Date: October 18, 2013

Optionity Daily Report offers daily market recap, providing data from leading financial websites and exchanges. Optionity's daily options positions are also updated in the report.

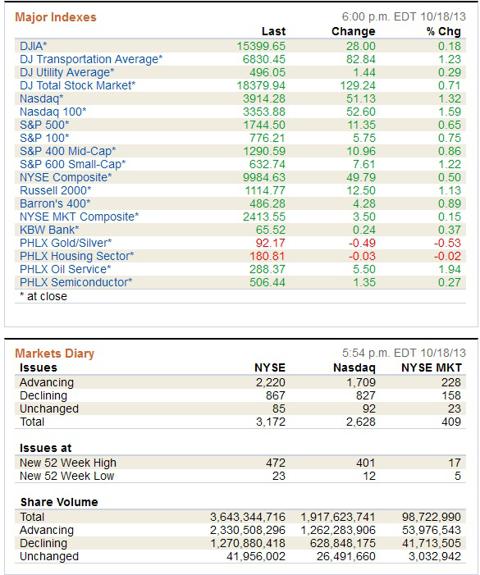

Daily Market Statistics

Source: Barrons

S&P 500 5-Day Daily Chart

Source: Google Finance

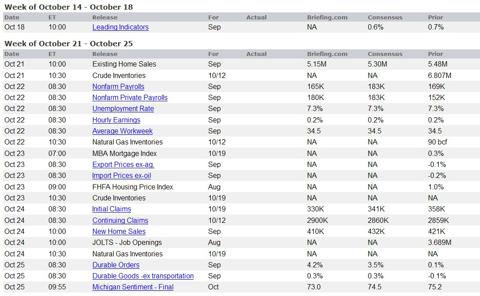

Economic Calendar

Source: Briefing

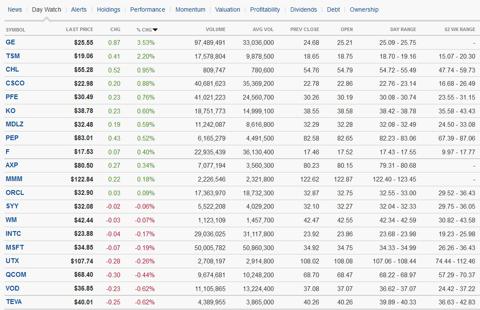

Options Market Recap

The market sentiment was driven by greed where Fear & Greed Index closed at 57, which had increased slightly from the previous day closing of 48. As reported by CBOE, the total put/call ratio was 0.69 for the day. The index put/call ratio was 0.87, and the equity put/call ratio was 0.46. The CBOE volatility index (VIX) put/call ratio was 0.42.

Market Volatility and Analysis

For Option Equity Put/Call Ratio, the MACD (12, 26, 9) is bearish. MACD is closing at -0.024. RSI (14) has decreased and remained bearish. RSI (14) closed at 42.31 (previous closing of 45.68). The market is expected to decline if both MACD and RSI are bullish; now, both MACD and RSI (14) are bearish.

SPDR S&P 500 ETF Trust (SPY)

SPY opened higher and closed higher at $174.36 (+0.63%). The volume was 36.34M. The MACD Histogram increased in the last trading day and closed at 0.001. SPY is currently trading above its 200-day MA of $128.64 and its 50-day MA of $156.25. RSI (14) increased and closed at 68.77.

Optionity Core-20 Options Portfolio (Credit Put Strategy)

Stock criteria:

- Large Cap with low beta

- Fair/Under-valued

- Consistent, strong earnings

- Dividend distribution

- High liquidity, large volume

- Good/strong economic moat

This options portfolio consists of 20 core stocks. The portfolio will employee mainly the credit put strategy with the primary objective of generating consistent cash flow. The portfolio focuses on 1) sufficient sector diversification 2) risk/reward ratio control 3) margin of safety by leveraging options.

