Pipe 1 is now 150x300x500 for the NR dated 21 May 2013

Quote:

Quote:

On the East anomaly graphite mineralization has been traced for approximately 150 metres in a NE - SW direction by 300 metres in a NW-SE direction. To date, drilling from eleven holes has shown graphite mineralization down to 500 metres vertical where it remains open. Assays are still pending for holes 11 through to 15.

Math for the anomaly "numbers from the company"150x300x500 .We decided to use 150x300x460 to remove irregularities in the pipe wall. Formula from hoov.

The correct formula, for an oval (ellipse) is pi X 1/2 long axis X 1/2 short axis = pi X 150 X 75. Then multiply by height.

Using this formula you get I get 16,258,000 cubic metres. 43.9 million tonnes.

Using a standard calc of length x width x height does not work for this pipe because you can clearly see its an ellipse.

So Gold Investments Newsletter is calculating 75K tons and that is wrong and should not be used as the reference. This calc should be.

43,000,000 tons @ 5.1% Graphite = 2,193,000 tons of Pure Graphite.

Zenyatta was to build a 100,000 ton Graphite facility.

Using the existing calculations at 90% recovery is 1,973,700 if we were to get 90% of ALL of the ore out of this pipe. However that is not possible. So I will deduct another 10% for what is "left over in the extremes of this pipe. Net tonnage to us would then be 1,776,330 tons of pure Graphite.

100,000 ton production per year and you can see we have a 17 year mine life, in fact for ease of calc lets do 15 year mine life at 100,000 tons.

From the Same NR provided by the Company Dated 21 May 2013

Quote:

Quote:

The West anomaly suggests a larger and more conductive zone but it will require more than the five holes that have been previously drilled in this area to determine the limits of the graphite mineralization.

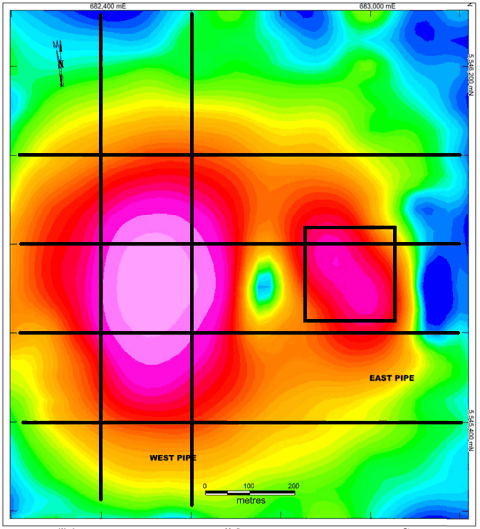

Plan maps showing the Crone geophysical survey (Figure 1) and the approximate outline of the graphite mineralization (graphitic breccia and surrounding graphite over printed syenite) on the East anomaly (Figure 2) accompany this news release and have been placed on the website.

The accompany dia was located in the NR at http://media3.marketwire.com/docs/zen0521.pdf

Here is the a copy of that diagram.

This pipe appears to be Circular, so we can use the standard math calc for it.

We have already drilled this pipe in a couple of places and found it is mineralized to 400m Pipe2 is approximately 4-5 times LARGER then Pipe 1.

So rather then "guess" numbers based on the size, lets replicate the existing size of Pipe 1 which is at least 4 times smaller and possibly 5 times smaller then Pipe 2.

So I will add another 1,776,330 tons of Pure ore to our existing calculations. For obvious reasons this is the only Pipe we have not proven up but taking 25% of its size or less is a reasonable speculation at this point. So in actuality, pipe 2 could hold as much as 7,000,000 tons of Pure Graphite using 5% as the density. That would put this project at or near the 9,000,000 tons of Pure Graphite level.

However we will stick with a pipe the size of Pipe 1 for this exercize. You can see already with Pipe 1s contents we will be a mine. There is no doubt. Especially when we start doing the Dollar numbers.

So we determined Pipe 1 was 1,776,330 tons of pure graphite, assuming 90% recovery and a 10% error on that recovery.

