Saturday 8 February 2012

The fundamentals for gold and silver worsen with each passing

week, it seems, yet the price for gold and silver still languish in

down trends. If everything is as precarious as is depicted in so

many other articles citing how PMs are in dire straights, for the

same deteriorating reasons presented with pinpoint numbers, as

in reduced stocks of deliverable metals, increased transfers from

West to East, why are gold and silver still near recent lows for the

past two years?

No one has offered answers to such a glaring fundamental

discrepancy of excessively low supply, exceptionally strong demand

and totally manipulated price.

We remain of the mind that the elephant in the room that no one

sees is the reason why PMs continue to be held hostage: the all-

powerful elites, the New World Order, call them what you will. There is a seemingly invisible hand directing world affairs in ways few

people can comprehend, and it is that inability to connect the dots

that keeps the elites in power and the remaining people in the dark.

This is an over-simplification, but on point.

The modus operandi of the elites, grandfathered by the House of

Rothschild, fathered by Mayer Amschel Bauer, who adopted the

better sounding name "Rothschild," for the red sign that used to

hang over the entrance of his house. No one has practiced the art

of deception more than the group that sprung from the cunning

mind of this man who understood the power of interest and

translated into practice to gain control of the European

governments, and ultimately, the entire Western world.

Fast forward to today with total control of money, via central banks,

that dictates to Western world governments. The elites have

unlimited numbers of important heads of governments, unlimited

numbers of agents to do their bidding and create problems on

demand. The Arab Spring, the theft of money from Cyprus, Greece,

Ireland, being the most obvious. How about the ransacking of the

United States for the past 100+ years? The US is a hollowed out

version of what it once was as a result from control of the elites.

What is transpiring in Ukraine, since the president decided to not

join the European Union, has been brought about by elite agents

organizing a disorganized population to rise up against the

government. It is widely known and acknowledged that Ukraine

cannot afford to join the EU, in order to have the privilege of being

financially raped once a member and controlled by the elite banking

cabal.

Ukraine is an effort to keep Putin from gaining control of natural gas

pipelines that are a source of heat for much of Europe. It was the

impetus behind the Obama regime to declare war on Syria, for

similar reasons, only to have the war-driven leader dressed down by Putin.

The elites create problems everywhere, but under the radar, mostly

undetected, unless one begins to see how they operate and can then better understand why problems arise where they do and when.

These are carefully planned operations. Once trouble develops, the

elites then gauge how the public reacts and then offers solutions to

the problems they purposefully created.

The reaction to 9/11 in the US? The public was driven into fear, [the created problem], and the reaction was to embrace the solutions

offered by the elite-controlled federal government, giving up

"freedoms" for greater "security" against "terrorists." America has

not been the Land of the Free for decades as a result of the true

shadow rulers.

Why did the popular Occupy Wall Street movement all of a sudden

disappear? It ran the risk of putting the spotlight on that cesspool

known as the venue for central banker control. How was the

movement put down? By police force under the direction of the

bankers, [who in turn are under the direction of the elites that keep

themselves a few steps removed from any direct involvement, but

always directing it]. Did the elite-controlled media ever question

why the New York City police force was under the control of private

banks? Former mayor Michael Bloomberg is an elite acolyte.

The governments are controlled, the media is controlled, the legal

systems are controlled, agriculture is controlled, [think Monsanto],

the pharmaceutical industry is controlled, drugs are controlled, etc,

etc, etc. All because of Rothschild's discovery that when one

controls the money, one controls everything.

What the arrogant elites did not expect was the rise of China and

Russia, [after being dismantled and now put back together, again],

as opposing forces not in control via the Western central bankers

and their endless issuance of worthless fiat. All of a sudden,

actually, over the past few decades, China and Russia, plus the other BRICS nations, have called the financial bluff of the moneychangers

and demanded payment in gold for all the toxic U S Treasury bonds,

[worthless, except in one's mind, just like the Federal Reserve

Notes, erroneously called "dollars,"], and to keep the elite's huge

Ponzi scam from being revealed, they have been selling every ounce of gold the have and also those they did not own but had under their control.

It is all about power, the ultimate fundamental that drives

everything, and gold has always been the Achilles heel for the elites, which is why they have always marginalized it in the public's mind.

There is no gold in Fort Knox. It is gone. There are no silver stocks

in the US. Gone! Roosevelt used an Executive Order, stating all

"persons" must turn in their gold or be penalized an exorbitant

amount.

