Secondary reaction continues

Let's get started with our Dow Theory commentary for today.

US stocks

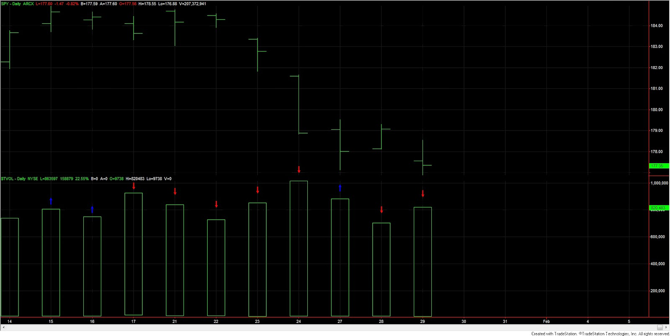

The Transports, the Industrials and the SPY closed down. Furthermore, all indices violated the last recorded minor low (Jan 27), which adds credence to the ongoing secondary reaction. Volume was larger than yesterday's, which is also a bearish sign.

However, provided tomorrow or latest the day after tomorrow, stocks stabilize, I see two relatively good signs in volume:

Firstly, today's volume was smaller than the volume we saw on January 27 when the markets closed also down.

Secondary, both today and on January 27, volume was smaller than the volume we saw on Friday, January 24.

So subtly, it seems that volume is slowly drying up as the stock indices make lower lows. This is a potential positive. However, for this "positive" to become actual, we need to see soon an "up" day on strong volume. Until this happens, the odds favor the continuation of the secondary bearish trend (secondary reaction).

Take a peek at the chart below and judge for yourself:

|

| Volume has been bearish, but depending on tomorrow's action we could see "green shots" |

The primary trend remains bullish, as explained here, and more in-depth here.

The primary trend was reconfirmed as bullish on October 17th and November 13th, for the reasons given here and here.

The secondary trend is bearish (secondary reaction against primary bull market), as explained here.

Gold and Silver

SLV and GLD closed up. For the reasons I explained here, and more recently here, the primary trend remains bearish. Here I analyzed the primary bear market signal given on December 20, 2012. The primary trend was reconfirmed bearish, as explained here. The secondary trend is bullish (secondary reaction against the primary bearish trend), as explained here.

On a statistical basis the primary bear market for GLD and SLV is getting old. More than one year since the bear market signal was flashed has elapsed. However, I am extremely skeptical as to the predictive power of statistics. I prefer price action to guide me, and the Dow Theory tells me that the primary trend remains bearish until reversed.

As to the gold and silver miners ETFs, SIL and GDX closed up. The secondary trend is bullish, as explained here.

The primary trend for SIL and GDX remains, nonetheless, bearish, as was profusely explained here and here.

Sincerely,

The Dow Theorist