Well, 2012 is over, and I've updated the Chumpmenudo Hybrid Dividend Growth portfolio.

With all the fiscal cliff drama at year's end, stocks were pretty volatile. The last trading day of the year saw a nice uptick in the portfolio, and 2013 is off to a good start.

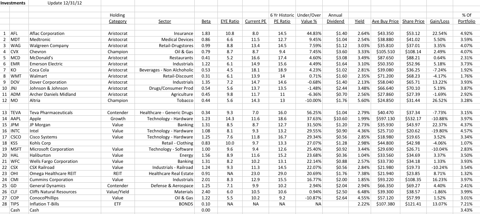

Looking back, I started converting my traditional IRA to what I call a "hybrid" dividend growth portfolio in June - August this past year. I'm buying two groups of stocks, and following different "rules" for the two groups. The core holdings are comprised of dividend Champions and Aristocrats, and are stocks I'd like to hang on to into retirement. I don't have full positions in all of these, but intend to have, and add additional names in the coming years as I approach retirement.

The second group, I call the non-core group, and is also comprised of dividend stocks, but the requirements for this group are less rigorous, and I favor undervalued stocks above all else when selecting holdings for this non-core group. These stocks I expect to appreciate, and will reduce my positions or sell completely when they reach or exceed fair value.

The goal of the portfolio is to out perform the S&P 500 in all types of markets, and throw off an increasing dividend yield every year.

Here is a summary of the portfolio for December 31, 2012:

Of the 28 total holdings, 12 are core holdings comprising around 40% of the portfolio, and 16 are non-core comprising (with cash) the other 60% of the portfolio.

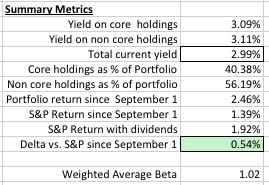

So how did the portfolio do versus my stated goal/benchmark? Probably too soon to tell, but so far, pretty well. Here is a performance summary:

I've managed to construct a portfolio with a weighted average beta of 1.02, about equal to the S&P, but with a superior yield to the S&P (3% vs. 2.12%), and better capital appreciation. It should be noted, of course, that this is just for the last four months of the year, and is too short a time to draw any conclusions.

I'll continue to monitor, manage, and tweak in 2013, and we'll see what happens.