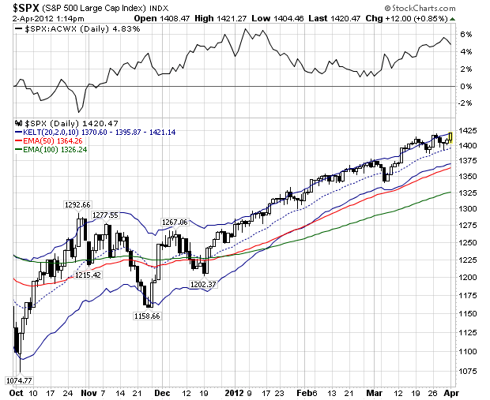

With 1Q earnings expected flat ex AAPL, April's reports will shed light on whether revenues can accelerate and profit margins stay at record levels, and thus if 2012's risk-on rally might go much further.

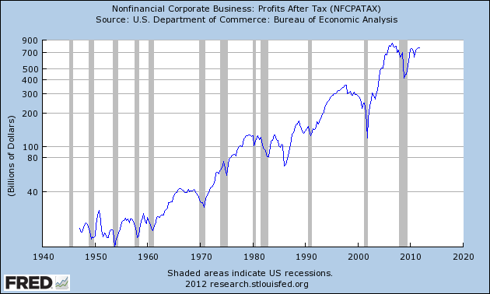

That record high profit margins will start to mean revert, helping to keep SPX's p/e below its historic average, is a key belief of some well-known cautious investors (e.g. new articles by GMO, Hussman), picked up by the media.

But what if financial markets start to more strongly believe that it really is "different this time," expanding p/e's further? Perhaps since arguably it already has been different, for over thirty years now, see further below.

Markets won't mainly judge profit mean reversion from economic arguments, but rather by extrapolating from earnings reports and stock price action. E.g., earnings from RHT, TIBX last week, ACN the week before, indicate that corporate IT demand seems strong. 1Q stock performance was blistering.

SPX +12.0%, sectors: fncl +21.5%, IT 21.2, cons disc 15.5, ind 10.7, matls 10.6, hlth cre 8.4, cons stpl 4.8, telco 0.6, util -2.7. Some key ETFS: +XLF 21.9%, QQQ 21.1, IWM 12.6, LQD 2.3, JNK 3.6, ACWI 11.9, ACWX 10.9, EFA 10.8, EEM 13.2, AAXJ 13.1, ILF 11.9. Nikkei +20.3%, Stoxx 7.5, Shanghai 2.9.

A few of many 1Q big winners, stocks: BAC +72%, NFLX 66, LNKD 62, LULU 60, PCLN 53, CRM 52, AAPL 48 (to $559 b market cap), JPM 39, EMC 39, GS 38, VMW 35. ETFs: VNM +32%, XHB 25, ITB 24, EPI 24, XBI 21, EWG 21.

This chart link shows that U.S. profit margins have been trending up since 1980 with the triumph of Reagan/Thatcher, then the rise of "state capitalism" in China and Russia.

These major political shifts combined with technology in a globalization with much higher U.S. corporate profitability, and much greater skew of American income and wealth, toward productive entrepreneurs (in start-ups and corporate America) who create that profitability, and also to those who can financially leverage off of it.

Have these 30-year big trends favoring higher corporate margins suddenly significantly changed after the 2007-09 crisis? Some issues continue to simmer, but currently are not on the front burner for rising financial markets.

Last week the EU reached a compromise firewall deal; Spain had general strikes and Rajoy introduced a tough austerity budget; Monti pressed ahead to change Article 18 of Italy's labor law; the U.S. Supreme Court took up Obamacare; Japan's parties maneuvered over a sales tax increase; Foxconn and AAPL addressed wages and working conditions, China cracked down on micro-bloggers,.

Periodic concerns during the Mar 09 bull market notwithstanding, so far there has been no serious threat to the status quo. For that reason, I wrote several times back in Oct-Nov that there was no significant opposition to bailing out TBTF European banks, just as with U.S. banks in 2008-09. ECB then did so, with its Dec 21 LTRO (see my Dec 22 "Draghi as Euro Santa Claus a Big Deal"), with the global risk-on rally since that day.

If anything, status quo trends might be accelerating, helped by, though not an intended goal of, Bernanke's E-Z money. E.g. according to a new academic study, 1 out of 10,000 U.S. taxpayers received 37% of the total increase in 2010 taxable income, 9,900 of the rest 7% combined.

Awareness of mean reversion is a key antidote to the human bias to extrapolate from the recent past, but guessing when it doesn't happen, e.g. creating or riding big secular trends, huge long-term stock winners, can be very profitable to those smart/lucky enough to do so.

LEFT CLICK on chart to enlarge, for profit chart, hold a straight edge to visualize rising trend line on log scale, noticeable in much higher low in last recession, even though the economic decline was much more severe than the previous two.