Daily portfolio performance will be updated at Seeking Alpha Instablog and Optionity.com.

Transaction details will be updated whenever new position is opened or the existing position is closed/expired/adjusted.

Core-20 Stocks Update

Existing Position(s):

Core 20 Positions:

N/A

Other Options Positions:

HL credit short put spread $3.5/$4.5 April 19, 2013 ($0.32 credit, established on March 11, 2013) => Acquired HL share at cost of $4.18

SQNM short put $2.5/$3 spread Sep 20, 2013 ($0.14 credit, established on Aug 9, 2013) => Acquired SQNM shares at cost of $2.86

Closed Position(s):

GLW credit short put spread $11/$12 Mar. 15, 2013 ($0.23 credit, established on February 7, 2013) => Closed short put $12 at $0.07 on February 20, 2013. $0.16 profit (20.78% Return on Margin, 13 days, including non-trading days). $11 put position was sold for $0.04 on February 26, 2013, adding $0.04 to the total profit.

ORCL credit short put spread $29/$31 May 17, 2013 ($0.32 credit, established on March 21, 2013) => Closed position on April 11, 2013. $0.23 profit (13.69% Return on Margin, 21 days, including non-trading days).

CHL credit short put spread $50/$52.5 April 19, 2013 ($0.55 credit, established on March 6, 2013) => Closed position on April 16, 2013. $0.15 profit (7.69% Return on Margin, 40 days, including non-trading days).

CHL credit short put spread $50/$52.5 April 19, 2013 ($0.75 credit, established on March 19, 2013) => Closed position on April 16, 2013. $0.35 profit (20% Return on Margin, 27 days, including non-trading days).

CHL credit short put spread $50/$52.5 April 19, 2013 ($0.30 credit, established on February 25, 2013) => Closed short put $52.5 put at $0.05 on April 19, 2013. $0.25 profit (11.36% return on margin, 55 days, including non-trading days)

TEVA credit short put spread $35/$37.5 April 20, 2013 ($0.19 credit, established on March 7, 2013) => Closed short put $37.5 at $0.02 on April 19, 2013. $0.17 profit (7.36% return on margin, 42 days, including non-trading days)

AKAM credit short put spread $30/$32 May 17, 2013 ($0.38 credit, established on February 13, 2013) => Closed AKAM short put $32 at $0.03 on April 25, 2013. $0.35 profit (21.60% return on margin, 72 days, including non-trading days)

ORCL credit short put spread $29/$31 May 17, 2013 ($0.38 credit, established on March 25, 2013) => Closed ORCL short put $31 at $0.06 on May 1, 2013. $0.32 profit (19.75% return on margin, 36 days, including non-trading days)

QCOM credit short put spread $57.5/$60 May 17, 2013 ($0.30 credit, established on April 25, 2013) => Closed QCOM short put spread $29/$31 at $0.06 on May 3, 2013. $0.24 profit (10.91% return on margin, 8 days, including non-trading days)

NOV credit short put spread $60/$62.5 May 17, 2013 ($0.51 credit, established on February 14, 2013) => Closed NOV short put spread $60/$62.5 at $0.14 on May 3, 2013. $0.37 profit (18.60% return on margin, 79 days, including non-trading days)

NOV credit short put spread $60/$62.5 May 17, 2013 ($0.36 credit, established on March 19, 2013) => Closed NOV short put spread $60/$62.5 at $0.156 on May 3, 2013. $0.204 profit (9.53% return on margin, 44 days, including non-trading days)

TEVA credit short put spread $35/$37.5 May 18, 2013 ($0.32 credit, established on April 1, 2013) => Closed TEVA short put spread $35/$37.5 at $0.13 on May 3, 2013. $0.19 profit (8.72% return on margin, 32 days, including non-trading days)

