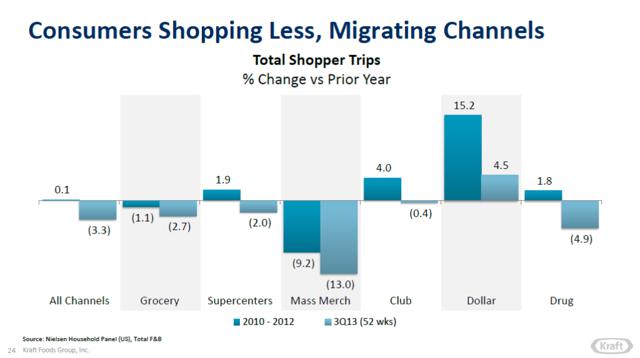

The traffic at dollar stores are still outpacing traffic at other retailers. From 2010 to 2012, total shopper trips grew 15% at the dollar stores, more than any other retail segment. And for the 52-weeks ended 3Q 2013, dollar store shopper trips were 4.5%, whereas all other segments saw a decline.

This comes as more and more Americans are making Dollar General (DG) and its peers the go-to-spot for necessities, such as food products and toiletries. I look for this trend to continue and still like Dollar General as a long-term pick.

Margins should continue expanding as Dollar General continues its expansion into private label products. The comp store growth has been more than robust at Dollar General. This has come despite a weak macro environment. A lot of this credit goes to the dollar store's strategic store locations, and continued remodeling and relocation plans.

Benefiting from CVS

It's also worth noting that Dollar General could be one of the biggest benefactors of the fact that CVS is planning to stop selling tobacco products. Dollar General should manage to capture the largest portion of CVS' $2 billion tobacco sales that it'll forfeit. CVS and Dollar General have a large geographical overlap, with about 50% of CVS' stores being located in the Southeast and Midwest. These same two regions account for 75% of Dollar General's store count. That's still a large opportunity for Dollar General to gain tobacco sales from CVS.

Dollar General has been quite aggressive in buying back stock. Dollar General bought $200 million in stock during 4Q, and already in 1Q bought $200 million. For the full year 2014, the retailer plans to buy up $1.1 billion in shares.

Bottom line

And over the last five years, Dollar General's shares have traded in a range of 15x to 22x. The industry average is closer to 21x. Assuming fiscal 2015 earnings come in at roughly $3.65 a share, I think Dollar General can get its earnings multiple back to 20x. That's a $74 price target, or 25% upside in less than a year's time. The move toward dollar stores has been pronounced. I'd expect them to remain a key part of many people's lives even after we see a rebound in employment.