Over the weekend, I enjoyed my first Pumpkin Spice Latte of the season at Peet's Coffee & Tea (PEET) with my girlfriend. An article in the weekend edition of the New York Times business section caught my eye.

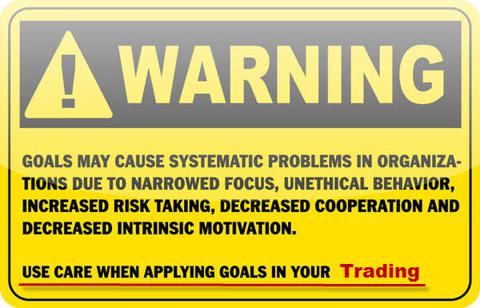

It's not often that I take the time to write about an article that I read, but I found it very interesting. It was located on page five and entitled," Experts' Advice To the Goal-Oriented: Don't Overdo It." While the story does not deal with trading directly, it does hit on some very important points related to goal setting.

I have had the privilege of helping hundreds of people become more consistent and profitable traders. Over the years, I have noticed a trend developing in how successful traders set goals versus how struggling traders set goals.

The article focuses on academic research from an experiment that was conducted by Eller College of Management. The participants were asked to create as many words as possible using a combination of letters, similar in concept to the game of Boggle. There were three groups and each group was given a chance to check their words in a dictionary to make sure they were legitimate. The first group was given the goal of forming nine words and if successfully produced, they would receive financial compensation. The second group was given the same goal but no financial incentive. The third group was simply told to try their best.

The researchers had a code whereby they were able to match the worksheet with the answer sheet. They discovered that both groups that had the goal of creating nine words, whether or not money was involved, cheated 8 to 13 percent of the time. Those in the third group, who were just doing their best, rarely cheated. Why this article is so interesting is because one of the first things I ask traders that I mentor is, "What are your trading goals?"

The majority of the time the answer is,

"I want to make more money."

From all my experience in working with traders, I can get a good idea of someone's hang-ups with how they answer this single question. Wanting to make more money is not a goal, but rather a desire. That is why I suggest creating goals that are stepping stones to your ultimate desire. For instance, if you want to make more money, then I would try to help you figure out what core issues are preventing you from obtaining that desire. Sometimes, it could be letting losing trades draw down the account by not obeying a defined exit. Other times, it could be fear that paralyzes you from taking the next legitimate trading set-up.

What I would do with a struggling trader is make them focus and pinpoint the exact source of the issue they are having. It can be many things, but if we focus on and fix that core issue, the trader will be more successful and ultimately achieve their desire of making more money.

There is a lot of pressure present when you think about naming your goals. One section of the article discusses an emotional block that hindered the performance of former New York Jets quarterback Ken O'Brien. O'Brien had the tendency to throw too many interceptions in his early career. To fix the problem, the team provided him with a contract that penalized him every time that he threw an interception. The contract worked in achieving the goal because he, in fact, threw fewer interceptions. However, he also threw fewer balls overall, even when there were good opportunities to do so. It became clear that O'Brien was so worried about getting penalized for an interception, that his anxiety hampered his aggressiveness on passes he should have, and normally would have, taken. In the long run, this fear of punishment becomes a burden which not only restricts the player, but also hinders the entire team's overall performance.

I see this concept to be a big problem for hedge funds. Hedge fund managers take on a lot of stress because of the tremendous pressure to perform. A lot of times, this pressure presents itself in fund managers acting in unethical ways. Often, they will

pay insiders of companies or government officials to get some kind of edge

over the rest of the investing/trading community. Frequently, this information can be tracked because they can use leverage to buy into the options market and load up on contracts that exceed normal daily trading volume. This unusual activity is the very reason why I follow the action in the options market.

Very recently, two Chinese companies received a proposal to go private and their stock saw very elevated accumulation of contracts in option calls. The companies are 7 Days Group Holdings ADR (SVN) and Feithe International (ADY). I noticed the unusual accumulation of these calls and pointed it out to my premium members because my experience tells me that some kind of news was likely to be published soon to move prices higher.

What You Can Do Right Now:

I would suggest that if you want to become more successful, then do not focus on a goal that will consume you and drain you like a vampire. The majority of people have very broad desires, such as I want to make more money. Enjoy the journey and focus on the path itself of setting goals that will lead you to achieve that desire. Lose your bird's eye focus on the end result and concentrate on creating the stepping stones you will need to have the greatest probability of achieving your goal.

Please let me know what your goal is the space below and what you are going to do differently to achieve that goal after reading this article.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.