Rayno Life Science Stocks -Green Screen Rules-NASDAQ (4168) Up 1.16%

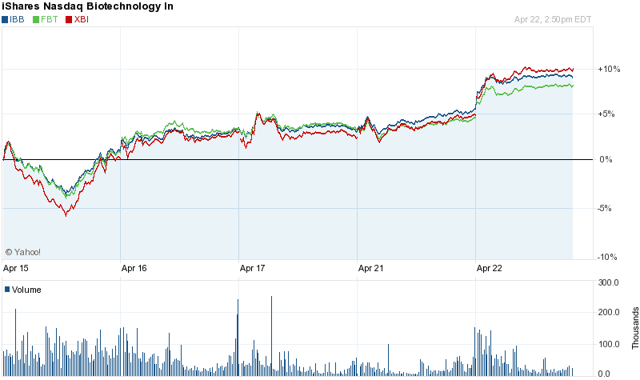

- Speculative ETF XBI (134.50) up 4.69% and 7.88% over 5 days; 52 week high $172.52.

- ETF PBE($40.85) up over 3%.

- Momentum stocks are soaring but way off all time highs in February.

- Big Rayno Biopharma Movers: ACHN up 8%, ALKS up 3.4%, ARIA up 5.3%, CBST up 4.5%. IMGN up 4.34%, PCYC up 5.9%, SGEN up 5.3%...etc.

- Big Rayno Dx and Tools Movers: EXAS up 3.76%, GHDX up 4.8%, ILMN up 4.6%, SQNM up 4.9% ..etc.

- Healthcare ETF XLV ($58.40) now up 5.4% YTD.

- Valeant Bid for Allergan is a Catalyst for sector.

Amgen (AMGN) , Cubist (CBST), Gilead (GILD), and Illumina (ILMN) earnings after the close. All are on our focus list.

Asset trade with Glaxo (GSK) , Lilly(LLY) and Novartis (NVS) reshapes product direction.

Our index of 55 mid-cap biopharma stocks is up a huge 10.2% driven by AGIO, ICPT, NKTR and SRPT. Shorts are covering and institutions have plenty of fire-power. There is only ONE stock down so if you have a loser today sell it. Speculation returns.

All that matters near term are earnings from large caps and technicals. All Rayno Life Science stocks are holds. The bull is back.

Disclosure: I am long ACHN, GILD, IMGN.

Additional disclosure: Long FBIOX.