After some hesitation, stocks found buyers and we were still able to close amid anxiety, but this kind of move ahead of the jobs report is impressive. Was it smart money or dumb money? I don't think it was the garden-variety mom and pop investors loading up late Wednesday on a slight weakness yesterday.

By the same token, it wasn't a lot of money. Once again, the tide stemmed just as the market was on the cusp of a big technical breakdown.

Still, the major indices are all range-bound and seeking a sign that could come this morning with the release of the jobs report. The Street has to be bracing for a big disappointment since the ADP report bombed.

The Dow Jones Industrial Average (DJIA) Performance

Late in the day, consumer credit for March was released. In spite of a net increase of $5.9 billion, outstanding credit card debt was down for the first quarter.

Outstanding credit card debt is now $889.4 billion, down from more than $1.0 trillion back in July 2008. Considering this is yet another earnings season, companies couldn't move the needle on top line growth. What's this all about? I suspect it's the dark clouds of uncertainty and the deep emotional and educational scares.

Game of Thrones

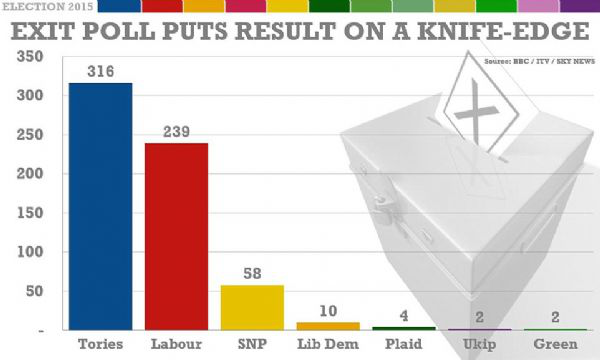

In many ways, today's election in the United Kingdom reflects the political issues and themes that will be prevalent when we go to the polls next year.

The Economist magazine that certainly leans on the progressive side issued this statement in the current issue:

"Our fealty is not to a political tribe, but to the liberal values that have guided us for 172 years. We believe in the radical center: free markets, a limited state and pen, meritocratic society."

With that statement, they reluctantly endorsed the Conservative Party led by Tory Chief David Cameron. Largely, due to their worries of Europhobia that could see the UK eventually leave the European Union (EU).

Moreover, some worry that the battle for male, white and working class voters have pulled the party into an anti-immigrant stance. As it turns out, this group has a much lower median income than the national average and there is a sense they are back on their heels.

In the meantime, the British Labour Party led by Ed Miliband wants to remake capitalism and the UK into a fairer society.

Considering the British economy has been more robust than ours and if the conservatives had lost, the shock waves would have been felt in America. By the way, the polls had the election as a toss-up, but it was a slaughter. The same goes for Scotland where an independence fever sparked a resounding victory for the Scottish National Party (SNP).

Today's Session

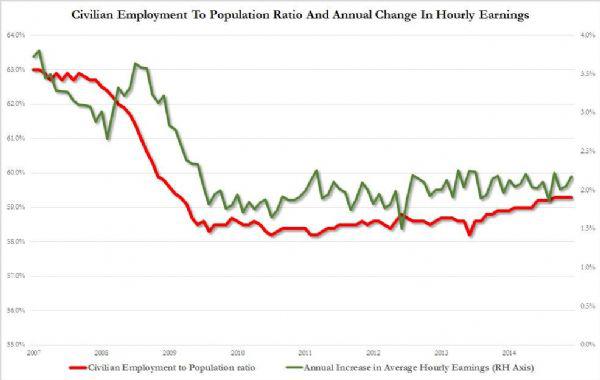

The jobs data came in around consensus and the Street breathed a sigh of relief. For the month of April, 223,000 jobs were added as the economy tried to make up for the only 85,000 (revised lower from 126,000) jobs added in March. The unemployment rate decreased slightly to 5.4% from 5.5% the prior month. Luckily, this wasn't due to another mass exodus of workers from the labor market. The labor force participation rate improved slightly in April to 62.8% from 62.7%.

Breaking News: The jobs report is a Goldilocks number for the stock market, but for Main Street, a reminder the wage-less recovery rages on as incomes were up 0.1% and just 2.2% from a year ago. Have your bills gone up more than 2.2% in the past year? The great news, however, is for the stock market because as more people work, they'll spend and that's great news and why the stock market is indicating up so much more.