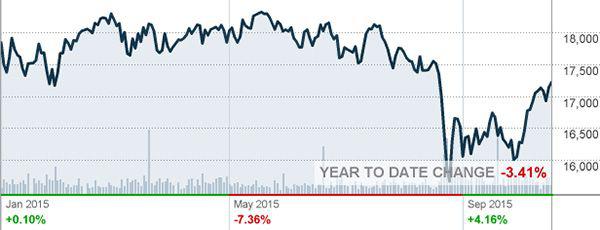

It's getting cold outside, but it's hot inside as the stock market continues to edge higher with an impressive session on Friday. There's no reason for stocks to be higher on a day when few are bold enough to hold trading positions with profits over a weekend. With that session, the Dow Jones Industrial Average cleared a pivotal resistance point (and former support point) of 17,164.

From here, the next big upside test is 17,500.

Tense Week

Last week, was a nip and tuck all the way with the market seesawing back-and-forth; the spurt late Friday made the difference. Nevertheless, looking under the hood, it's clear the market is still indecisive.

Market Breadth - Volume | NYSE | NASDAQ |

Advancing Volume | 8.1 million | 4.4 million |

Declining Volume | 8.7 million | 4.0 million |

One thing is encouraging; stocks are moving higher versus lower and new highs versus new lows.

Market Breadth - Movers | NYSE | NASDAQ |

Up | 1,753 | 1,527 |

Down | 1,477 | 1,427 |

New Highs | 131 | 153 |

New Lows | 74 | 141 |

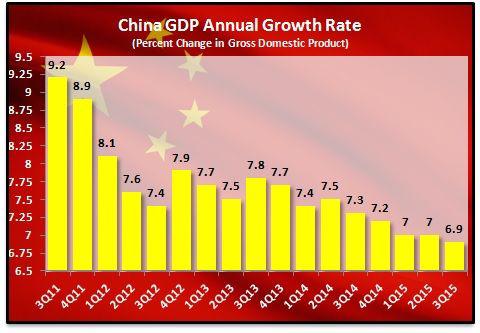

There are a lot of earnings reports due this week, beginning with Halliburton (HAL) and Morgan Stanley (MS) this morning. However, the session might feed off China's third quarter 2015, gross domestic product (3Q15-GDP) data, expected to come in at a 6.7% growth.

Today's Session

So the China GDP number comes in at 6.9%, and while nobody is cheering, I want to laugh at the humbug class that cries foul every time data comes in at, or slightly above, consensus. I also find it somewhat amusing that headlines are calling 6.9% "weak" when the US has been in dire need of sustained economic growth. The last time we posted a quarterly gain of 6.9% GDP was in 3Q2003.

The news from China, however, isn't moving the needle as much as the prominent earnings miss this morning.

Morgan Stanley missed, blaming volatility or lack of volatility, I can't keep it straight, but it is worrisome that the smartest guys on Wall Street (and presumably the world) need a perfect trading backdrop to make an earnings number. Not sure it's a proxy for the economy or a cry for Wall Street investment banks to get back to basics.

The most exciting news of the morning is Oprah taking a 10% stake in Weight Watchers and joining the board. Too bad she can't take a 10% stake in the entire market. This will be a lackluster start reflecting earnings results.

By the way, I don't think it matters who becomes the next president of the United States. Valiant Pharmaceuticals posted strong earnings, and raised guidance, but the stock reversed lower when management conceded "outside pressures" are creating a new pricing environment for all pharmaceutical companies. Down the stock goes- thanks Hillary.