I am sitting here shaking my head while reading yet another newsletter calling for the end of America due to massive money printing which will lead to massive inflation and blood in the streets. While I do agree that the government is currently meddling in the markets to lift asset prices ( seekingalpha.com/article/246471-during-a-correction-or-a-crash-funerals-keep-going-consider-hillenbrand ) the constant call for the end of America as we know it is getting tired.

Without picking on the newsletter writer individually, his position is pretty easy to learn just by spending time in the blog world. They are all calling for a collapse in the dollar, food and metal prices to soar, chaos, and blood shed in the streets.

It sure gets old.

One MASSIVE point these fear mongerers forget to include in their writings, while talking about prices of everything we buy soaring as the dollar collapses, is that wages over the decades of fiat currency have more than compensated for the increases in prices.

I had a great debate online with an even greater friend recently. He is of the mindset that the price of a car going up 350% over the past few decades is proof that our dollar does not go nearly as far as it used to. I am sure you have heard this same argument. Somehow "end of America bloggers" think that because we used to be able to buy a candy bar for 5 cents our quality of life has gone down.

Now the facts.

While the prices for cars, gas, food and candy bars have gone up, the key point is that productivity and wages has more than compensated for this increase. What I mean by that is this, while it used to take you 30 minutes to earn enough money to buy a pack of gum, today you might be able to buy that same pack of gum with only 10 minutes of work. (These numbers are not exact, I am just making a point). Using the car price increase example, while the price of the car is up 350% roughly, our wages have increased over 400% . So my stance is, if the price of gas increases 500% over my lifetime, but my wages increase 501%, am I truly poorer?

You know, the task of washing clothes used to be nearly free a few decades ago. Mom, more likely than dad, would spend hours rubbing the clothes in a pail of water across a wash board then hang the clothes out on a line for hours. The cost to the family was a little soap and some water. Today, the cost to do laundry is MUCH higher as we use electricity, heat, soap, plumbing, and machines. But the technology sure allows us to go do much more productive "wealth building" things instead of wash, even though the cost of doing that activity is up thousands of % over the course of decades.

I just found some more great examples on a Mises.org blog that shows this phenomena in action. I will use some of the salient points and graphs:

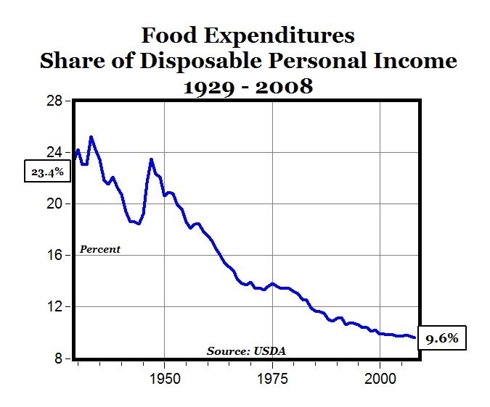

The chart stops at 2008, which is good because commodity prices were at a peak then, even higher than they are today. As you can see, the portion of our income that goes to food has dropped from 23% to under 10%. So even though food prices have gone up over time, and may be "exploding" now, due to our much higher wages over time, the amount of money we spend on food has come down quite a bit.

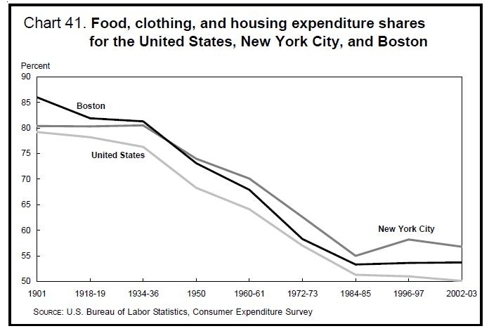

This chart shows that in contrast to the claim that our quality of life is dropping due to the "money printing" that is killing us, we are spending much less of our income on the basics of survival. Those who are dying to go back to the gold standard must really want to spend 6 out of 8 working hours a day just to survive again like we did early in the 1900's. Do you desire for a "sound money time" in which you spent 80% of your work day on food, clothing and housing?

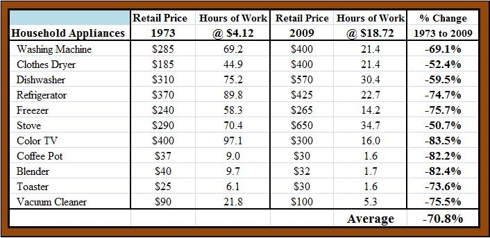

Technology has made things better and cheaper as you can see below:

Do we really want to go back to 1982 Apple products in the day when the dollar was stronger?

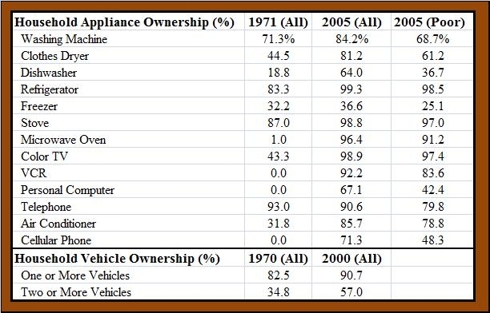

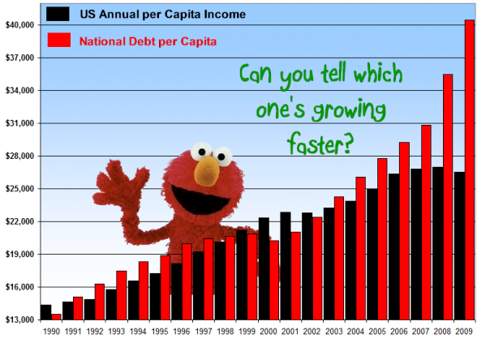

Another 2 charts shooting an arrow into the heart of the doom-and-gloomer crowd trying to sell newsletter subscriptions:

