Date: February 12, 2013

Daily Market Statistics

Source: Barrons

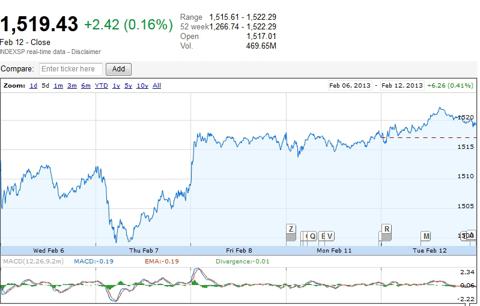

S&P 500 5-Day Daily Chart

Source: Google Finance

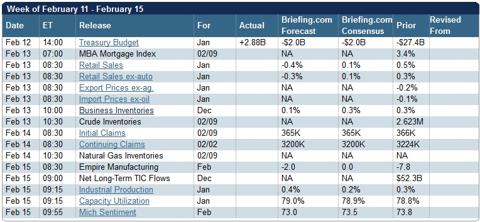

Economic Calendar

Source: Briefing

Options Market Recap

The market sentiment was driven by extreme greed with Fear & Greed Index at 86, which had increased from the previous day of 83. As reported by CBOE, the total put/call ratio was 0.92 for the day. The index put/call ratio was 1.05, and the equity put/call ratio was 0.61. The CBOE volatility index (VIX) put/call ratio was 0.75. The stocks with unusual call activities had been identified through our daily options scanning process, with the scanning criteria where the daily call option volume ratio was above 2.00 (2x of the average call option volume) with a call option volume above 10,000. Unusual option activities can be an indicator or precursor of a major movement for the underlying stock.

For the complete list, please visit Optionity.com.

Market Volatility and Analysis

For Option Equity Put/Call Ratio, the MACD (12, 26, 9) is showing a bearish trend and the MACD difference converged. RSI (14) had increased to 47.42 from 44.59. It could signal a market reversal if the MACD difference starts to converge and the MACD Histogram moves into the positive territory.

SPY opened flat and closed higher with 0.15% gain. The volume was 13.56M. On weekly basis, the MACD (12, 26, 9) is showing a bullish trend and the MACD Histogram increased slightly and closed at 0.858 (increased from 0.842). SPY is currently trading above its 200-day MA of $118.05 and its 50-day MA of $139.26. RSI (14) increased to 69.45 from 69.07 with increasing buying momentum. The next resistance is $154.09 (R1), followed by $161.81 (R2).

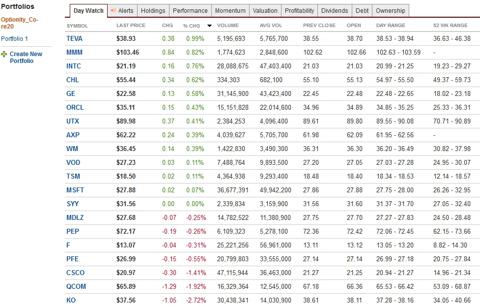

Optionity Core-20 Options Portfolio (Credit Put Strategy)

Stock criteria:

- Large Cap with low beta

- Fair/Under-valued

- Consistent, strong earnings

- Dividend distribution

- High liquidity, large volume

- Good/strong economic moat

This options portfolio consists of 20 core stocks. The portfolio will employee mainly the credit put strategy with the primary objective of generating consistent cash flow. The portfolio focuses on 1) sufficient sector diversification 2) risk/reward ratio control 3) margin of safety by leveraging options.

Daily portfolio performance will be updated at Seeking Alpha Instablog and Optionity.com.

Transaction details will be updated whenever new position is opened or the existing position is closed/expired/adjusted.

Core-20 Stocks Update

Pending transaction(s) to be setup:

For the complete list, please visit Optionity.com.

Existing Position(s):

For the complete list, please visit Optionity.com.

All rights reserved © Optionity 2013