End of Q2, start of Q3 income Portfolio updates:

June 30, 2015

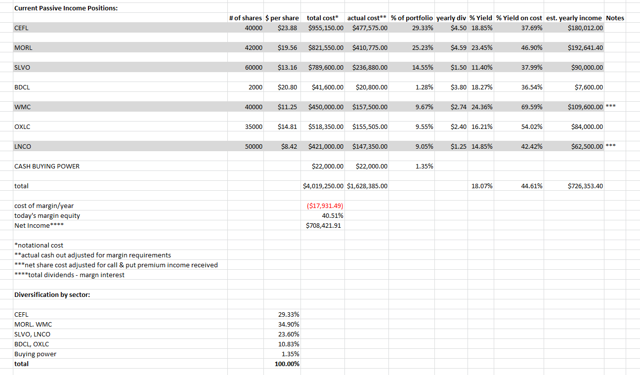

As you can see here, I was fiddling around all quarter, and in the last 2 weeks, added:

| 06/22/2015 | YOU BOUGHT | |||

| OXLC | OXFORD LANE CAP CORP | |||

| Margin | Shares: +5,000.000 | Price: $14.65 | Amount: -$73,250.00 | |

| Settlement Date: 06/25/2015 | ||||

| 06/22/2015 | YOU BOUGHT | |||

| OXLC | OXFORD LANE CAP CORP | |||

| Margin | Shares: +5,000.000 | Price: $14.70 | Amount: -$73,500.00 | |

| Settlement Date: 06/25/2015 | ||||

| 06/17/2015 | YOU BOUGHT | |||

| MORL | UBS AG LONDON BRH ETRACS MONTHLY PAY 2X | |||

| Margin | Shares: +2,000.000 | Price: $17.99 | Amount: -$35,980.00 | |

| Settlement Date: 06/22/2015 | ||||

of course as it turns out I was a bit PREMATURE, missing out on the bargains we have before us this week. Below is the current mix:

You will note that the projected annual income for the 12 months starting July 2015 to June 2016 has increased +$58,247.29 from $650,174.62 at the beginning of June to $708,421.91 at the end. Marvelous.

End of June NAV at (6/30/2015) closing: $3,766,930.00

Due to the recent market price decline, Nav however has just increased a little even with all that buying, from $3,718,938.00 to $3,766,930.00, and the net paper loss from cost basis has increased to -$241,320 (-6.02%)

It was not a bad month for dividends booked though:

| June | ||

| KBS | 6/2/2015 | $497.70 |

| LNCO | 6/18/2015 | $5,210.00 |

| CEFL | 6/22/2015 | $14,148.00 |

| MORL | 6/22/2015 | $5,133.10 |

| SLVO | 6/25/2015 | $5,832.00 |

| OXLC | 6/30/2015 | $15,000.00 |

| monthly total: | $45,820.80 |

Bringing the first 2 quarters running total to $197,901.03.

Since I've blown through my 10% "equity safety cushion" through the combination of buying too many additional shares and the recent negative price action, (my cushion is down to 1.35%) I can't take advantage of the all the bargains surrounding me.

BUMMER.

You might though.

To be continued next month.......

Q: Hey, your paper loss above is higher than your divs received - WTF? I thought you did this to make money?

A: The paper loss is from "inception" or when I started the transition from "trading" to buying ever increasing positions of INCOME shares. The divs running total is just the first 6 months of the year. See this link.