KAMAT HOTELS – proxy trading play on Sayaji Hotels (SHL) buy by Foreign Fund and bailout bet by bubble market.

For details on listed Indian Hotel firm -Sayaji Hotels Ltd buy / open offer by a distressed Foreign Fund -Clearwater Capital. See my earlier post

Clearwater Capital - also recently acquired ~ 2% stake in Kamat Hotels at 58 per share. ( see Kamat Hotels SHP as on Dec`09). This definitely means they see value in this as well.

Kamat Hotels – 84 ( +9%) on volumes of 3.6 lacs shares ( vs 2 week avg of 1.1 lac). % Delivery of 32%

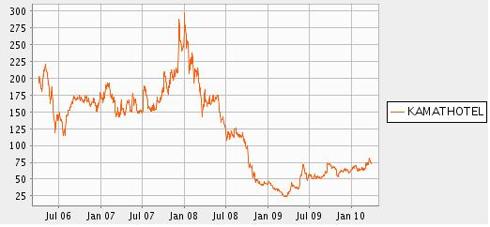

- Technically (and also fundamentally due to mentioned below factors) has potential to give a +50% upside to 125-130.

- Good and safer levels to enter after 90% correction from peak of 300 to 30.

- Already broken resistance of 75. ( stop loss of same level 75 or trailing 10% stop loss)

- 30% up in past one month (one month low of 64.)

- 200 DMA of 62 . 50 DMA of 70.

- Insider buying – Promoter bought 1% stake on 10th Mar 2010 from Open market ( bought 1.38 lac shares at 60 or Rs. 0.8 crores !! ). Promoter hasn’t sold any stake in many years is also a big positive.

- Market cap – 111 crs. Free float 33 crs.

- Valuation – Trailing Earnings all negative. Peak PAT of 25 crs in FY08. But on total rooms of ~500 ( most in Mumbai), Market Cap per Room 0.22 crs or EV per room of 1 cr per room ( 400 crs of debt). But as mentioned in the past has plans to double room to 1000 plus in next 1 yr. Also has food and restaurant business.

- Website - http://www.khil.com/

- For fundamental research by big brokerage firm – see here and here ( LoL..)

Kamat Hotels is a Proxy trading play of such a SHL foreign takeover / bailout by white night investor/QIP FPO . (Mumbai based hotel co. Not that similar to SHL as Promoter holding is high at 73% and it has pledged its 40% stake vs 90% for SHL but similar in terms of very high debt and has FCCB). But it can be a trading pick. 1 yr high at 87. Cmp. 84 ( +9%). Kamat Hotels assets are also better quality and variety (owns Orchid Hotels next to Mumbai Santacruz Airport and Lotus Suites in Juhu, resorts – Lotus Suites in Goa) , restaurant business and coming results should be definitely better than last years negative earnings.

Disclosure: None