The freshly released BOE Inflation Report, which sheds light on the central bank's inflation outlook and monetary policy plans, revealed that the BOE was ready and willing to implement further easing if necessary. After all, growth in the U.K. remains subdued as the economy faces a potential triple-dip recession.

BOE officials even downgraded their growth forecasts for the year from a previous estimate of 2.0% to just 1.7%. Inflation, on the other hand, was projected to stay above the central bank's 2% target for the rest of the year. The BOE also explained that the increase in consumer price levels for November last year was a result of the pound's depreciation and higher energy costs.

In his recent speech, BOE Governor Mervyn King acknowledged that stronger than usual inflationary pressures pose a threat to price stability. However, he clarified that the BOE's priority is to spur growth through additional monetary stimulus, even if this means risking higher inflation. According to him, choosing growth over price stability isn't exactly desirable but it's "the hand they have to play".

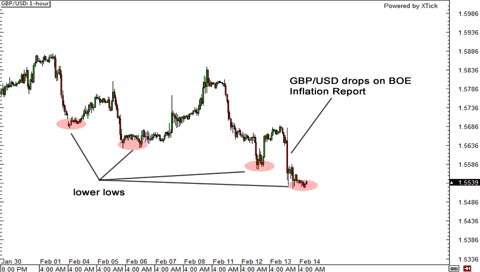

So how did the markets react? Why, by selling the pound of course!

This makes sense, as the traders are now thinking that the BOE might ramp up their bond purchase program. This makes the pound weaker, as more units of the currency are being flooded into the market.

The pound's saving grace though, is that incoming Governor Mark Carney, who's being pirated from the Bank of Canada, hasn't shown any indication that he's leaning in favor of further quantitative easing measures. In a speech last week, traders took Carney's words as a sign that he was good to go with the central bank's current monetary policy strategies.

Furthermore, with Mervyn King just a few months away from stepping down, he may decide to sit pretty and wait. He may feel that it would be better to leave Carney with a clean sheet in order to implement his own policies.

For now, all we can do is wait and see what Carney has to say about the BOE's recent "openness" to more QE. If he is adamant that current measures are enough, it could give the pound a slight boost up the charts.