Note: We continue to produce high quality 7-12 investment analysis on attractive small cap biotech stocks on a weekly basis. To get these free investment reports as they are published, just register at bretjenseninvests.com.

Chaos returned to the global markets on Friday. After equities rallied this Thursday on the belief that the U.K. had voted to stay in the EU, just the opposite occurred when votes were tallied. It appears this will turn out to be one of the bigger mistaken assumptions in recent memory. Once again the so called elite and economic pundits have not taken into account how much anger & angst are in the electorates in the developed nations after a decade of slow economic growth, tepid job gains, a rise in terrorist acts, major expansions of regulations and massive interventions by the world's central banks. Looking back with hindsight, England deciding to leave the EU seems almost logical given those cross currents. One only has to look at our recent election primaries to see how unpredictable these forces are at the moment. This event will have ripple effects across global markets for weeks and we will see over time whether the U.K. is just a one off event or the start of other nations reasserting their sovereignty and leaving the European Union as well.

The next potential trouble spot up for our market is second quarter earnings reports which will start to trickle in a couple weeks hence. They are expected to show the fifth straight quarter of profit decline within the S&P 500 as we continue to be locked in a "profit recession" since the early part of 2015. Not all sectors of the economy and market are seeing earnings declines of course. One area of strength is housing. Last week two of the largest home builders, KB Home (KBH) and Lennar Corporation (LEN) both delivered past solid results and saw their stocks rise nicely as a result.

We made a significant bet at Small Cap Gems in the second half of 2015 on housing, infrastructure and construction plays and put a good portion of our optimized 20 stock portfolio into these areas. Although it took a bit longer than we would have liked for that theme to play out, the portfolio is now benefiting greatly from that allocation. Construction and infrastructure concerns MasTec (MTZ) and Tutor Perini (TPC) have continued to build on recent strength in recent months. These two names are not only two of the best performing stocks in our portfolio in 2016 so far, but also two of top performers in the market. Both are up more than 50% this year.

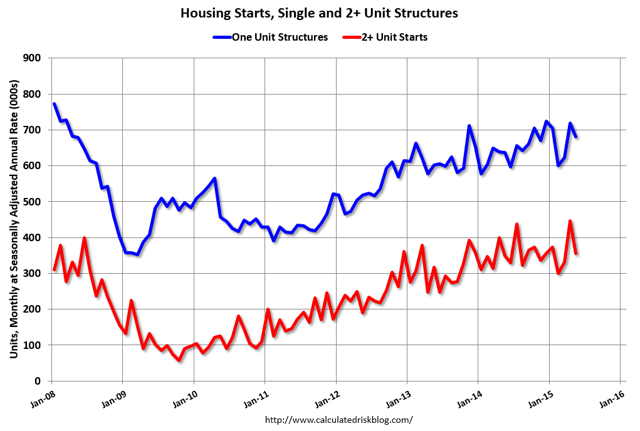

Our faith in these sectors rebounding and having solid value were based on a couple of observations. First, even though housing starts posted their best levels since 2007 in 2015; they were still significantly under on an annual basis the average of the past 30 or 40 years. With household formation now above pre-crisis levels, job growth solid, credit underwriting standards starting to loosen and mortgage rates near historical lows; we reasoned we should see years of improved housing activity outside a significant recession. In addition, an upcoming five-year transportation bill that was approved late last year took a lot of uncertainty away from infrastructure and construction projects after many years of approving one off one-year budget bills in Congress.

Although the housing market continues to improve in a two step forward, one step back basis; the trend is up with housing starts running at just under 10% above the same period last year. Average selling price growth is also solid. Many of my favorite small homebuilders are seeing even faster growth than national averages. Longtime favorite LGI Homes (LGIH) has seen monthly home closings jump some 35% in the first five months of the year compared with the same period a year ago. After making just under $2.50 a share in earnings in FY2015, this home builder is tracking to ~$3.30 a share this fiscal year. The consensus has LGI Homes making nearly $4 a share in FY2017. Even after a recent rally, the shares are too cheap at $30.

A much larger home builder that is showing good growth and sporting attractive valuations is high end home builder Toll Brothers (TOL) whose communities dot most of the nation. The company should post a 30% gain in earnings this year on back of a 20% rise in revenues. Growth is conservatively projected in 2017 to see another 15% rise in profits on a 10% increase in revenues. The stock currently sells for less than 11 times this year's profits, a significant discount to the overall market multiple despite the homebuilder's superior growth prospects.

Finally, Blue Chip Retailer Home Depot (HD) continues to benefit from the uptick in housing starts as well as remodeling activity. Although somewhat pricey at 20 times this year's earnings, the company continues to grow earnings at a 15% annual clip on a mid-single digit rise in revenues. The stock also yields nearly two and a quarter percent in dividends. There are worse things to buy in any dip in the market than this long term "buy and hold" stock that keeps providing good solid singles.

Thank You & Happy Hunting

Bret Jensen

Founder, Biotech Forum