If inflation over the past 3 decades from a purely fiat currency system were truly making us much poorer, then why do so many more Americans own these luxuries today, compared to the 70's when inflation was "out of control"? Why does it take over 70% less time at work to buy them? Some might make the argument that it has to do with debt, which is only partially true as we spend more now on debt payments than we used to in the past. I am going to use a chart from teh people at Acrossthestreetnet.wordpress.com, as it shows the kind of hubris of the blog world towards their stance on the economy :

Debt is too high, I agree. Debt is the reason some people have lived a "wealthier looking" lifestyle than they should have. Thus the reason we are now living in a world of deleveraging. People who are neck deep in debt are in the mode of either giving up their assets in which the debt was secured, walking away from debt that is not secured through bankruptcy, or slowing spending in order to pay down the debt. As the age of deleveraging continues to take hold, the demand for the currency in which debt is repaid will always be there. If you need proof, just take a look at the Japanese Yen since the age of deleveraging was forced upon those people: www.mrci.com/pdf/jy.pdf

The dollar is not going anywhere, anytime soon, as long as the government can continue to require that you pay taxes in dollars, and have the guns to put you in jail if you don't give it to them. If the government for example started requiring taxes to be paid in hibiscus flowers, you can bet the value of the US Dollar would plummet and the value of nibiscus flowers would skyrocket. Hibiscus flower seed companies would be the new banks, and businesses would only accept payment of goods and services in seeds or hibiscus flowers. It is the reason that gold is a store of wealth, but not actually a currency as I have been wrong to assume myself. In general, you still can't buy most goods with a one ounce gold coin. You can't pay taxes with a gold coin. All one can do is decide to sell the gold coin for dollars, and then use those dollars to buy most goods and pay taxes. So event he gold bugs of the world who call for the collapse of the dollar, will always need to be ready to convert those coins into dollars, thus creating an underlying demand for the currency they so despise. This comment will usually draw out the "every fiat currency in history has failed" remarks, or "the US Dollar has lost 96% of it's purchasing power since the Fed was created" line. Don't forget to look past the smoke and mirrors of those comments to realize that it also takes much less work to buy those products. The 96% less comment makes the reader think that we have to some how work 25 times longer to purchase that same item.

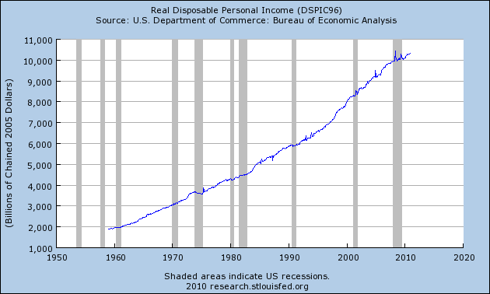

To drive this point home, take a look at this chart showing real disposable personal income. This chart measures the amount of money people have to spend after taxes on whatever they want to:

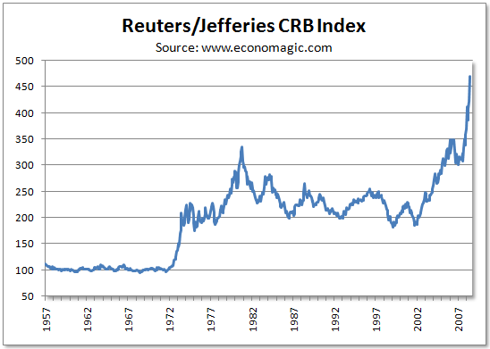

Now let's take a look at historical inflation stopping in 2008 when the CRB was at its peak for emphasis:

Since the late 1950's, the CRB index, which measures prices in most goods we have to buy, is up about 350%. My question is this, if inflation is making us all so much poorer, why do we have over 400% more in real disposable income during this time? Nominal disposable income is up around 3600% www.philadelphiafed.org/research-and-data/real-time-center/real-time-data/data-files/NDPI/ in the same time, but to be fair - we should only consider real income.

Next, the same people who want to talk Fed conspiracy are quick to say that the government is in bed with the Federal Reserve to steal our money through inflation. These same people also like to say that the Fed is a thief because they are propping up the banks and giving them free money. While I do not disagree with the statement, the core of the argument for the evil Fed working for both the banks and the states is impossible. Austrian Economist Vijay Boyapati concludes in this paper libertarianpapers.org/articles/2010/lp-2-43.pdf , he states:

"While the Federal Reserve has the theoretical power to force the

resumption in credit expansion by monetizing enough public debt that the

losses from the housing bust were wiped away, it is unlikely to do so. The

Fed was created for the benefit of the banking class and while it remains

under the control of that class it will not pursue a policy that would lead to a

breakdown in the monetary system from which the banking class profits."

By serving the government only and it's desire to spend endlessly, the Fed will hurt the banks it intends to protect.

I write this to point out that you can ignore the constant call of the doom and gloomers who are talking about the end of America and the quality of life going down the tubes. We are in for some belt tightening as the deleveraging process takes hold. But to call for the end of America reeks in emotionalism meant to sell ideas or newsletters. I have recently changed my thinking on all of this, and would encourage you to contemplate the ideas here to help you with a less stressful night of sleep tonight. Save some money by cancelling those newsletter subscriptions whose author is calling for the end of America, and causing you to become anxious and scared.

Disclosure: I am short SPY.

Additional disclosure: I am long many essential service stocks that are included in the SP 500 but am also short the index as a hedge against any drops. We are also long a lot of bonds which include treasuries. We receive no compensation to write about any specific stock, sector, or theme.

The Myth of Inflation Making Us Poorer

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.