First of all, Executive Orders issued by any President only apply to

Federal officers of the government. That is it! People did not know

that, and the elite-controlled federal government made no effort to

dissuade anyone of that misconception. [There are so many, many

others.]. Secondly, the definition of a "person," according to laws

passed by the federal government, includes corporations. A

corporation is a "person." All corporations are created by statute,

making them fictions of law of the state in which it is incorporated.

When Roosevelt issued his Executive Order, it did not, by law, apply

to individuals as persons, but to corporations as "persons." Any

individual who considered him/herself as a "person," made that

[uninformed] choice freely. Things have not changed. How does

Obama rule? He passes Executive Orders and by-passes Congress,

a puppet clan, anyway.

The end game is not totally in place. China has no interest in having the "value" of its ever-increasing gold hoard rise, not while it can

acquire it at current low prices. Remember the sale of JP Morgan's

crown jewel office building, One Chase Plaza, to China, for $750

million? That is probably less than half of its market value. It also

housed the world's largest gold vault, directly connected to that of

the Federal Reserve, across the street via and underground tunnel.

To keep China from dumping all of its worthless Treasury paper, and

destroying the "dollar" and ruining the elite Ponzi scam, China is

being accommodated by the US elites via half-price sales of coveted

assets. China is buying both gold and America on the cheap.

Russia is not quite secure in total control of the natural gas pipelines that are being opposed by the West, particularly the Nobel Peace

Prize president that is conducting more wars than any other leader

on the planet. Ukraine is pay-back to Putin by the elites, trying to

divide Ukraine into EU submission and away from Russia. This is

why Ukraine "opposition" to the government has been so strong and

persistent. It is the work of the well-paid agents on the payroll of

the elites. Many of those same agents were at work in Egypt and

other Arab countries during their "staged" uprisings.

The point to be made from these somewhat broad assessments, any of which can be verified by doing one's own due diligence, is that

gold and silver are being held hostage by the elites to keep their

world power alive. It has not yet been determined how those in

power will survive, and they are likely working fast and furious

behind the scenes with China to keep the gold/silver scam alive,

making whatever deal[s] they can to keep control over their flagging Western empire and crumbling fiat scheme.

Last Fall, we said the rally in PMs would take longer than most

expect. Expectations were unmet in 2013, and it is possible that

2014 may be no different. So far, the charts give no hint to the

reality of the gold/silver situation. We also know of no other source

of market information that has been more in sync with price as it is

and for whatever reasons.

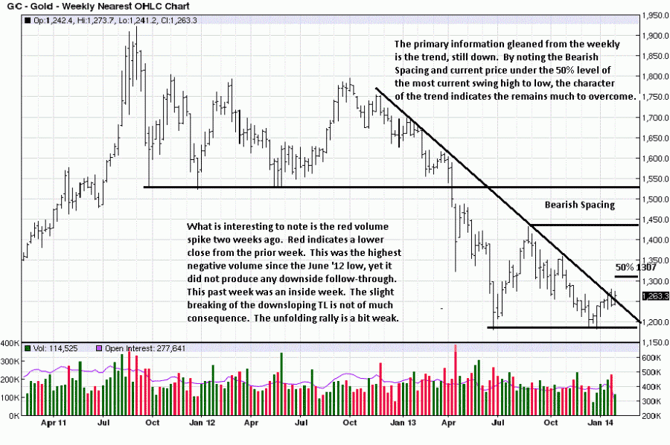

Gold is well under a 50% retracement between the last swing high

and low. This is just a general guide to indicate the strength or

weakness of a market. The farther away price is under the half-way area, the weaker the market. More of an issue is the bearish

spacing. Whenever there is a space between the last swing low and

the next swing high that fails to close that space, it indicates that

sellers are more aggressively in control.

Based on the weekly chart, gold give no indication of beginning a

strong rally that will change the trend, any time soon.

The trend is always treated with respect as the most important

first piece of information because it captures the prevailing price

momentum. The best way to trade successfully is in harmony with

the trend. Regardless of whatever information that portrays the

reality of dwindling supply for gold, the reality of the charts takes

preference because the charts are more driven as to timing, and

now is not the time to be long futures, just yet.

The reading of charts is always in opposition to the ongoing

purchase of the physical metal. Given the circumstances driven by

central bankers, at some point, reality will rear itself onto center

stage, and the physical will outperform almost every other asset

class, and just as importantly, availability may not exist. Keep on

buying the physical.

