EDIT/APPENDIX:

A commenter on Seeking Alpha pointed out the omission of Canada as being unfortunate given the example that it sets in terms of sustaining a surplus and showing fiscal discipline. To see the article on Seeking Alpha go here: seekingalpha.com/article/180278-develope...

The purpose of this article was to point to the key risk areas and inform strategy. But the comments are worthy of thought and I include the charts below with the Canada data added:

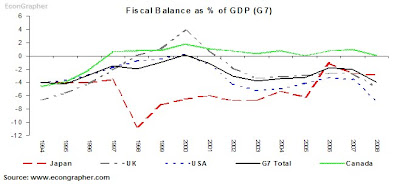

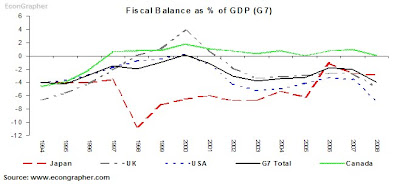

Chart 3. Fiscal Balances (G7)

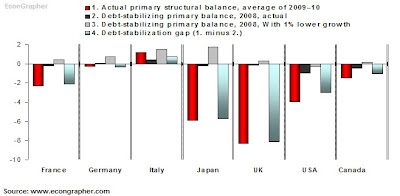

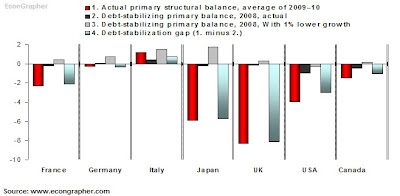

Chart 5. Spending/Borrowing Gap

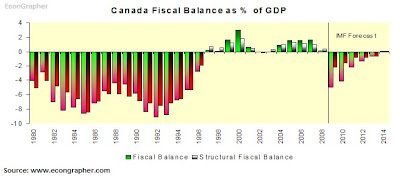

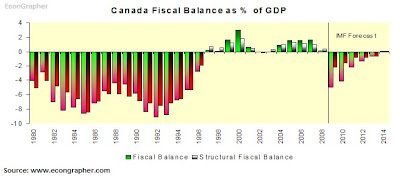

Canada: Fiscal Balance (IMF Data)

This chart shows that Canada has broadly speaking run surpluses through the better part of the past decade. IMF forecasts are for a significant turnaround to deficits (likely driven by implications of the recession/crisis). The impact on Canadian government borrowing can be seen in the next chart...

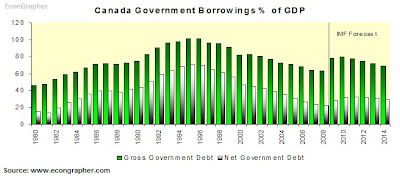

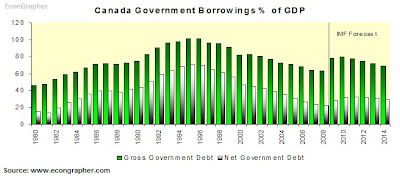

Canada: Government Borrowings (IMF Data)

Unsurprisingly Canada's government debt peaked around the time that it started generating fiscal surpluses, and since then has been on a steady downward track.

Ultimately the other developed economies probably want to find themselves on a similar path - and to a certain extent the borrowings/deficits will be somewhat self limiting in that at a certain arbitrary threshold it will become a hot political issue - then doing the right thing will become fashionable and there may be some short-medium term action towards it. Ultimately also market forces will weigh in on fiscal profligacy!

Originally published here: econgrapher.blogspot.com/2009/12/are-dev...

Disclosure: "No positions"

A commenter on Seeking Alpha pointed out the omission of Canada as being unfortunate given the example that it sets in terms of sustaining a surplus and showing fiscal discipline. To see the article on Seeking Alpha go here: seekingalpha.com/article/180278-develope...

The purpose of this article was to point to the key risk areas and inform strategy. But the comments are worthy of thought and I include the charts below with the Canada data added:

Chart 3. Fiscal Balances (G7)

Chart 5. Spending/Borrowing Gap

Canada: Fiscal Balance (IMF Data)

This chart shows that Canada has broadly speaking run surpluses through the better part of the past decade. IMF forecasts are for a significant turnaround to deficits (likely driven by implications of the recession/crisis). The impact on Canadian government borrowing can be seen in the next chart...

Canada: Government Borrowings (IMF Data)

Unsurprisingly Canada's government debt peaked around the time that it started generating fiscal surpluses, and since then has been on a steady downward track.

Ultimately the other developed economies probably want to find themselves on a similar path - and to a certain extent the borrowings/deficits will be somewhat self limiting in that at a certain arbitrary threshold it will become a hot political issue - then doing the right thing will become fashionable and there may be some short-medium term action towards it. Ultimately also market forces will weigh in on fiscal profligacy!

Originally published here: econgrapher.blogspot.com/2009/12/are-dev...

Disclosure: "No positions"