NOK credit short put spread $2.5/$3.5 May 17, 2013 ($0.37 credit, established on April 18, 2013) *High Reward/High Risk Position => Reduced the position by 1/3, closed at $0.23 with a profit on May 3, 2013. => Closed the remaining NOK short put spread $2.5/$3.5 at $0.08 on May 7, 2013. $0.29 profit (46% return on margin, 19 days, including non-trading days)

WFM credit put spread $80.5/$83 May 17, 2013 ($0.68 credit, established on March 13, 2013) => Closed WFM short put $83 May 17, 2013 at $0.05 on May 8, 2013. $0.63 profit (34.62% return on margin, 56 days, including non-trading days)

MDLZ credit short put spread $22/$25 June 21, 2013 ($0.31 credit, established on February 15, 2013) => Closed MDLZ credit short put spread $22/$25 at $0.10 on May 20, 2013. $0.21 profit (7.80% return on margin, 35 days, including non-trading days)

ZNGA credit short put spread $2.5/$3 June 21, 2013 ($0.16 credit, established on March 25, 2013) => Closed 2/3 of the position at the cost of $0.07, with a profit of $0.09 on May 13, 2013. => Closed the remaining 1/3 of the position at the cost of $0.06, with a profit of $0.10 on May 20, 2013.

PBI credit short put spread $11/$13 June 21, 2013 ($0.375 credit, established on May 1, 2013) *Buying on Weakness => Reduced the position by 1/2, closed at $0.20 with a profit of $0.175 on May 3, 2013 => Closed the remaining 1/2 of the position at the cost of $0.10 with a profit of $0.275 on May 20, 2013

ORCL short put $30/$32 June 21, 2013 ($0.345 credit, established on May 6, 2013) => Closed ORCL credit put spread $30/$32 at the cost of $0.10 on May 20, 2013. $0.245 profit (14.80% return on margin, 14 days, including non-trading days)

CHL short put $50/$52.5 June 21, 2013 ($0.90 credit, established on May 29, 2013) => Closed CHL credit put spread $50/$52.5 at the cost of $0.65 on May 30, 2013. $0.25 profit (15.62% return on margin, 1 day)

CHKP credit short put spread $43/$45 July 20, 2013 ($0.40 credit, established on May 9, 2013) => Closed CHKP credit put spread $43/$45 at the cost of $0.15 on June 7, 2013. $0.25 profit (15.62% return on margin, 28 days, including non-trading days)

INTC short put $21 May 17, 2013 ($0.34 credit, established on April 17, 2013) => Closed short put $21 at $0.10 on April 22, 2013. $0.24 profit => Set up a new INTC short put $22 May 17, 2013 position ($0.30 credit, established on April 22, 2013) => Closed short put $22 at $0.09 on April 29, 2013. $0.21 profit => Set up a new INTC credit short put $21/$23 May 17, 2013 position ($0.24 credit, established on April 29, 2013). => Closed INTC short put $21/$23 May 17 position at $0.06 on May 7, 2013. $0.18 profit (10.23% return on margin, 8 days, including non-trading days). Setup a new credit short put spread $21/$23 June 21, 2013 ($0.19 credit, established on May 7, 2013) => INTC $21/$23 June 21, 2013 credit put spread expired worthless. $0.19 profit (10.50% return on margin, 44 days, including non-trading days)

CHL short put $50/$52.5 July 19, 2013 ($0.3 credit, established on May 21, 2013) => Expired worthless on July 19, 2013. $0.30 profit (13.63% return on margin, 58 days, including non-trading days)

CHL short put $50/$52.5 July 19, 2013 ($0.95 credit, established on May 23, 2013) => Expired worthless on July 19, 2013. $0.95 profit (61.29% return on margin, 56 days, including non-trading days)

ORCL short put $27/$29 July 19, 2013 ($0.31 credit, established on June 24, 2013) => Expired worthless on July 19, 2013. $0.31 profit (18.34% return on margin, 25 days, including non-trading days)