The charts keep the paper market in context. At some point, the

price expectation that actually reflects true supply and demand will

align, but now is not that time. For as long as the trend remains

down and price is well under a 50% retracement, the market is

weak.

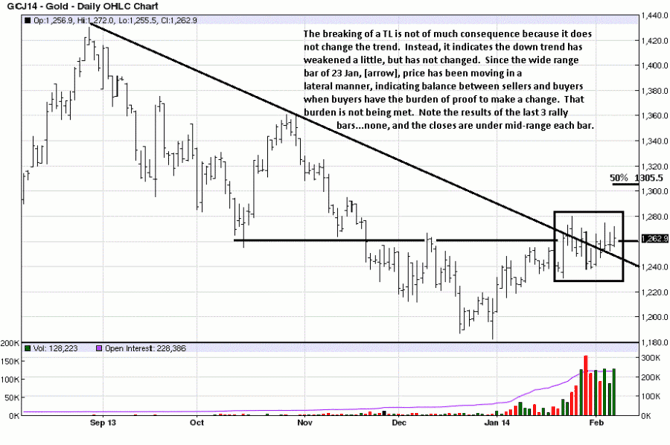

There has been a series of overlapping bar, seen in the box.

Overlapping bars indicates a struggle between buys and sellers for

control. There is a temporary balance, and it will eventually lead to

an imbalance as price next moves directionally.

The lack of downside follow-through, after the highest volume bar 7 TDs ago, has been an anchor for the current rally, of sorts. The

caveat as to which way price will move from here is the trend, which favors lower price behavior until there is an indication of change. Right now, such an indication is absent. Of minor concern is the

location of the closes for the 3 bars at the end, tending toward the

lower range of each bar. The offset is the fact that despite apparent

weakness, price did not move lower.

If gold trades higher next week, the daily trend will turn up, and

confirmation will come from a lower swing high on the next

correction.

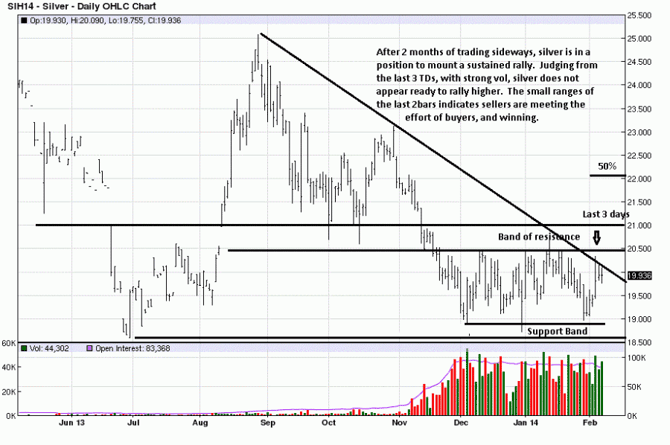

The same applies to the buying and accumulation of physical silver.

Based on the ratio for gold/silver, strongly in gold's favor, the next

sustained bull market may well favor silver outperforming gold. We

strongly advocate the buying of physical silver.

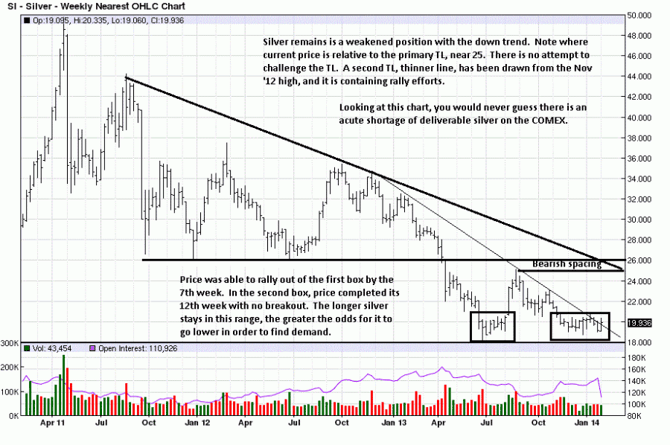

The silver chart is similar to gold but more compact, and weaker, in

general. Comments on the chart explain our view of that developing market.

Silver has been "looking" like it could be forming a bottom, but the

fact that price is so far not showing any ability to rally, and the

continual hugging of this low area may mean that there is insufficient demand. In order to find demand, silver may have to

go lower before it can go higher.

We will just have to wait until supply and demand are resolved.