions:

- Unusable land

- Zero crude oil

- Citizens wearing gas mask

- New ice age

- Worldwide famine

- Mass starvation

- Extinction

- End of civilization

These kinds of predictions had been made by so many others in so many eras and never came close to being true. Some came from honorable people, but many times, prognosticators were actually focused on the extinction of other things including religion and capitalism.

Yes, we love the Earth and want to keep it livable, and for me, the best stewards would be God-fearing folks with money to make things better.