CHL short put $50/$52.5 June 21, 2013 (at average credit of $0.7875: $0.47 credit, established on May 6, 2013; $0.35 credit, established on May 13, 2013; $0.40 credit, established on May 22, 2013; $1.93 credit, established on June 12, 2013). Bought back at $1.75 => Roll over to credit short put $47.5/$52.5 July 19, 2013 (for the credit for $3.37, rolled over on June 20, 2013) => Expired worthless on July 19, 2013. $3.37 profit. (206.7% return on margin)

GG short put $21/$23 Aug 17, 2013 ($0.27 credit, established on July 16, 2013) => Closed GG credit put spread on July 22, 2013 at the cost of $0.07. $0.20 profit. (11.56% return on margin, 6 days, including non-trading days)

BRCM short put $24/$26 spread Aug 16, 2013 ($0.31 credit, established on July 25, 2013) => Closed BRCM credit put spread on July 31, 2013 at the cost of $0.12. $0.19 profit. (11.24% return on margin, 7 days, including non-trading days)

SI short put $95/$100 spread Sep 20, 2013 ($0.85 credit, established on July 29, 2013) => Closed SI credit put spread on July 31, 2013 at the cost of $0.55. $0.30 profit (7.23% return on margin, 2 days)

MCD short put $92.5/$95 spread Aug 17, 2013 ($0.31 credit, established on July 23, 2013) => Closed MCD credit put spread on Aug 1, 2013 at the cost of $0.10. $0.21 profit (9.59% return on margin, 10 days, including non-trading days)

EXPE short put $44/$46 spread Sep 20, 2013 ($0.70 credit, established on July 31, 2013) => Closed EXPE credit put spread on Aug 6, 2013 at the cost of $0.30. $0.40 profit (30.77% return on margin, 6 days, including non-trading days)

MSFT short put $29/$31 spread Aug 17, 2013 ($0.21 credit, established on July 19, 2013) => Closed MSFT credit put spread on Aug 8, 2013 at the cost of $0.08. $0.13 profit (7.26% return on margin, 20 days, including non-trading days)

MSFT short put $29/$31 spread Aug 17, 2013 ($0.38 credit, established on July 22, 2013) => Closed MSFT credit put spread on Aug 8, 2013 at the cost of $0.08. $0.30 profit (18.52% return on margin, 17 days, including non-trading days)

BAX short put $65/$67.5 spread Sep 20, 2013 ($0.41 credit, established on Aug 5, 2013) => Closed BAX credit put spread on Aug 9, 2013 at the cost of $0.17. $0.24 profit (11.48% return on margin, 4 days)

TEVA short put $35/$37.5 spread Sep 20, 2013 ($0.41 credit, established on July 30, 2013) => Closed TEVA credit put spread on Aug 9, 2013 at the cost of $0.15. $0.26 profit (12.44% return on margin, 11 days, including non-trading days)

ZNGA short put $2/$2.5 spread Sep 20, 2013 ($0.07 credit, established on July 26, 2013) => Closed ZNGA short put position on Aug 9, 2013 at the cost of $0.03. $0.04 profit (9.3% return on margin, 15 days, including non-trading days)

GG short put $25/$26 spread Aug 16, 2013 ($0.20 credit, established on July 26, 2013) => Closed GG short put position on Aug 12, 2013 at the cost of $0.05. $0.15 profit (18.75% return on margin, 17 days, including non-trading days)

CHL short put $50/$52.5 spread Aug 17, 2013 ($0.50 credit, established on July 24, 2013) => Closed CHL short put position on Aug 14, 2013 at the cost of $0.10. $0.40 profit (20% return on margin, 21 days, including non-trading days)

POT short put $25/$27 spread Sep 20, 2013 ($0.43 credit, established on Aug 6, 2013) => Closed POT short put position on Aug 15, 2013 at the cost of $0.21. $0.22 profit (14.01% return on margin, 9 days, including non-trading days)