We add Pipe 2's theoretical tonnage in at 1,776,330 and we get 3,552,660 tons of Pure Graphite. for this Anomaly out of 100,000,000 tonnes of Ore. Note- You can see that 3,552,660 works out to about 3.55% Ore for the entire project by subtracting the 10% recovery and the 10% for error.

Lets round down the 3,552,660 to 3.5 million tons

This is a "terribly important number". We now have a 35 year mine life at 100K tons. This is not important to us, its important to BIG BIG companies that will come in and do a 200K a year facility. So ZEN has now catapulted itself into the BIG Leagues and is now bait for the BIG players to bid for us.

Next Excerpt from an NR dated- April 25 2013

Quote:

All trials using a simple caustic baking leach process conclusively demonstrated that an ultra-high purity graphite product with greater than 99.97% Carbon ("C") can be produced from the Albany graphite deposit. The process was successfully applied to a variety of graphite concentrate samples that had initial carbon grades in the range of 46 - 90% using conventional flotation techniques. In all trials the final purity values were greater than 99.97% C and up to 99.99% C in many cases, regardless of initial carbon grades.

Aubrey Eveleigh, President and CEO stated, "Achieving these ultra-high purity carbon values at such an early stage from a simple and relatively inexpensive process is extraordinary. The graphite purification process is effective across a wide range of initial concentrate grades and particle sizes, producing ultra-high purity graphite with good recoveries. This is a very significant development for the Albany deposit and shows how easily the graphite material can be purified."

Both these para's above are exciting news but the underlined portion is the most significant. It basically states that WHATEVER graphite we get out of the ground, no matter the grade, it can ALL be refined to 99.97% or greater.

Heresay- We have no proof of this but we are being told the cost to do this refining is $600 a ton. So we are adding $1400 to that ton for 2 reasons, one, is too go and get it below 40m of overburden. The other is for error on the refining costs. (We know it is below $1000 for sure, just not sure how far below).

Is $1400 a ton good enough? We have suggested removing the first 40m will cost $50,000,000 so we add that to the stated Capex of $150,000,000 and then add another $50,000,000 for error. So Initial CAPEX we are suggesting is $250,000,000 with $150,000,000 going to the build, and $100,000,000 to remove the cap.

Why do we think that is reasonable? We have Natural Gas, Electricity less then 30KM from the project. We also have the TransCanada highway less than 30KM from the project. The existing road can be upgraded to all weather easily and Provincial Grants etc would cover the costs of bringing in the NG and Electricity to the site. Heavy equipment can get to the site via the TransCanada Highway with ease.

Graphite mines by their very nature are far far cheaper to build than any other facility. In our case the refining process will likely be able to be done inside a large building as opposed to heap leaching ponds, which tend to get tagged as a huge environmental obstacle. So we will have a very small environmental footprint compared to any other mining facility.

Zenyatta itself will NEVER build a mine. Aubrey has already stated that Zenyatta has no interest in becoming a producer. So that is an "immediate plus" for shareholders, and lets everyone know in the mining industry that for the right price, we are for sale, now!

Lump, Vein, Hydrothermal, Graphite.

Personally I wish we would stay with one descriptor but Aubrey seems to like bouncing between them all. It may be that people just do not know what we have, but I left this interview wondering what we had too

Watch the last interview on TCC

http://tradingchief.com/stock-board.php?exchange=CDNX&symbol=ZEN:CA&company-name

=Zenyatta-Ventures-Ltd&subject=Re:-%95Ze nyatta-Ventures-(OTC:ZENYF)-Click-here-f

or-interview&pid=85898

Dollars

We now know we can do 99.97% with ease from virtually everything found on the Albany project thus far. So there is no reason to suspect we would ever have to sell a ton for anything less than $15,000

100,000 tons a year at $15,000 is $1,500,000,000 (yes that is 1 Billion 500 million dollars.

Lets do $12000 a ton that is $1,200,000,000

Lets subtract our $2000 a ton all in OCCPT (Operating Cash Cost per ton) and its hard to believe but you end up with a NET profit of $1 Billion bucks.

But thats gotta be stupid? So lets say we forgot to pay the $250,000,000 loan (CAPEX) to get to our first year of full mining. Thats still $750,000,000 NET income. Lets suppose the Natives we hire all want $1,000,000 a year in wages?

Lets reduce that to $500,000,000 in NET Profit.

Is this fair?

Its good to be a native working on the ZEN property

So you debt free making $500 million a year? Perhaps you would like to cut back wages to $500K a year per person

Well then we could build an airport, and own a G5 Galaxy Jet too???

Do you see how UTTERLY and COMPLETELY ridiculous this all is??

You may say, we have not considered extending the railway and its associated costs. Well I have an answer for that too Get 10 trucks capable of carrying 50 tons and every day make 1 trip to the railway 70KM away. Or only pay the Natives $150K a year and build your own railway?

Trust me, we will be sold, and I am saying we will be sold BEFORE the 43-101 is even tallied, after all, big companies can do math too.

Why am I not now calcuating a share price? Well pick a number. Pick a billion, now divide it by 100,000,000 shares FD and you get $10.00 in EPS. Now do a 10 to 20 multiple?

Thats $50 to $100 but if you truly were making that amount of money you would have a much higher multiple. Now increase to 200K tons a year? So its all really really ridiculous. All we all need to know is the numbers are higher then a 10 bagger from here.

Valuing ZEN

How do you value ZEN?

Well its fairly easy. If we look at Pipe1 we know we have about 45,000,000 tonnes at 5.1% then even assuming a moderate recovery rate we already have 2,000,000 tons of Graphite. But I am working with 1.4million at the moment.

The interesting thing about ZEN's lump is that it can be refined cheaply and easily to 99.97-99.99% pure.

The purity dictates a price of $30,000 but for safety sake I use $12,000 and then subtract $2000 a ton, for Operating Cash Cost per tonne to get it out of the ground and refined to 99.99%

I am told that this is way too much as far as Cost per ton, but I am being safe for all the measurements.

So 1.4million tons at $10,000 a ton.

That gives an isitu value of 1,400,000 * $10,000=$14,000,000,000

$14billion dollars. Now find a comparable gold project that has an insitu value of $14billion.

At $1300 an ounce that would mean you would need a resource of 10,769,230 ounces of gold.

So find a project that has 10.7million ounces and that is a good "value of ZEN".

Now start working with some of the actual numbers? $30,000 a ton Triples the insitu value. to $42,000,000,000 or $42billion.

Now forget my 50% reduction of mineralization in Pipe 1 and double that? $84,000,000,000 or $84billion

Now, add in the fact that Pipe 2 is 5 times bigger then Pipe 1 and we know already because we have drilled it, thats its also mineralized to 400meters.

So now lets say we get only another 1.4million in pipe 2? Add another $14billion?

Gee what if we had the same as Pipe 1? Add another $14billion?

Now heaven forbid, what happens if we actually have 3X the size of pipe 1? That would be a total of $42 billion but thats at $10,000? Now start doing the $30,000 with that pipe?

Now..... Try to find a project that has an insitu value of much higher then $150 billion whats that worth for share price?

What happens if you just say we should have 2,000,000 tons of Graphite in Pipe 1 total and 5,000,000 in Pipe 2?

7,000,000 tons at $30,000 a ton =$210,000,000,000 or $210 billion insitu value.

Now try to find a project anywhere 161 million ounces of gold and figure out what the shareprice should be with 60,000,000 shares FD?

So its easy to value ZEN, what is not easy is BELIEVING ANY OF IT.

What I have great ease telling anyone is. You ain't seen nothing yet.

If even 1/3 of this comes true... man $2.50 will look like chump change and you will wonder what the debate was about.

Disclosure: I am long ZENYF.PK.

Additional disclosure: ZENYF is the US listing I am long ZEN-Vancouver