CLH short put $45/$50 spread Sep 20, 2013 ($0.90 credit, established on Aug 7, 2013) => Closed CLH short put position on Aug 19, 2013 at the cost of $0.50. $0.40 profit (9.76% return on margin, 12 days, including non-trading days)

CVS short put $55/$57.5 spread Sep 20, 2013 ($0.52 credit, established on Aug 7, 2013) => Closed CVS short put position on Aug 20, 2013 at the cost of $0.41. $0.11 profit (5.56% return on margin, 13 days, including non-trading days)

EXPE short put $40/$45 spread Sep 20, 2013 ($1.02 credit, established on July 29, 2013) => Closed EXPE short put position on Aug 23, 2013 at the cost of $0.25. $0.77 profit (19.35% return on margin, 25 days, including non-trading days)

RIG short put $43/$45 spread Sep 20, 2013 ($0.34 credit, established on Aug 13, 2013) => Closed RIG short put position on Aug 23, 2013 at the cost of $0.29. $0.05 profit (3% return on margin, 10 days, including non-trading days)

CRUS short put $16/$18 spread Sep 20, 2013 ($0.30 credit, established on Aug 6, 2013) => Closed CRUS short put position on Aug 23, 2013 at the cost of $0.10. $0.20 profit (11.76% return on margin, 17 days, including non-trading days)

PSX short put $52.5/$55 spread Sep 20, 2013 ($0.60 credit, established on Aug 5, 2013) => Closed PSX short put position on Aug 29, 2013 at the cost of $0.39. $0.21 profit (11.05% return on margin, 24 days, including non-trading days)

INTC short put $21/22 spread Sep 20, 2013 ($0.18 credit, established on Aug 2, 2013) => Position expired with full $0.18 profit. (21.95% return on margin, 48 days, including non-trading days)

CHL short put $50/$52.5 spread Sep 20, 2013 ($0.45 credit, established on Aug 14, 2013) => Position expired with full $0.45 profit. (21.95% return on margin, 36 days, including non-trading days)

CSCO short put $22/$24 spread Sep 20, 2013 ($0.35 credit, established on Aug 15, 2013) => Position expired with full $0.35 profit. (21.21% return on margin, 35 days, including non-trading days)

SYY short put $31/$32 spread Sep 20, 2013 ($0.20 credit, established on Aug 15, 2013) => Position expired with full $0.29 profit. (25% return on margin, 35 days, including non-trading days)

MO short put $32/$34 spread Sep 20, 2013 ($0.29 credit, established on July 24, 2013) => Position expired with full $0.29 profit. (16.96% return on margin, 56 days, including non-trading days)

JIVE short put $10/$12.5 spread Sep 20, 2013 ($0.45 credit, established on Aug 1, 2013) => Position expired with full $0.45 profit. (21.95% return on margin, 49 days, including non-trading days)

AOL short put $32/$34 spread Sep 20, 2013 ($0.30 credit, established on Aug 9, 2013) => Position expired with full $0.30 profit. (17.65% return on margin, 41 days, including non-trading days)

DTV short put $57.5/$60 spread Sep 20, 2013 ($0.54 credit, established on Aug 13, 2013) => Position expired with full $0.54 profit. (27.55% return on margin, 37 days, including non-trading days)

CREE short put $50/$52.5 spread Sep 20, 2013 ($0.45 credit, established on Aug 15, 2013) => Position expired with full $0.45 profit. (21.95% return on margin, 35 days, including non-trading days)

LM short put $31/$33 spread Sep 20, 2013 ($0.75 credit, established on Aug 21, 2013) => Position expired with full $0.75 credit. (60% return on margin, 29 days, including non-trading days)

JBLU short put $6/$7 spread Sep 20, 2013 ($0.55 credit, established on Aug 23, 2013) => Position closed on Sep 20, 2013. $0.25 profit. (55.56% return on margin, 27 days, including non-trading days)

All rights reserved © Optionity 2013